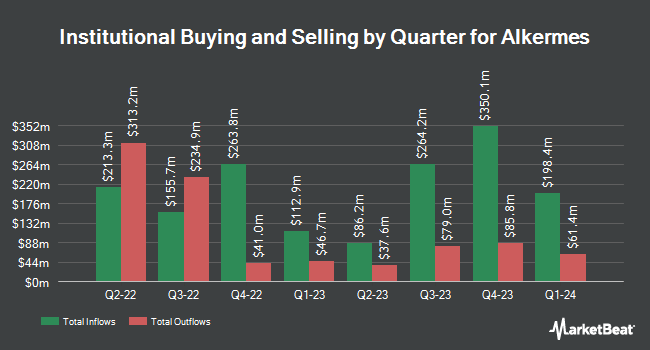

Y Intercept Hong Kong Ltd boosted its holdings in Alkermes plc (NASDAQ:ALKS - Free Report) by 76.3% during the first quarter, according to the company in its most recent disclosure with the SEC. The firm owned 25,339 shares of the company's stock after purchasing an additional 10,966 shares during the quarter. Y Intercept Hong Kong Ltd's holdings in Alkermes were worth $837,000 at the end of the most recent quarter.

A number of other hedge funds and other institutional investors have also bought and sold shares of ALKS. Avoro Capital Advisors LLC purchased a new stake in Alkermes in the fourth quarter worth about $70,462,000. Norges Bank bought a new position in shares of Alkermes in the fourth quarter worth approximately $56,684,000. RTW Investments LP lifted its stake in shares of Alkermes by 13.6% in the fourth quarter. RTW Investments LP now owns 7,557,835 shares of the company's stock worth $217,363,000 after buying an additional 903,802 shares in the last quarter. Nuveen Asset Management LLC lifted its stake in shares of Alkermes by 109.5% in the fourth quarter. Nuveen Asset Management LLC now owns 1,659,821 shares of the company's stock worth $47,736,000 after buying an additional 867,492 shares in the last quarter. Finally, JPMorgan Chase & Co. lifted its stake in shares of Alkermes by 147.4% in the fourth quarter. JPMorgan Chase & Co. now owns 889,472 shares of the company's stock worth $25,581,000 after buying an additional 529,962 shares in the last quarter. Hedge funds and other institutional investors own 95.21% of the company's stock.

Insider Activity

In other Alkermes news, SVP Christian Todd Nichols sold 3,334 shares of Alkermes stock in a transaction on Tuesday, June 10th. The shares were sold at an average price of $31.09, for a total value of $103,654.06. Following the sale, the senior vice president directly owned 86,208 shares in the company, valued at approximately $2,680,206.72. The trade was a 3.72% decrease in their position. The sale was disclosed in a legal filing with the SEC, which is accessible through this link. Corporate insiders own 4.40% of the company's stock.

Wall Street Analysts Forecast Growth

Several research firms have recently weighed in on ALKS. Needham & Company LLC restated a "buy" rating and issued a $45.00 price target on shares of Alkermes in a research note on Monday, July 21st. HC Wainwright restated a "neutral" rating and issued a $46.00 price target on shares of Alkermes in a research note on Monday, July 21st. UBS Group upgraded Alkermes from a "neutral" rating to a "buy" rating and boosted their price target for the stock from $33.00 to $42.00 in a research note on Tuesday, June 17th. Cantor Fitzgerald upgraded Alkermes to a "strong-buy" rating in a research note on Tuesday, May 13th. Finally, The Goldman Sachs Group assumed coverage on shares of Alkermes in a research report on Tuesday, July 15th. They set a "buy" rating and a $43.00 price objective on the stock. Three investment analysts have rated the stock with a hold rating, nine have given a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat, the company has a consensus rating of "Moderate Buy" and an average target price of $40.92.

Read Our Latest Stock Analysis on Alkermes

Alkermes Stock Performance

NASDAQ:ALKS opened at $26.13 on Friday. The stock has a 50-day simple moving average of $29.59 and a two-hundred day simple moving average of $30.82. Alkermes plc has a 52-week low of $25.56 and a 52-week high of $36.45. The firm has a market capitalization of $4.31 billion, a PE ratio of 12.50, a P/E/G ratio of 1.65 and a beta of 0.44.

Alkermes (NASDAQ:ALKS - Get Free Report) last announced its quarterly earnings data on Thursday, May 1st. The company reported $0.13 EPS for the quarter, missing the consensus estimate of $0.32 by ($0.19). Alkermes had a net margin of 23.30% and a return on equity of 27.52%. The firm had revenue of $306.51 million for the quarter, compared to the consensus estimate of $307.53 million. During the same quarter in the previous year, the business earned $0.43 earnings per share. The firm's revenue for the quarter was down 12.6% on a year-over-year basis. Equities analysts forecast that Alkermes plc will post 1.31 earnings per share for the current fiscal year.

About Alkermes

(

Free Report)

Alkermes plc, a biopharmaceutical company, researches, develops, and commercializes pharmaceutical products to address unmet medical needs of patients in therapeutic areas in the United States, Ireland, and internationally. It has a portfolio of proprietary commercial products for the treatment of alcohol dependence, opioid dependence, schizophrenia and bipolar I disorder and a pipeline of clinical and preclinical product candidates in development for neurological disorders.

See Also

Want to see what other hedge funds are holding ALKS? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Alkermes plc (NASDAQ:ALKS - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Alkermes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alkermes wasn't on the list.

While Alkermes currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.