Royal Bank of Canada reissued their outperform rating on shares of First Horizon (NYSE:FHN - Free Report) in a research report report published on Monday, MarketBeat reports. Royal Bank of Canada currently has a $24.00 price objective on the financial services provider's stock, up from their prior price objective of $22.00.

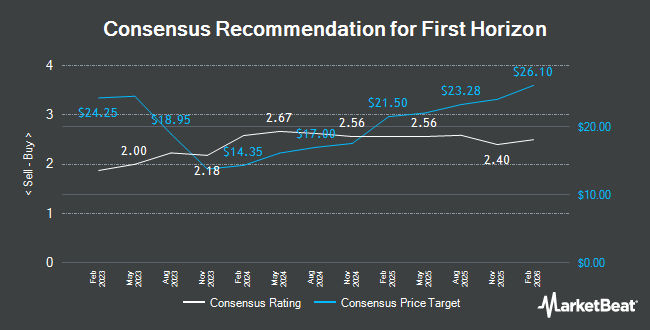

A number of other analysts have also recently issued reports on the company. Baird R W raised First Horizon from a "hold" rating to a "strong-buy" rating in a research report on Monday, April 7th. Barclays dropped their price target on First Horizon from $25.00 to $23.00 and set an "overweight" rating on the stock in a research note on Tuesday, April 8th. Keefe, Bruyette & Woods reduced their price objective on shares of First Horizon from $24.00 to $22.00 and set a "market perform" rating for the company in a research report on Thursday, April 17th. Citigroup upped their price objective on shares of First Horizon from $24.00 to $25.00 and gave the company a "buy" rating in a report on Friday, February 28th. Finally, Wall Street Zen upgraded shares of First Horizon from a "sell" rating to a "hold" rating in a research note on Monday, May 12th. Seven research analysts have rated the stock with a hold rating, ten have given a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat.com, First Horizon currently has a consensus rating of "Moderate Buy" and a consensus price target of $22.53.

Get Our Latest Report on FHN

First Horizon Stock Performance

FHN stock traded down $0.16 during trading hours on Monday, reaching $19.80. The stock had a trading volume of 3,947,444 shares, compared to its average volume of 6,071,248. The stock has a 50-day simple moving average of $18.85 and a 200 day simple moving average of $19.87. First Horizon has a fifty-two week low of $14.09 and a fifty-two week high of $22.44. The stock has a market capitalization of $10.04 billion, a PE ratio of 14.56, a price-to-earnings-growth ratio of 1.19 and a beta of 0.61. The company has a debt-to-equity ratio of 0.14, a current ratio of 0.96 and a quick ratio of 0.95.

First Horizon (NYSE:FHN - Get Free Report) last issued its earnings results on Wednesday, April 16th. The financial services provider reported $0.42 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.40 by $0.02. First Horizon had a net margin of 15.38% and a return on equity of 10.10%. The company had revenue of $823.69 million for the quarter, compared to analysts' expectations of $825.11 million. During the same period in the prior year, the firm earned $0.35 EPS. Analysts predict that First Horizon will post 1.67 EPS for the current fiscal year.

First Horizon Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Tuesday, July 1st. Stockholders of record on Friday, June 13th will be issued a dividend of $0.15 per share. The ex-dividend date is Friday, June 13th. This represents a $0.60 annualized dividend and a dividend yield of 3.03%. First Horizon's dividend payout ratio is presently 41.67%.

Institutional Investors Weigh In On First Horizon

Several institutional investors have recently made changes to their positions in the stock. Millennium Management LLC increased its stake in First Horizon by 102.3% during the 4th quarter. Millennium Management LLC now owns 21,285,306 shares of the financial services provider's stock worth $428,686,000 after acquiring an additional 10,763,349 shares during the period. Bank of New York Mellon Corp grew its holdings in shares of First Horizon by 26.2% during the 4th quarter. Bank of New York Mellon Corp now owns 37,131,162 shares of the financial services provider's stock worth $747,822,000 after purchasing an additional 7,715,191 shares in the last quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC increased its position in shares of First Horizon by 496.3% in the fourth quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 8,202,539 shares of the financial services provider's stock worth $165,199,000 after purchasing an additional 6,827,040 shares during the period. Norges Bank bought a new position in shares of First Horizon in the fourth quarter worth $132,418,000. Finally, Raymond James Financial Inc. acquired a new position in First Horizon in the fourth quarter valued at about $102,467,000. 80.28% of the stock is currently owned by institutional investors.

First Horizon Company Profile

(

Get Free Report)

First Horizon Corporation operates as the bank holding company for First Horizon Bank that provides various financial services. The company operates through Regional Banking and Specialty Banking segments. It offers general banking services for consumers, businesses, financial institutions, and governments.

See Also

Before you consider First Horizon, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and First Horizon wasn't on the list.

While First Horizon currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Today, we are inviting you to take a free peek at our proprietary, exclusive, and up-to-the-minute list of 20 stocks that Wall Street's top analysts hate.

Many of these appear to have good fundamentals and might seem like okay investments, but something is wrong. Analysts smell something seriously rotten about these companies. These are true "Strong Sell" stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.