XTX Topco Ltd lowered its position in shares of Catalyst Pharmaceuticals, Inc. (NASDAQ:CPRX - Free Report) by 56.6% in the first quarter, according to its most recent disclosure with the SEC. The institutional investor owned 11,623 shares of the biopharmaceutical company's stock after selling 15,179 shares during the quarter. XTX Topco Ltd's holdings in Catalyst Pharmaceuticals were worth $282,000 as of its most recent SEC filing.

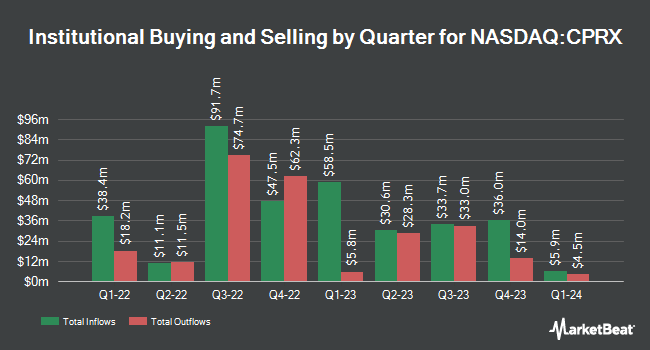

A number of other hedge funds and other institutional investors also recently modified their holdings of the company. Castlekeep Investment Advisors LLC bought a new position in shares of Catalyst Pharmaceuticals in the fourth quarter worth $37,494,000. Bank of America Corp DE grew its stake in Catalyst Pharmaceuticals by 139.5% during the fourth quarter. Bank of America Corp DE now owns 1,568,791 shares of the biopharmaceutical company's stock worth $32,741,000 after buying an additional 913,843 shares in the last quarter. Allianz Asset Management GmbH grew its stake in Catalyst Pharmaceuticals by 397.8% during the first quarter. Allianz Asset Management GmbH now owns 694,125 shares of the biopharmaceutical company's stock worth $16,833,000 after buying an additional 554,674 shares in the last quarter. Raymond James Financial Inc. acquired a new stake in Catalyst Pharmaceuticals during the fourth quarter worth about $6,887,000. Finally, JPMorgan Chase & Co. grew its stake in Catalyst Pharmaceuticals by 80.3% during the fourth quarter. JPMorgan Chase & Co. now owns 736,197 shares of the biopharmaceutical company's stock worth $15,364,000 after buying an additional 327,936 shares in the last quarter. Institutional investors and hedge funds own 79.22% of the company's stock.

Catalyst Pharmaceuticals Trading Down 0.1%

NASDAQ CPRX traded down $0.03 during trading on Friday, hitting $20.04. 123,028 shares of the company's stock were exchanged, compared to its average volume of 1,308,239. The company has a market cap of $2.45 billion, a PE ratio of 12.17, a P/E/G ratio of 0.82 and a beta of 0.70. Catalyst Pharmaceuticals, Inc. has a fifty-two week low of $19.00 and a fifty-two week high of $26.58. The stock's 50 day moving average price is $21.86 and its two-hundred day moving average price is $22.72.

Analyst Upgrades and Downgrades

A number of equities research analysts have issued reports on the stock. Cantor Fitzgerald upgraded shares of Catalyst Pharmaceuticals to a "strong-buy" rating in a research note on Thursday, June 5th. Wall Street Zen downgraded shares of Catalyst Pharmaceuticals from a "strong-buy" rating to a "hold" rating in a research note on Saturday, August 9th. One investment analyst has rated the stock with a hold rating, five have given a buy rating and two have assigned a strong buy rating to the stock. According to data from MarketBeat.com, Catalyst Pharmaceuticals has a consensus rating of "Buy" and an average target price of $33.20.

Get Our Latest Stock Report on Catalyst Pharmaceuticals

Insider Buying and Selling

In other Catalyst Pharmaceuticals news, insider Preethi Sundaram sold 2,324 shares of the business's stock in a transaction dated Tuesday, June 10th. The stock was sold at an average price of $26.41, for a total transaction of $61,376.84. Following the completion of the transaction, the insider owned 42,681 shares of the company's stock, valued at approximately $1,127,205.21. The trade was a 5.16% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Insiders own 10.40% of the company's stock.

Catalyst Pharmaceuticals Profile

(

Free Report)

Catalyst Pharmaceuticals, Inc, a commercial-stage biopharmaceutical company, focuses on developing and commercializing therapies for people with rare debilitating, chronic neuromuscular, and neurological diseases in the United States. It offers Firdapse, an amifampridine phosphate tablets for the treatment of patients with lambert-eaton myasthenic syndrome (LEMS); and Ruzurgi for the treatment of pediatric LEMS patients.

Featured Articles

Before you consider Catalyst Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Catalyst Pharmaceuticals wasn't on the list.

While Catalyst Pharmaceuticals currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.