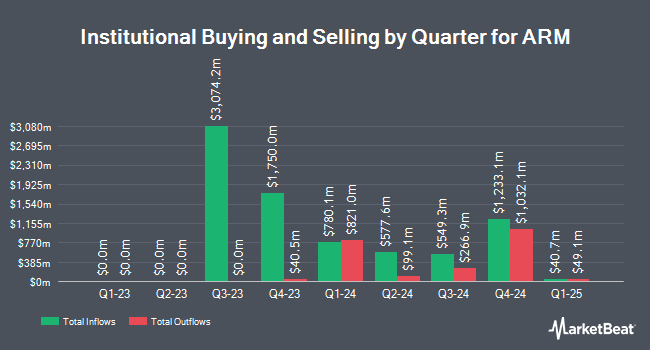

Y Intercept Hong Kong Ltd bought a new position in shares of ARM Holdings PLC Sponsored ADR (NASDAQ:ARM - Free Report) during the 1st quarter, according to its most recent 13F filing with the SEC. The fund bought 6,999 shares of the company's stock, valued at approximately $747,000.

Other large investors have also modified their holdings of the company. Envestnet Portfolio Solutions Inc. raised its stake in ARM by 6.7% in the 4th quarter. Envestnet Portfolio Solutions Inc. now owns 2,127 shares of the company's stock worth $262,000 after acquiring an additional 133 shares during the last quarter. LPL Financial LLC raised its stake in shares of ARM by 5.3% in the fourth quarter. LPL Financial LLC now owns 234,004 shares of the company's stock worth $28,867,000 after purchasing an additional 11,852 shares during the last quarter. Corebridge Financial Inc. raised its stake in shares of ARM by 1.8% in the fourth quarter. Corebridge Financial Inc. now owns 8,329 shares of the company's stock worth $1,027,000 after purchasing an additional 147 shares during the last quarter. Mitsubishi UFJ Asset Management Co. Ltd. lifted its holdings in shares of ARM by 23.3% during the fourth quarter. Mitsubishi UFJ Asset Management Co. Ltd. now owns 59,773 shares of the company's stock worth $7,374,000 after purchasing an additional 11,287 shares during the period. Finally, NEOS Investment Management LLC boosted its position in ARM by 15.8% in the fourth quarter. NEOS Investment Management LLC now owns 4,547 shares of the company's stock valued at $561,000 after buying an additional 621 shares during the last quarter. Hedge funds and other institutional investors own 7.53% of the company's stock.

Analyst Ratings Changes

ARM has been the subject of several research reports. Raymond James Financial decreased their price objective on shares of ARM from $175.00 to $140.00 and set an "outperform" rating for the company in a research note on Thursday, May 8th. KeyCorp lowered their price target on ARM from $195.00 to $175.00 and set an "overweight" rating on the stock in a research report on Thursday, May 8th. BNP Paribas Exane upgraded shares of ARM from a "neutral" rating to an "outperform" rating and set a $210.00 target price on the stock in a research report on Wednesday, July 16th. Loop Capital reduced their price objective on ARM from $195.00 to $155.00 and set a "buy" rating for the company in a research note on Tuesday, May 13th. Finally, JPMorgan Chase & Co. decreased their target price on shares of ARM from $175.00 to $150.00 and set an "overweight" rating on the stock in a research note on Thursday, May 8th. Two investment analysts have rated the stock with a sell rating, seven have given a hold rating, twenty have given a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus target price of $162.96.

View Our Latest Analysis on ARM

ARM Stock Up 0.7%

NASDAQ ARM traded up $1.20 during trading hours on Monday, hitting $164.37. 4,023,192 shares of the company were exchanged, compared to its average volume of 5,465,264. The company has a 50 day moving average of $144.61 and a two-hundred day moving average of $133.91. The firm has a market cap of $173.66 billion, a price-to-earnings ratio of 219.16, a PEG ratio of 9.42 and a beta of 4.19. ARM Holdings PLC Sponsored ADR has a 52-week low of $80.00 and a 52-week high of $182.88.

ARM (NASDAQ:ARM - Get Free Report) last released its earnings results on Wednesday, May 7th. The company reported $0.55 earnings per share for the quarter, topping analysts' consensus estimates of $0.52 by $0.03. ARM had a net margin of 19.76% and a return on equity of 17.97%. The firm had revenue of $1.24 billion for the quarter, compared to analyst estimates of $1.23 billion. During the same period in the prior year, the firm earned $0.36 earnings per share. The business's quarterly revenue was up 33.7% compared to the same quarter last year. On average, equities research analysts predict that ARM Holdings PLC Sponsored ADR will post 0.9 EPS for the current year.

ARM Profile

(

Free Report)

Arm Holdings Plc engages in the licensing, marketing, research, and development of microprocessors, systems IP, graphics processing units, physical IP and associated systems IP, software, and tools. It operates through the following geographical segments: United Kingdom, United States, and Other Countries.

Featured Articles

Before you consider ARM, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ARM wasn't on the list.

While ARM currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.