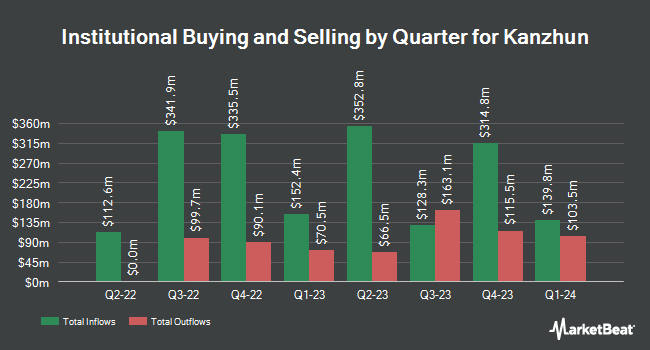

Zurcher Kantonalbank Zurich Cantonalbank raised its position in KANZHUN LIMITED Sponsored ADR (NASDAQ:BZ - Free Report) by 7.4% during the first quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 223,788 shares of the company's stock after purchasing an additional 15,353 shares during the quarter. Zurcher Kantonalbank Zurich Cantonalbank owned 0.06% of KANZHUN worth $4,290,000 as of its most recent SEC filing.

Other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Skandinaviska Enskilda Banken AB publ grew its stake in shares of KANZHUN by 1,298.0% in the first quarter. Skandinaviska Enskilda Banken AB publ now owns 142,600 shares of the company's stock worth $2,734,000 after acquiring an additional 132,400 shares in the last quarter. Baillie Gifford & Co. acquired a new position in shares of KANZHUN in the first quarter worth $71,111,000. New York State Common Retirement Fund acquired a new position in shares of KANZHUN in the first quarter worth $3,527,000. Genus Capital Management Inc. grew its stake in shares of KANZHUN by 200.0% in the first quarter. Genus Capital Management Inc. now owns 13,000 shares of the company's stock worth $249,000 after acquiring an additional 26,000 shares in the last quarter. Finally, Cerity Partners LLC acquired a new position in shares of KANZHUN during the first quarter worth $417,000. Hedge funds and other institutional investors own 60.67% of the company's stock.

KANZHUN Trading Up 3.1%

Shares of BZ stock traded up $0.61 on Tuesday, reaching $19.90. 1,671,070 shares of the stock were exchanged, compared to its average volume of 4,055,575. KANZHUN LIMITED Sponsored ADR has a twelve month low of $10.57 and a twelve month high of $20.81. The company has a market capitalization of $8.16 billion, a price-to-earnings ratio of 34.25 and a beta of 0.41. The business's 50 day moving average price is $18.36 and its 200 day moving average price is $17.09.

Wall Street Analysts Forecast Growth

Separately, Daiwa America upgraded shares of KANZHUN from a "hold" rating to a "strong-buy" rating in a research note on Monday, June 2nd. One equities research analyst has rated the stock with a hold rating, three have assigned a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat.com, the stock currently has an average rating of "Buy" and a consensus target price of $18.50.

Check Out Our Latest Report on BZ

KANZHUN Company Profile

(

Free Report)

Kanzhun Limited, together with its subsidiaries, provides online recruitment services in the People's Republic of China. The company offers its recruitment services through a mobile app under the BOSS Zhipin brand name. Its services allow enterprise customers to access and interact with job seekers and manage their recruitment process.

Read More

Before you consider KANZHUN, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and KANZHUN wasn't on the list.

While KANZHUN currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.