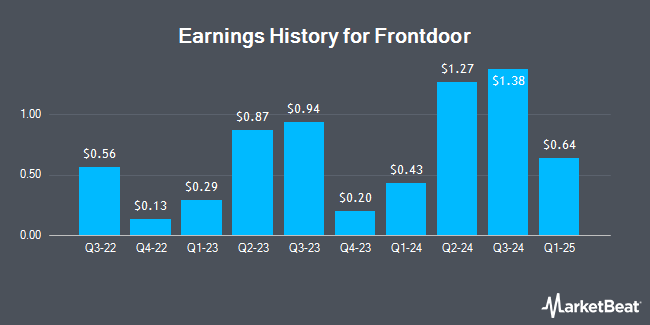

Frontdoor (NASDAQ:FTDR - Get Free Report) announced its earnings results on Tuesday. The company reported $1.63 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.44 by $0.19, Zacks reports. Frontdoor had a return on equity of 125.21% and a net margin of 13.07%. The business had revenue of $617.00 million for the quarter, compared to analyst estimates of $602.62 million. During the same period in the previous year, the company earned $1.27 earnings per share. The company's revenue for the quarter was up 13.8% compared to the same quarter last year. Frontdoor updated its Q3 2025 guidance to EPS and its FY 2025 guidance to EPS.

Frontdoor Stock Performance

FTDR stock traded down $1.44 during midday trading on Friday, reaching $54.88. The company had a trading volume of 525,542 shares, compared to its average volume of 650,161. The company has a quick ratio of 1.34, a current ratio of 1.49 and a debt-to-equity ratio of 4.56. The stock has a 50 day moving average price of $57.87 and a 200 day moving average price of $51.43. Frontdoor has a fifty-two week low of $35.61 and a fifty-two week high of $64.91. The firm has a market capitalization of $4.00 billion, a PE ratio of 16.19 and a beta of 1.32.

Hedge Funds Weigh In On Frontdoor

Hedge funds and other institutional investors have recently made changes to their positions in the business. Millennium Management LLC lifted its position in Frontdoor by 533.0% in the first quarter. Millennium Management LLC now owns 307,497 shares of the company's stock worth $11,814,000 after purchasing an additional 258,920 shares during the period. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC lifted its position in Frontdoor by 5.9% in the first quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 237,526 shares of the company's stock worth $9,126,000 after purchasing an additional 13,134 shares during the period. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. lifted its position in Frontdoor by 4.5% in the first quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 45,846 shares of the company's stock worth $1,761,000 after purchasing an additional 1,994 shares during the period. Finally, Empowered Funds LLC lifted its position in Frontdoor by 10.5% in the first quarter. Empowered Funds LLC now owns 11,008 shares of the company's stock worth $423,000 after purchasing an additional 1,044 shares during the period.

Wall Street Analysts Forecast Growth

A number of brokerages have recently issued reports on FTDR. Truist Financial lifted their target price on Frontdoor from $67.00 to $71.00 and gave the stock a "buy" rating in a research report on Wednesday. JPMorgan Chase & Co. lifted their target price on Frontdoor from $50.00 to $55.00 and gave the stock a "neutral" rating in a research report on Tuesday, June 3rd. Oppenheimer lifted their target price on Frontdoor from $56.00 to $63.00 and gave the stock an "outperform" rating in a research report on Wednesday. Finally, The Goldman Sachs Group lifted their target price on Frontdoor from $44.00 to $50.00 and gave the stock a "sell" rating in a research report on Wednesday.

Read Our Latest Research Report on Frontdoor

About Frontdoor

(

Get Free Report)

Frontdoor, Inc provides home warranties in the United States in the United States. Its customizable home warranties help customers protect and maintain their homes from costly and unplanned breakdowns of essential home systems and appliances. The company's home warranty customers subscribe to an annual service plan agreement that covers the repair or replacement of principal components of approximately 20 home systems and appliances, including electrical, plumbing, water heaters, refrigerators, dishwashers, and ranges/ovens/cooktops, as well as electronics, pools, and spas and pumps; and heating, ventilation, and air conditioning systems.

Further Reading

Before you consider Frontdoor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Frontdoor wasn't on the list.

While Frontdoor currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.