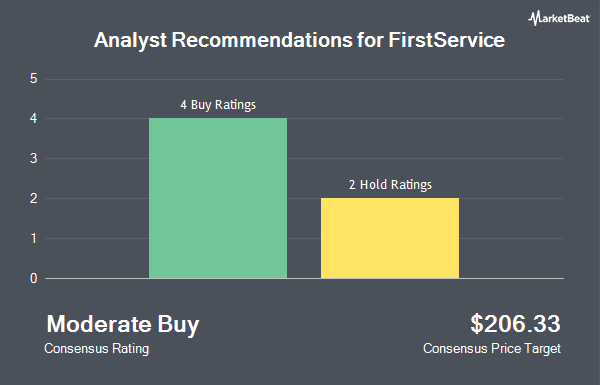

FirstService Corporation (NASDAQ:FSV - Get Free Report) TSE: FSV has received a consensus recommendation of "Moderate Buy" from the five ratings firms that are covering the stock, Marketbeat reports. Two analysts have rated the stock with a hold rating and three have assigned a buy rating to the company. The average 12-month price target among brokers that have updated their coverage on the stock in the last year is $208.40.

Several equities research analysts recently commented on the company. TD Securities upped their target price on FirstService from $198.00 to $200.00 and gave the company a "hold" rating in a research report on Wednesday, May 7th. Scotiabank cut their target price on FirstService from $217.50 to $210.00 and set a "sector perform" rating on the stock in a research report on Thursday, April 17th. Finally, Wall Street Zen lowered FirstService from a "buy" rating to a "hold" rating in a report on Thursday, March 27th.

Get Our Latest Report on FirstService

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently added to or reduced their stakes in FSV. Y Intercept Hong Kong Ltd bought a new position in FirstService in the fourth quarter worth approximately $308,000. Bank of New York Mellon Corp lifted its holdings in shares of FirstService by 9.6% in the fourth quarter. Bank of New York Mellon Corp now owns 39,525 shares of the financial services provider's stock valued at $7,155,000 after purchasing an additional 3,449 shares in the last quarter. Raymond James Financial Inc. bought a new position in shares of FirstService in the fourth quarter valued at approximately $48,541,000. Amundi lifted its holdings in shares of FirstService by 21.4% in the fourth quarter. Amundi now owns 67,162 shares of the financial services provider's stock valued at $11,921,000 after purchasing an additional 11,846 shares in the last quarter. Finally, Zurcher Kantonalbank Zurich Cantonalbank lifted its holdings in shares of FirstService by 4.7% in the fourth quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 20,353 shares of the financial services provider's stock valued at $3,685,000 after purchasing an additional 922 shares in the last quarter. Institutional investors own 69.35% of the company's stock.

FirstService Stock Up 0.6%

Shares of FirstService stock opened at $172.48 on Friday. FirstService has a one year low of $149.44 and a one year high of $197.84. The company has a debt-to-equity ratio of 1.09, a current ratio of 1.94 and a quick ratio of 1.94. The stock's 50-day moving average is $174.84 and its 200 day moving average is $175.41. The firm has a market cap of $7.84 billion, a price-to-earnings ratio of 59.68 and a beta of 1.01.

FirstService (NASDAQ:FSV - Get Free Report) TSE: FSV last announced its earnings results on Thursday, April 24th. The financial services provider reported $0.92 EPS for the quarter, beating the consensus estimate of $0.84 by $0.08. FirstService had a return on equity of 17.49% and a net margin of 2.46%. The company had revenue of $1.21 billion for the quarter, compared to analyst estimates of $1.28 billion. During the same quarter in the prior year, the company earned $0.67 EPS. The firm's revenue for the quarter was up 8.0% compared to the same quarter last year. Equities research analysts anticipate that FirstService will post 5.27 EPS for the current year.

FirstService Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Tuesday, July 8th. Shareholders of record on Monday, June 30th will be issued a $0.275 dividend. The ex-dividend date is Monday, June 30th. This represents a $1.10 annualized dividend and a yield of 0.64%. FirstService's payout ratio is currently 38.06%.

About FirstService

(

Get Free ReportFirstService Corporation, together with its subsidiaries, provides residential property management and other essential property services to residential and commercial customers in the United States and Canada. It operates through two segments: FirstService Residential and FirstService Brands. The FirstService Residential segment offers services for private residential communities, such as condominiums, co-operatives, homeowner associations, master-planned communities, active adult and lifestyle communities, and various other residential developments.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider FirstService, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FirstService wasn't on the list.

While FirstService currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.