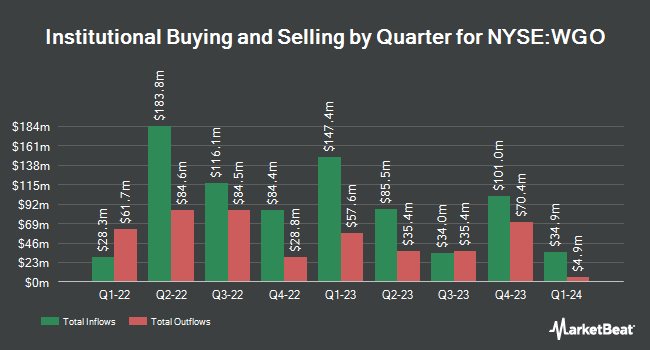

Y Intercept Hong Kong Ltd purchased a new position in Winnebago Industries, Inc. (NYSE:WGO - Free Report) during the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor purchased 18,874 shares of the construction company's stock, valued at approximately $650,000. Y Intercept Hong Kong Ltd owned 0.07% of Winnebago Industries as of its most recent filing with the Securities and Exchange Commission (SEC).

Several other institutional investors have also recently made changes to their positions in the company. Vanguard Group Inc. increased its holdings in shares of Winnebago Industries by 2.3% in the fourth quarter. Vanguard Group Inc. now owns 2,181,874 shares of the construction company's stock worth $104,250,000 after purchasing an additional 48,517 shares during the period. First Trust Advisors LP increased its stake in Winnebago Industries by 40.6% in the fourth quarter. First Trust Advisors LP now owns 1,643,786 shares of the construction company's stock valued at $78,540,000 after acquiring an additional 474,273 shares during the last quarter. Millennium Management LLC increased its stake in Winnebago Industries by 20.0% in the fourth quarter. Millennium Management LLC now owns 571,334 shares of the construction company's stock valued at $27,298,000 after acquiring an additional 95,113 shares during the last quarter. Northern Trust Corp increased its stake in Winnebago Industries by 11.3% in the fourth quarter. Northern Trust Corp now owns 345,226 shares of the construction company's stock valued at $16,495,000 after acquiring an additional 35,177 shares during the last quarter. Finally, BNP Paribas Financial Markets increased its stake in Winnebago Industries by 1,930.2% in the fourth quarter. BNP Paribas Financial Markets now owns 321,662 shares of the construction company's stock valued at $15,369,000 after acquiring an additional 305,818 shares during the last quarter.

Analyst Ratings Changes

WGO has been the topic of a number of recent research reports. Wall Street Zen raised Winnebago Industries from a "sell" rating to a "hold" rating in a research note on Sunday, June 29th. Baird R W cut Winnebago Industries from a "strong-buy" rating to a "hold" rating in a research note on Friday, April 4th. Truist Financial dropped their target price on shares of Winnebago Industries from $40.00 to $36.00 and set a "buy" rating for the company in a report on Thursday, June 26th. BMO Capital Markets dropped their target price on shares of Winnebago Industries from $50.00 to $42.00 and set an "outperform" rating for the company in a report on Thursday, June 26th. Finally, Robert W. Baird dropped their target price on shares of Winnebago Industries from $38.00 to $35.00 and set a "neutral" rating for the company in a report on Thursday, June 26th. Five equities research analysts have rated the stock with a hold rating and six have given a buy rating to the stock. Based on data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $42.33.

Read Our Latest Report on Winnebago Industries

Winnebago Industries Stock Down 3.5%

WGO traded down $1.11 on Wednesday, hitting $30.58. The company had a trading volume of 619,717 shares, compared to its average volume of 625,506. The company has a debt-to-equity ratio of 0.44, a current ratio of 2.41 and a quick ratio of 0.89. Winnebago Industries, Inc. has a 52-week low of $28.00 and a 52-week high of $65.65. The stock has a fifty day simple moving average of $31.90 and a 200-day simple moving average of $36.04. The firm has a market capitalization of $857.16 million, a P/E ratio of -51.83 and a beta of 1.01.

Winnebago Industries (NYSE:WGO - Get Free Report) last announced its earnings results on Wednesday, June 25th. The construction company reported $0.81 earnings per share for the quarter, beating analysts' consensus estimates of $0.79 by $0.02. Winnebago Industries had a negative net margin of 0.62% and a positive return on equity of 2.86%. The business had revenue of $775.10 million during the quarter, compared to the consensus estimate of $808.15 million. During the same quarter last year, the firm earned $1.13 earnings per share. The business's revenue for the quarter was down 1.4% on a year-over-year basis. As a group, equities analysts expect that Winnebago Industries, Inc. will post 3.41 EPS for the current fiscal year.

Winnebago Industries Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Wednesday, June 25th. Investors of record on Wednesday, June 11th were given a dividend of $0.34 per share. This represents a $1.36 annualized dividend and a dividend yield of 4.45%. The ex-dividend date was Wednesday, June 11th. Winnebago Industries's dividend payout ratio (DPR) is currently -230.51%.

About Winnebago Industries

(

Free Report)

Winnebago Industries, Inc manufactures and sells recreation vehicles and marine products primarily for use in leisure travel and outdoor recreation activities. The company operates through three segments: Towable RV, Motorhome RV, and Marine. It provides towable products that are non-motorized vehicles to be towed by automobiles, pickup trucks, SUVs, or vans for use as temporary living quarters for recreational travel, such as conventional travel trailers, fifth wheels, folding camper trailers, and truck campers under the Winnebago and Grand Design brand names.

See Also

Before you consider Winnebago Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Winnebago Industries wasn't on the list.

While Winnebago Industries currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.