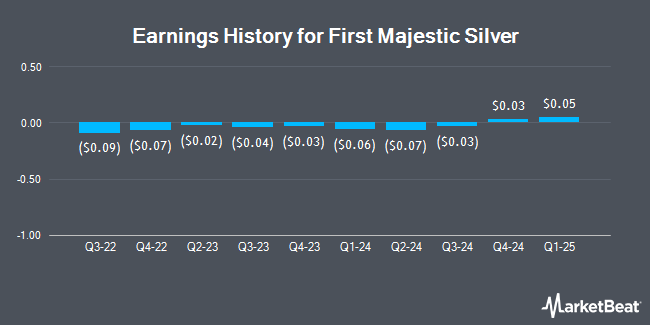

First Majestic Silver (NYSE:AG - Get Free Report) TSE: FR is anticipated to post its Q2 2025 quarterly earnings results before the market opens on Thursday, August 14th. Analysts expect First Majestic Silver to post earnings of $0.12 per share and revenue of $387.25 million for the quarter.

First Majestic Silver (NYSE:AG - Get Free Report) TSE: FR last released its quarterly earnings data on Wednesday, May 7th. The mining company reported $0.05 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.06 by ($0.01). First Majestic Silver had a negative return on equity of 0.14% and a negative net margin of 12.32%. The business had revenue of $241.12 million for the quarter, compared to analysts' expectations of $358.65 million. During the same quarter in the prior year, the firm earned ($0.05) earnings per share. First Majestic Silver's quarterly revenue was up 41.6% compared to the same quarter last year. On average, analysts expect First Majestic Silver to post $1 EPS for the current fiscal year and $1 EPS for the next fiscal year.

First Majestic Silver Trading Down 1.5%

AG traded down $0.13 during trading on Friday, hitting $8.60. 14,496,603 shares of the company's stock were exchanged, compared to its average volume of 15,785,859. The company has a current ratio of 3.19, a quick ratio of 2.74 and a debt-to-equity ratio of 0.08. First Majestic Silver has a 1 year low of $4.59 and a 1 year high of $9.48. The stock has a 50 day moving average price of $8.34 and a 200 day moving average price of $6.83. The firm has a market cap of $4.19 billion, a P/E ratio of -29.65 and a beta of 0.72.

First Majestic Silver Announces Dividend

The company also recently announced a dividend, which was paid on Friday, May 30th. Stockholders of record on Monday, May 19th were paid a $0.0045 dividend. The ex-dividend date was Friday, May 16th. This represents a dividend yield of 32.0%. First Majestic Silver's dividend payout ratio is -6.90%.

Analyst Ratings Changes

Several research analysts have recently weighed in on the stock. Scotiabank upped their target price on shares of First Majestic Silver from $6.00 to $6.50 and gave the company a "sector perform" rating in a research note on Wednesday, July 9th. National Bank Financial upgraded shares of First Majestic Silver to a "hold" rating in a research note on Thursday, June 12th. Finally, HC Wainwright upped their target price on shares of First Majestic Silver from $11.50 to $12.75 and gave the company a "buy" rating in a research note on Thursday, July 10th. Five analysts have rated the stock with a hold rating and one has assigned a buy rating to the company. According to MarketBeat.com, First Majestic Silver presently has a consensus rating of "Hold" and a consensus target price of $9.63.

Get Our Latest Analysis on First Majestic Silver

Institutional Inflows and Outflows

Large investors have recently added to or reduced their stakes in the stock. Creative Planning raised its holdings in shares of First Majestic Silver by 25.3% during the second quarter. Creative Planning now owns 28,837 shares of the mining company's stock worth $238,000 after purchasing an additional 5,828 shares during the period. Geode Capital Management LLC raised its holdings in shares of First Majestic Silver by 12.4% during the second quarter. Geode Capital Management LLC now owns 240,083 shares of the mining company's stock worth $1,994,000 after purchasing an additional 26,553 shares during the period. Royal Bank of Canada raised its holdings in shares of First Majestic Silver by 77.4% during the first quarter. Royal Bank of Canada now owns 604,186 shares of the mining company's stock worth $4,042,000 after purchasing an additional 263,688 shares during the period. Finally, UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC raised its holdings in shares of First Majestic Silver by 355.7% during the first quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 1,193,589 shares of the mining company's stock worth $7,985,000 after purchasing an additional 931,690 shares during the period. 27.16% of the stock is currently owned by institutional investors.

First Majestic Silver Company Profile

(

Get Free Report)

First Majestic Silver Corp. engages in the acquisition, exploration, development, and production of mineral properties with a focus on silver and gold production in North America. Its projects include the San Dimas mine covering an area of approximately 71,867 hectares located in Durango State, Mexico; the Santa Elena that covers an area of approximately 102,244 hectares located in Sonora State, México; and the La Encantada covering an area of approximately 4,076 hectares located in Coahuila State, México.

See Also

Before you consider First Majestic Silver, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and First Majestic Silver wasn't on the list.

While First Majestic Silver currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.