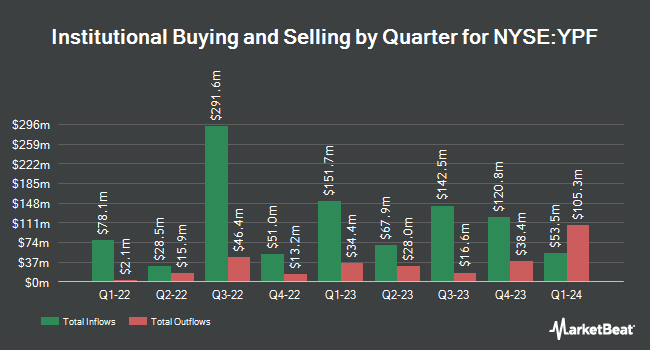

Vaughan Nelson Investment Management L.P. increased its position in shares of YPF Sociedad Anonima (NYSE:YPF - Free Report) by 12.8% in the 2nd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 173,256 shares of the oil and gas exploration company's stock after acquiring an additional 19,640 shares during the period. Vaughan Nelson Investment Management L.P.'s holdings in YPF Sociedad Anonima were worth $5,449,000 as of its most recent filing with the Securities and Exchange Commission.

Other hedge funds and other institutional investors have also modified their holdings of the company. Crocodile Capital Partners GmbH raised its holdings in shares of YPF Sociedad Anonima by 100.0% during the second quarter. Crocodile Capital Partners GmbH now owns 60,000 shares of the oil and gas exploration company's stock worth $1,887,000 after acquiring an additional 30,000 shares in the last quarter. GAMMA Investing LLC grew its stake in shares of YPF Sociedad Anonima by 3,099.7% in the 1st quarter. GAMMA Investing LLC now owns 70,746 shares of the oil and gas exploration company's stock valued at $2,479,000 after buying an additional 68,535 shares in the last quarter. Banco Santander S.A. grew its stake in shares of YPF Sociedad Anonima by 92.0% in the 1st quarter. Banco Santander S.A. now owns 34,858 shares of the oil and gas exploration company's stock valued at $1,221,000 after buying an additional 16,707 shares in the last quarter. BNP Paribas Financial Markets grew its stake in shares of YPF Sociedad Anonima by 24.7% in the 1st quarter. BNP Paribas Financial Markets now owns 1,179,942 shares of the oil and gas exploration company's stock valued at $41,345,000 after buying an additional 233,983 shares in the last quarter. Finally, Compound Planning Inc. bought a new stake in shares of YPF Sociedad Anonima in the 1st quarter valued at approximately $411,000. 10.08% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

Several equities research analysts recently commented on YPF shares. Weiss Ratings reissued a "hold (c)" rating on shares of YPF Sociedad Anonima in a research note on Saturday, September 27th. Wall Street Zen raised YPF Sociedad Anonima from a "sell" rating to a "hold" rating in a research note on Friday, June 27th. Finally, Zacks Research cut YPF Sociedad Anonima from a "hold" rating to a "strong sell" rating in a research note on Tuesday, September 9th. Three analysts have rated the stock with a Buy rating, four have assigned a Hold rating and one has given a Sell rating to the company's stock. According to data from MarketBeat, the company has a consensus rating of "Hold" and an average price target of $46.70.

View Our Latest Report on YPF Sociedad Anonima

YPF Sociedad Anonima Stock Up 1.4%

YPF opened at $24.15 on Friday. The business has a 50 day moving average price of $29.99 and a 200 day moving average price of $32.10. YPF Sociedad Anonima has a twelve month low of $21.40 and a twelve month high of $47.43. The company has a debt-to-equity ratio of 0.67, a quick ratio of 0.55 and a current ratio of 0.75. The firm has a market cap of $9.50 billion, a P/E ratio of 7.79, a price-to-earnings-growth ratio of 0.47 and a beta of 1.72.

YPF Sociedad Anonima (NYSE:YPF - Get Free Report) last posted its earnings results on Thursday, August 7th. The oil and gas exploration company reported $0.13 earnings per share for the quarter, missing the consensus estimate of $0.56 by ($0.43). YPF Sociedad Anonima had a return on equity of 12.39% and a net margin of 6.32%.The company had revenue of $3.47 million during the quarter, compared to analyst estimates of $3.37 million. Research analysts forecast that YPF Sociedad Anonima will post 7.25 EPS for the current year.

YPF Sociedad Anonima Company Profile

(

Free Report)

YPF Sociedad Anónima, an energy company, engages in the oil and gas upstream and downstream activities in Argentina. Its upstream operations include the exploration, exploitation, and production of crude oil, and natural gas. The company's downstream operations include petrochemical production and crude oil refining; transportation and distribution refined and petrochemical products; commercialization of crude oil, petrochemical products, and specialties.

See Also

Want to see what other hedge funds are holding YPF? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for YPF Sociedad Anonima (NYSE:YPF - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider YPF Sociedad Anonima, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and YPF Sociedad Anonima wasn't on the list.

While YPF Sociedad Anonima currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.