XTX Topco Ltd lifted its stake in OPENLANE, Inc. (NYSE:KAR - Free Report) by 224.0% in the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 74,984 shares of the specialty retailer's stock after purchasing an additional 51,842 shares during the period. XTX Topco Ltd owned 0.07% of OPENLANE worth $1,446,000 at the end of the most recent quarter.

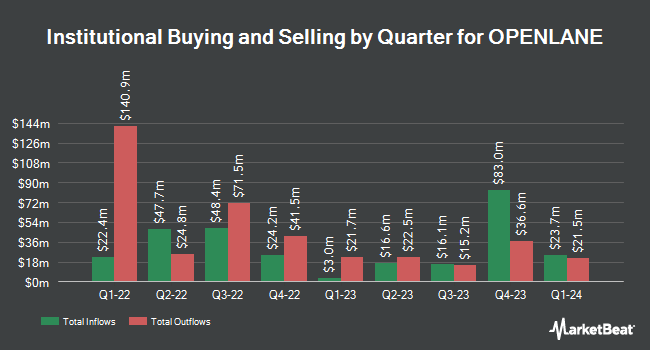

A number of other hedge funds and other institutional investors have also recently bought and sold shares of KAR. KLP Kapitalforvaltning AS acquired a new position in shares of OPENLANE in the 4th quarter valued at $448,000. JPMorgan Chase & Co. grew its holdings in shares of OPENLANE by 119.4% in the 4th quarter. JPMorgan Chase & Co. now owns 306,038 shares of the specialty retailer's stock valued at $6,072,000 after buying an additional 166,536 shares during the period. Norges Bank bought a new stake in OPENLANE in the 4th quarter valued at $7,007,000. Pictet Asset Management Holding SA lifted its position in OPENLANE by 15.6% in the 4th quarter. Pictet Asset Management Holding SA now owns 13,092 shares of the specialty retailer's stock valued at $260,000 after acquiring an additional 1,765 shares in the last quarter. Finally, Arrowstreet Capital Limited Partnership lifted its position in OPENLANE by 10.0% in the 4th quarter. Arrowstreet Capital Limited Partnership now owns 622,190 shares of the specialty retailer's stock valued at $12,344,000 after acquiring an additional 56,531 shares in the last quarter. 99.76% of the stock is owned by institutional investors.

Analyst Ratings Changes

Several research firms recently commented on KAR. Wall Street Zen raised shares of OPENLANE from a "hold" rating to a "buy" rating in a research report on Friday, May 9th. Bank of America boosted their price objective on shares of OPENLANE from $22.00 to $25.00 and gave the company a "neutral" rating in a research report on Monday, June 16th. Two investment analysts have rated the stock with a hold rating and three have assigned a buy rating to the stock. Based on data from MarketBeat, the company presently has an average rating of "Moderate Buy" and an average target price of $24.00.

Get Our Latest Stock Report on KAR

OPENLANE Trading Up 0.6%

Shares of OPENLANE stock traded up $0.15 during trading on Monday, hitting $24.48. 158,666 shares of the stock were exchanged, compared to its average volume of 816,364. The stock has a market capitalization of $2.63 billion, a price-to-earnings ratio of 37.09, a price-to-earnings-growth ratio of 2.72 and a beta of 1.40. The company has a fifty day moving average price of $24.05 and a 200-day moving average price of $21.60. OPENLANE, Inc. has a 1-year low of $15.44 and a 1-year high of $26.03.

OPENLANE (NYSE:KAR - Get Free Report) last released its quarterly earnings data on Wednesday, May 7th. The specialty retailer reported $0.31 earnings per share for the quarter, topping the consensus estimate of $0.24 by $0.07. The company had revenue of $460.10 million for the quarter, compared to analyst estimates of $445.70 million. OPENLANE had a net margin of 7.15% and a return on equity of 10.38%. OPENLANE's revenue for the quarter was up 7.0% compared to the same quarter last year. During the same period in the previous year, the business earned $0.19 EPS. Equities research analysts forecast that OPENLANE, Inc. will post 0.95 EPS for the current fiscal year.

Insider Activity at OPENLANE

In related news, EVP James P. Coyle sold 7,000 shares of OPENLANE stock in a transaction dated Friday, May 9th. The shares were sold at an average price of $21.72, for a total transaction of $152,040.00. Following the completion of the sale, the executive vice president owned 36,511 shares of the company's stock, valued at approximately $793,018.92. The trade was a 16.09% decrease in their position. The sale was disclosed in a filing with the SEC, which is accessible through the SEC website. Insiders own 2.32% of the company's stock.

OPENLANE Profile

(

Free Report)

OPENLANE, Inc, together with its subsidiaries, operates as a digital marketplace for used vehicles, which connects sellers and buyers in North America, Europe, the Philippines, and Uruguay. The company operates through two segments, Marketplace and Finance. The Marketplace segment offers digital marketplace services for buying and selling used vehicles.

See Also

Before you consider OPENLANE, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and OPENLANE wasn't on the list.

While OPENLANE currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.