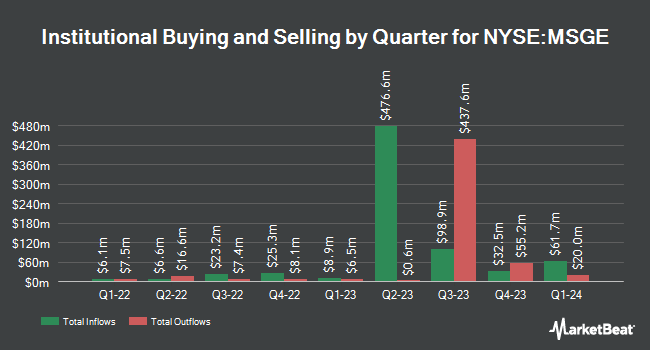

XTX Topco Ltd bought a new stake in Madison Square Garden Entertainment Corp. (NYSE:MSGE - Free Report) in the 1st quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm bought 37,066 shares of the company's stock, valued at approximately $1,214,000. XTX Topco Ltd owned about 0.09% of Madison Square Garden Entertainment at the end of the most recent quarter.

Several other large investors have also recently bought and sold shares of the company. KBC Group NV bought a new position in Madison Square Garden Entertainment during the 1st quarter valued at approximately $31,000. Sterling Capital Management LLC increased its holdings in shares of Madison Square Garden Entertainment by 785.2% in the 4th quarter. Sterling Capital Management LLC now owns 1,133 shares of the company's stock worth $40,000 after purchasing an additional 1,005 shares in the last quarter. NBC Securities Inc. increased its holdings in shares of Madison Square Garden Entertainment by 136,900.0% in the 1st quarter. NBC Securities Inc. now owns 1,370 shares of the company's stock worth $44,000 after purchasing an additional 1,369 shares in the last quarter. GAMMA Investing LLC increased its holdings in shares of Madison Square Garden Entertainment by 1,632.3% in the 1st quarter. GAMMA Investing LLC now owns 2,685 shares of the company's stock worth $82,000 after purchasing an additional 2,530 shares in the last quarter. Finally, Tower Research Capital LLC TRC lifted its position in Madison Square Garden Entertainment by 26.5% during the fourth quarter. Tower Research Capital LLC TRC now owns 2,405 shares of the company's stock valued at $86,000 after purchasing an additional 504 shares in the last quarter. 96.86% of the stock is currently owned by institutional investors.

Madison Square Garden Entertainment Price Performance

Shares of Madison Square Garden Entertainment stock traded up $0.13 during trading hours on Wednesday, hitting $38.06. The company's stock had a trading volume of 46,413 shares, compared to its average volume of 331,673. Madison Square Garden Entertainment Corp. has a 12-month low of $28.29 and a 12-month high of $44.14. The company has a debt-to-equity ratio of 60.61, a quick ratio of 0.57 and a current ratio of 0.57. The business has a 50 day moving average price of $38.65 and a two-hundred day moving average price of $35.81. The company has a market cap of $1.54 billion, a PE ratio of 13.89 and a beta of 0.44.

Analyst Upgrades and Downgrades

Several research firms recently weighed in on MSGE. Susquehanna began coverage on Madison Square Garden Entertainment in a research report on Monday, April 28th. They set a "positive" rating and a $39.00 target price on the stock. The Goldman Sachs Group lifted their target price on Madison Square Garden Entertainment from $36.00 to $41.00 and gave the company a "buy" rating in a research report on Wednesday, May 7th.

Check Out Our Latest Analysis on MSGE

About Madison Square Garden Entertainment

(

Free Report)

Madison Square Garden Entertainment Corp. engages in the provision of entertainment services. Its portfolio of venues includes The Garden, Radio City Music Hall, the Beacon Theatre, The Theater at Madison Square, and The Chicago Theatre. The company was founded in 1879 and is headquartered in New York, NY.

Featured Stories

Before you consider Madison Square Garden Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Madison Square Garden Entertainment wasn't on the list.

While Madison Square Garden Entertainment currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.