Finning International (TSE:FTT - Get Free Report) had its target price increased by Raymond James Financial from C$56.00 to C$68.00 in a research report issued to clients and investors on Thursday,BayStreet.CA reports. The firm currently has an "outperform" rating on the stock. Raymond James Financial's target price suggests a potential upside of 19.01% from the stock's current price. Raymond James Financial also issued estimates for Finning International's Q3 2025 earnings at $1.07 EPS and FY2026 earnings at $4.60 EPS.

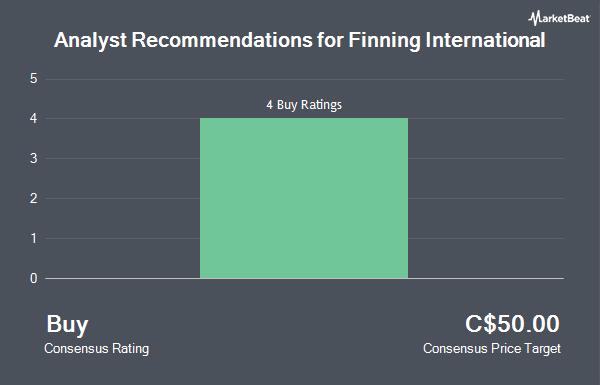

FTT has been the topic of a number of other reports. BMO Capital Markets increased their target price on Finning International from C$57.00 to C$66.00 in a research note on Tuesday, July 22nd. Canaccord Genuity Group lifted their price objective on Finning International from C$55.00 to C$60.00 and gave the stock a "buy" rating in a research note on Thursday, May 22nd. Royal Bank Of Canada boosted their price objective on Finning International from C$49.00 to C$61.00 in a report on Thursday, May 22nd. Scotiabank upped their target price on Finning International from C$48.00 to C$55.00 and gave the stock an "outperform" rating in a report on Thursday, May 22nd. Finally, TD Securities upped their target price on Finning International from C$50.00 to C$57.00 and gave the company a "buy" rating in a research report on Thursday, May 22nd. One analyst has rated the stock with a hold rating and seven have assigned a buy rating to the company's stock. According to data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and a consensus target price of C$59.44.

View Our Latest Stock Report on Finning International

Finning International Price Performance

Shares of TSE FTT traded down C$0.26 during midday trading on Thursday, hitting C$57.14. 500,962 shares of the company's stock were exchanged, compared to its average volume of 499,236. The company has a market cap of C$7.85 billion, a price-to-earnings ratio of 15.98, a PEG ratio of 0.56 and a beta of 1.55. The business's fifty day moving average price is C$57.93 and its two-hundred day moving average price is C$47.43. The company has a current ratio of 1.65, a quick ratio of 0.59 and a debt-to-equity ratio of 98.14. Finning International has a 12-month low of C$34.59 and a 12-month high of C$62.78.

Insider Transactions at Finning International

In other news, Senior Officer Gregory Palaschuk sold 4,070 shares of the stock in a transaction that occurred on Monday, June 16th. The stock was sold at an average price of C$54.80, for a total transaction of C$223,036.00. Also, Senior Officer Sebastian Tomas Guridi sold 3,299 shares of the company's stock in a transaction that occurred on Thursday, June 5th. The stock was sold at an average price of C$50.82, for a total value of C$167,655.18. Insiders sold a total of 17,628 shares of company stock valued at $926,016 over the last quarter. Company insiders own 0.10% of the company's stock.

Finning International Company Profile

(

Get Free Report)

Finning International Inc sells, services, and rents heavy equipment, engines, and related products in Canada, Chile, Bolivia, the United Kingdom, Argentina, Ireland, and internationally. The company offers articulated trucks, asphalt pavers, backhoe loaders, cold planers, compactors, dozers, drills, electric rope shovels, excavators, hydraulic mining shovels, material handlers, motor graders, off-highway trucks, pipelayers, road reclaimers, skid steer and compact track loaders, track loaders, underground-hard rock, wheel loaders, and wheel tractor-scrapers, as well as mobile and stationary generator sets.

See Also

Before you consider Finning International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Finning International wasn't on the list.

While Finning International currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.