Focus Partners Wealth purchased a new stake in shares of UDR, Inc. (NYSE:UDR - Free Report) during the fourth quarter, according to its most recent filing with the Securities & Exchange Commission. The firm purchased 54,454 shares of the real estate investment trust's stock, valued at approximately $2,364,000.

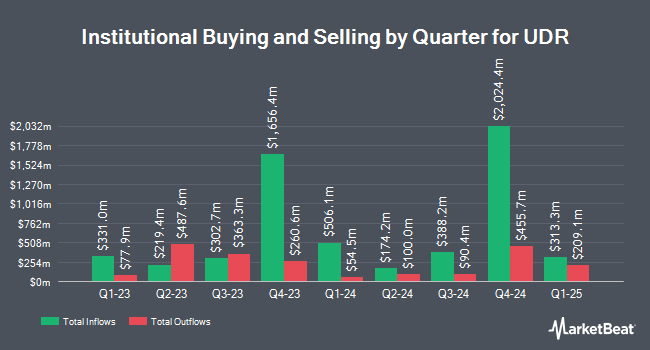

Several other large investors have also recently made changes to their positions in UDR. Norges Bank bought a new position in shares of UDR during the 4th quarter valued at $1,273,442,000. Capital Research Global Investors increased its holdings in shares of UDR by 64.1% in the fourth quarter. Capital Research Global Investors now owns 13,060,120 shares of the real estate investment trust's stock worth $566,940,000 after buying an additional 5,101,668 shares during the period. Invesco Ltd. increased its holdings in shares of UDR by 92.0% in the fourth quarter. Invesco Ltd. now owns 7,535,234 shares of the real estate investment trust's stock worth $327,104,000 after buying an additional 3,609,925 shares during the period. Northern Trust Corp boosted its holdings in UDR by 54.2% during the 4th quarter. Northern Trust Corp now owns 4,853,979 shares of the real estate investment trust's stock valued at $210,711,000 after acquiring an additional 1,706,037 shares during the period. Finally, FMR LLC boosted its holdings in UDR by 10.5% during the 4th quarter. FMR LLC now owns 12,592,458 shares of the real estate investment trust's stock valued at $546,639,000 after acquiring an additional 1,191,432 shares during the period. 97.84% of the stock is owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

Several brokerages have weighed in on UDR. Evercore ISI boosted their price objective on UDR from $43.00 to $45.00 and gave the company an "in-line" rating in a research report on Monday, February 10th. Royal Bank of Canada lifted their price target on shares of UDR from $43.00 to $44.00 and gave the company a "sector perform" rating in a research report on Thursday, May 8th. Wells Fargo & Company cut their price objective on shares of UDR from $48.00 to $45.00 and set an "overweight" rating on the stock in a report on Friday, January 24th. Truist Financial cut UDR from a "buy" rating to a "hold" rating and boosted their price target for the stock from $45.00 to $46.00 in a research report on Monday, March 10th. Finally, Scotiabank boosted their target price on UDR from $48.00 to $49.00 and gave the stock a "sector perform" rating in a report on Friday, February 14th. One equities research analyst has rated the stock with a sell rating, ten have assigned a hold rating and seven have assigned a buy rating to the company. According to data from MarketBeat.com, the stock currently has an average rating of "Hold" and a consensus target price of $46.69.

View Our Latest Stock Report on UDR

UDR Price Performance

UDR traded down $0.55 during trading on Wednesday, reaching $41.45. 135,254 shares of the company traded hands, compared to its average volume of 2,172,204. The company has a market cap of $13.73 billion, a P/E ratio of 165.72, a PEG ratio of 8.67 and a beta of 0.84. The company has a debt-to-equity ratio of 1.71, a quick ratio of 5.91 and a current ratio of 5.61. UDR, Inc. has a 12-month low of $36.61 and a 12-month high of $47.55. The firm has a fifty day simple moving average of $42.18 and a 200 day simple moving average of $42.93.

UDR (NYSE:UDR - Get Free Report) last posted its earnings results on Wednesday, April 30th. The real estate investment trust reported $0.61 earnings per share for the quarter, meeting the consensus estimate of $0.61. The company had revenue of $419.84 million during the quarter, compared to analysts' expectations of $421.23 million. UDR had a net margin of 5.36% and a return on equity of 2.65%. UDR's quarterly revenue was up 2.0% on a year-over-year basis. During the same period last year, the company posted $0.61 earnings per share. On average, equities analysts forecast that UDR, Inc. will post 2.51 EPS for the current year.

UDR Increases Dividend

The firm also recently announced a quarterly dividend, which was paid on Wednesday, April 30th. Shareholders of record on Thursday, April 10th were given a dividend of $0.43 per share. This represents a $1.72 annualized dividend and a dividend yield of 4.15%. The ex-dividend date was Thursday, April 10th. This is a positive change from UDR's previous quarterly dividend of $0.43. UDR's payout ratio is 491.43%.

Insider Activity

In other UDR news, CEO Thomas W. Toomey sold 25,000 shares of the firm's stock in a transaction on Thursday, February 20th. The stock was sold at an average price of $42.75, for a total transaction of $1,068,750.00. Following the transaction, the chief executive officer now directly owns 824,716 shares in the company, valued at $35,256,609. This trade represents a 2.94% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. Insiders own 3.39% of the company's stock.

About UDR

(

Free Report)

UDR, Inc NYSE: UDR, an S&P 500 company, is a leading multifamily real estate investment trust with a demonstrated performance history of delivering superior and dependable returns by successfully managing, buying, selling, developing and redeveloping attractive real estate communities in targeted U.S.

See Also

Before you consider UDR, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and UDR wasn't on the list.

While UDR currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report