Zimmer Partners LP boosted its stake in ArcBest Co. (NASDAQ:ARCB - Free Report) by 23.5% during the 4th quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The firm owned 105,000 shares of the transportation company's stock after acquiring an additional 20,000 shares during the period. Zimmer Partners LP owned 0.45% of ArcBest worth $9,799,000 as of its most recent SEC filing.

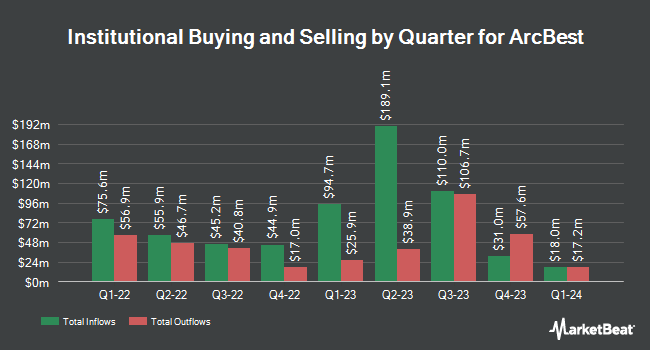

Several other institutional investors have also recently added to or reduced their stakes in the stock. Westwood Holdings Group Inc. increased its position in ArcBest by 2.6% in the 4th quarter. Westwood Holdings Group Inc. now owns 635,858 shares of the transportation company's stock valued at $59,338,000 after acquiring an additional 16,239 shares during the period. Two Sigma Advisers LP increased its position in ArcBest by 147.1% in the 4th quarter. Two Sigma Advisers LP now owns 16,800 shares of the transportation company's stock valued at $1,568,000 after acquiring an additional 10,000 shares during the period. Two Sigma Investments LP increased its position in ArcBest by 12.0% in the 4th quarter. Two Sigma Investments LP now owns 64,399 shares of the transportation company's stock valued at $6,010,000 after acquiring an additional 6,900 shares during the period. Seven Six Capital Management LLC purchased a new stake in ArcBest in the 4th quarter valued at approximately $4,237,000. Finally, Shay Capital LLC purchased a new stake in ArcBest in the 4th quarter valued at approximately $509,000. Institutional investors and hedge funds own 99.27% of the company's stock.

ArcBest Price Performance

Shares of NASDAQ:ARCB traded down $1.28 during trading on Friday, hitting $60.77. 257,950 shares of the stock were exchanged, compared to its average volume of 307,736. The company has a fifty day moving average price of $64.84 and a two-hundred day moving average price of $85.71. The company has a market cap of $1.39 billion, a PE ratio of 8.29, a P/E/G ratio of 1.70 and a beta of 1.70. The company has a current ratio of 1.01, a quick ratio of 1.04 and a debt-to-equity ratio of 0.10. ArcBest Co. has a 12-month low of $55.19 and a 12-month high of $129.83.

ArcBest (NASDAQ:ARCB - Get Free Report) last issued its quarterly earnings data on Tuesday, April 29th. The transportation company reported $0.51 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.52 by ($0.01). ArcBest had a return on equity of 11.79% and a net margin of 4.16%. The company had revenue of $967.08 million for the quarter, compared to analyst estimates of $990.03 million. During the same quarter in the prior year, the firm earned $1.34 earnings per share. The company's revenue for the quarter was down 6.7% on a year-over-year basis. On average, analysts forecast that ArcBest Co. will post 7 EPS for the current year.

ArcBest Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Friday, May 23rd. Investors of record on Friday, May 9th were given a dividend of $0.12 per share. The ex-dividend date was Friday, May 9th. This represents a $0.48 annualized dividend and a dividend yield of 0.79%. ArcBest's dividend payout ratio is currently 6.35%.

Wall Street Analyst Weigh In

A number of equities research analysts have weighed in on the company. Wells Fargo & Company lowered their price objective on ArcBest from $80.00 to $60.00 and set an "equal weight" rating on the stock in a report on Wednesday, April 30th. Stifel Nicolaus lowered their price objective on ArcBest from $102.00 to $83.00 and set a "buy" rating on the stock in a report on Wednesday, April 30th. Stephens reaffirmed an "overweight" rating and issued a $116.00 price objective on shares of ArcBest in a report on Tuesday, March 11th. Wall Street Zen raised ArcBest from a "sell" rating to a "hold" rating in a report on Friday, May 9th. Finally, TD Cowen lowered their price objective on ArcBest from $80.00 to $72.00 and set a "hold" rating on the stock in a report on Wednesday, April 30th. One investment analyst has rated the stock with a sell rating, eight have issued a hold rating and five have issued a buy rating to the stock. According to data from MarketBeat.com, ArcBest presently has a consensus rating of "Hold" and an average price target of $88.25.

View Our Latest Stock Report on ARCB

Insider Buying and Selling

In related news, CFO John Matthew Beasley acquired 700 shares of the business's stock in a transaction that occurred on Thursday, March 13th. The stock was purchased at an average cost of $74.89 per share, for a total transaction of $52,423.00. Following the transaction, the chief financial officer now directly owns 8,142 shares of the company's stock, valued at approximately $609,754.38. This trade represents a 9.41% increase in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this link. Insiders own 1.28% of the company's stock.

About ArcBest

(

Free Report)

ArcBest Corporation, an integrated logistics company, engages in the provision of ground, air, and ocean transportation solutions. It operates through two segments: Asset-Based and Asset-Light. The Asset-Based segment provides less-than-truckload (LTL) services, that transports general commodities, such as food, textiles, apparel, furniture, appliances, chemicals, non-bulk petroleum products, rubber, plastics, metal and metal products, wood, glass, automotive parts, machinery, and miscellaneous manufactured products.

Further Reading

Before you consider ArcBest, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ArcBest wasn't on the list.

While ArcBest currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.