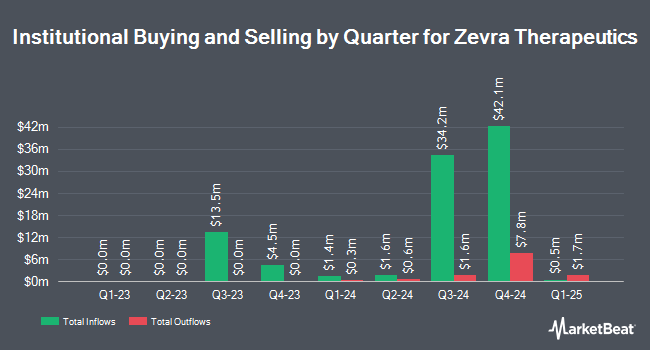

Altium Capital Management LLC decreased its position in shares of Zevra Therapeutics, Inc. (NASDAQ:ZVRA - Free Report) by 30.4% during the first quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 1,287,333 shares of the company's stock after selling 562,667 shares during the period. Zevra Therapeutics makes up approximately 23.2% of Altium Capital Management LLC's holdings, making the stock its largest holding. Altium Capital Management LLC owned approximately 2.35% of Zevra Therapeutics worth $9,642,000 at the end of the most recent reporting period.

A number of other large investors have also added to or reduced their stakes in ZVRA. Woodline Partners LP increased its holdings in shares of Zevra Therapeutics by 2.2% in the fourth quarter. Woodline Partners LP now owns 4,139,593 shares of the company's stock worth $34,524,000 after buying an additional 90,940 shares during the period. Adage Capital Partners GP L.L.C. increased its holdings in shares of Zevra Therapeutics by 462.4% in the fourth quarter. Adage Capital Partners GP L.L.C. now owns 3,650,000 shares of the company's stock worth $30,441,000 after buying an additional 3,001,000 shares during the period. Vanguard Group Inc. increased its holdings in shares of Zevra Therapeutics by 2.5% in the fourth quarter. Vanguard Group Inc. now owns 2,824,212 shares of the company's stock worth $23,554,000 after buying an additional 68,151 shares during the period. AIGH Capital Management LLC increased its holdings in shares of Zevra Therapeutics by 82.4% in the first quarter. AIGH Capital Management LLC now owns 1,438,109 shares of the company's stock worth $10,771,000 after buying an additional 649,495 shares during the period. Finally, Geode Capital Management LLC increased its holdings in shares of Zevra Therapeutics by 13.8% in the fourth quarter. Geode Capital Management LLC now owns 1,188,120 shares of the company's stock worth $9,912,000 after buying an additional 144,256 shares during the period. Hedge funds and other institutional investors own 35.03% of the company's stock.

Zevra Therapeutics Stock Down 5.6%

Zevra Therapeutics stock traded down $0.53 during trading hours on Thursday, hitting $8.90. 3,390,289 shares of the stock traded hands, compared to its average volume of 1,303,310. The firm's 50-day moving average price is $10.55 and its two-hundred day moving average price is $8.74. The company has a current ratio of 7.85, a quick ratio of 2.93 and a debt-to-equity ratio of 0.52. The company has a market cap of $499.56 million, a PE ratio of -42.38 and a beta of 1.87. Zevra Therapeutics, Inc. has a one year low of $6.19 and a one year high of $13.16.

Zevra Therapeutics (NASDAQ:ZVRA - Get Free Report) last posted its quarterly earnings data on Tuesday, August 12th. The company reported ($0.06) earnings per share for the quarter, missing the consensus estimate of $1.43 by ($1.49). The firm had revenue of $25.88 million for the quarter, compared to the consensus estimate of $22.49 million. Zevra Therapeutics had a net margin of 4.33% and a negative return on equity of 112.40%. On average, research analysts forecast that Zevra Therapeutics, Inc. will post -1.95 EPS for the current year.

Wall Street Analysts Forecast Growth

ZVRA has been the topic of several recent analyst reports. HC Wainwright initiated coverage on Zevra Therapeutics in a research note on Wednesday, July 2nd. They issued a "buy" rating and a $26.00 target price on the stock. JMP Securities cut their target price on Zevra Therapeutics from $19.00 to $18.00 and set a "market outperform" rating on the stock in a research note on Wednesday. Citigroup reissued an "outperform" rating on shares of Zevra Therapeutics in a research note on Wednesday. Cantor Fitzgerald raised their target price on Zevra Therapeutics from $25.00 to $29.00 and gave the stock an "overweight" rating in a research note on Thursday, July 10th. Finally, Wall Street Zen cut Zevra Therapeutics from a "strong-buy" rating to a "buy" rating in a research note on Sunday, July 20th. Nine analysts have rated the stock with a buy rating and one has given a strong buy rating to the stock. According to MarketBeat.com, the stock has a consensus rating of "Buy" and a consensus target price of $23.71.

Read Our Latest Analysis on Zevra Therapeutics

About Zevra Therapeutics

(

Free Report)

Zevra Therapeutics, Inc discovers and develops various proprietary prodrugs to treat serious medical conditions in the United States. The company develops its products through Ligand Activated Therapy platform. Its lead product candidate is KP1077, consisting of KP1077IH, which is under Phase 2 clinical trial for the treatment of idiopathic hypersomnia, and KP1077N, which is under Phase ½ clinical trial to treat narcolepsy.

Read More

Before you consider Zevra Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zevra Therapeutics wasn't on the list.

While Zevra Therapeutics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.