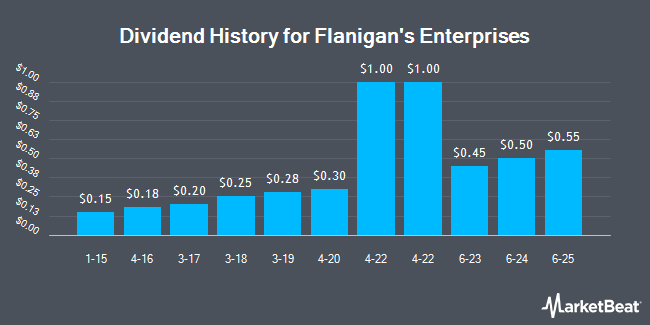

Flanigan's Enterprises, Inc. (NYSEAMERICAN:BDL - Get Free Report) announced an annual dividend on Wednesday, May 28th, Wall Street Journal reports. Stockholders of record on Thursday, June 12th will be paid a dividend of 0.55 per share on Friday, June 27th. This represents a dividend yield of 1.8%. The ex-dividend date is Thursday, June 12th. This is a 10.0% increase from Flanigan's Enterprises's previous annual dividend of $0.50.

Flanigan's Enterprises Stock Up 2.7%

Shares of BDL traded up $0.74 during trading hours on Monday, reaching $28.10. 835 shares of the company traded hands, compared to its average volume of 3,146. The stock has a fifty day simple moving average of $24.62. The company has a quick ratio of 1.16, a current ratio of 1.46 and a debt-to-equity ratio of 0.27. The company has a market capitalization of $52.27 million, a PE ratio of 15.88 and a beta of 0.68. Flanigan's Enterprises has a 12-month low of $22.61 and a 12-month high of $29.25.

Insider Buying and Selling at Flanigan's Enterprises

In other news, COO James Flanigan II purchased 10,940 shares of Flanigan's Enterprises stock in a transaction dated Wednesday, May 21st. The shares were purchased at an average price of $25.39 per share, with a total value of $277,766.60. Following the transaction, the chief operating officer now owns 980,130 shares in the company, valued at $24,885,500.70. This represents a 1.13% increase in their ownership of the stock. The purchase was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, insider August Bucci bought 2,000 shares of the firm's stock in a transaction on Wednesday, May 21st. The stock was bought at an average cost of $26.73 per share, for a total transaction of $53,460.00. Following the transaction, the insider now directly owns 4,600 shares of the company's stock, valued at $122,958. The trade was a 76.92% increase in their ownership of the stock. The disclosure for this purchase can be found here. 54.70% of the stock is owned by insiders.

Institutional Inflows and Outflows

A hedge fund recently raised its stake in Flanigan's Enterprises stock. Empowered Funds LLC lifted its holdings in shares of Flanigan's Enterprises, Inc. (NYSEAMERICAN:BDL - Free Report) by 3.1% during the 1st quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 14,725 shares of the company's stock after acquiring an additional 445 shares during the period. Empowered Funds LLC owned 0.79% of Flanigan's Enterprises worth $364,000 at the end of the most recent reporting period. Institutional investors own 11.03% of the company's stock.

Wall Street Analysts Forecast Growth

Separately, Wall Street Zen began coverage on shares of Flanigan's Enterprises in a report on Monday, May 19th. They set a "hold" rating on the stock.

Read Our Latest Stock Analysis on Flanigan's Enterprises

About Flanigan's Enterprises

(

Get Free Report)

Flanigan's Enterprises, Inc, together with its subsidiaries, operates a chain of full-service restaurants and package liquor stores in South Florida. The company operates in two segments, Package Stores and Restaurants. It operates package liquor stores under the Big Daddy's Liquors name, which offer private label liquors, beer, and wines; and restaurants under the Flanigan's Seafood Bar and Grill service mark that provide alcoholic beverages and full food services.

Featured Articles

Before you consider Flanigan's Enterprises, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Flanigan's Enterprises wasn't on the list.

While Flanigan's Enterprises currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.