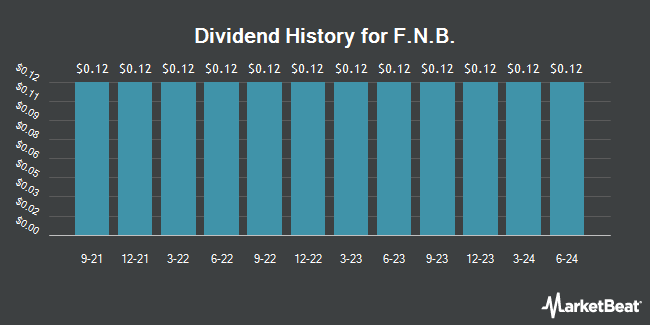

F.N.B. Corporation (NYSE:FNB - Get Free Report) announced a quarterly dividend on Thursday, July 31st, RTT News reports. Investors of record on Tuesday, September 2nd will be paid a dividend of 0.12 per share by the bank on Monday, September 15th. This represents a c) dividend on an annualized basis and a dividend yield of 3.2%. The ex-dividend date is Tuesday, September 2nd.

F.N.B. has a dividend payout ratio of 28.9% indicating that its dividend is sufficiently covered by earnings. Equities analysts expect F.N.B. to earn $1.68 per share next year, which means the company should continue to be able to cover its $0.48 annual dividend with an expected future payout ratio of 28.6%.

F.N.B. Trading Up 0.5%

Shares of F.N.B. stock traded up $0.07 during trading on Monday, reaching $14.93. 549,121 shares of the company were exchanged, compared to its average volume of 3,268,595. The company has a quick ratio of 0.93, a current ratio of 0.93 and a debt-to-equity ratio of 0.41. F.N.B. has a twelve month low of $10.88 and a twelve month high of $17.70. The business has a 50-day moving average price of $14.80 and a 200-day moving average price of $14.28. The firm has a market capitalization of $5.37 billion, a price-to-earnings ratio of 11.67, a P/E/G ratio of 0.85 and a beta of 0.94.

F.N.B. (NYSE:FNB - Get Free Report) last announced its quarterly earnings data on Thursday, July 17th. The bank reported $0.36 EPS for the quarter, topping analysts' consensus estimates of $0.33 by $0.03. The business had revenue of $438.21 million during the quarter, compared to analysts' expectations of $424.39 million. F.N.B. had a return on equity of 7.94% and a net margin of 17.88%. During the same period in the previous year, the firm earned $0.34 earnings per share. Sell-side analysts anticipate that F.N.B. will post 1.45 EPS for the current fiscal year.

Institutional Trading of F.N.B.

Institutional investors have recently modified their holdings of the company. McClarren Financial Advisors Inc. bought a new stake in shares of F.N.B. in the first quarter valued at about $28,000. BI Asset Management Fondsmaeglerselskab A S bought a new stake in shares of F.N.B. in the first quarter valued at about $34,000. Headlands Technologies LLC bought a new stake in shares of F.N.B. in the fourth quarter valued at about $39,000. Parallel Advisors LLC lifted its holdings in shares of F.N.B. by 47.4% in the first quarter. Parallel Advisors LLC now owns 3,096 shares of the bank's stock valued at $42,000 after purchasing an additional 995 shares in the last quarter. Finally, Smallwood Wealth Investment Management LLC bought a new stake in shares of F.N.B. in the first quarter valued at about $42,000. 79.25% of the stock is currently owned by institutional investors.

F.N.B. Company Profile

(

Get Free Report)

F.N.B. Corporation, a bank and financial holding company, provides a range of financial products and services primarily to consumers, corporations, governments, and small- to medium-sized businesses in the United States. The company operates through three segments: Community Banking, Wealth Management, and Insurance.

Featured Stories

Before you consider F.N.B., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and F.N.B. wasn't on the list.

While F.N.B. currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.