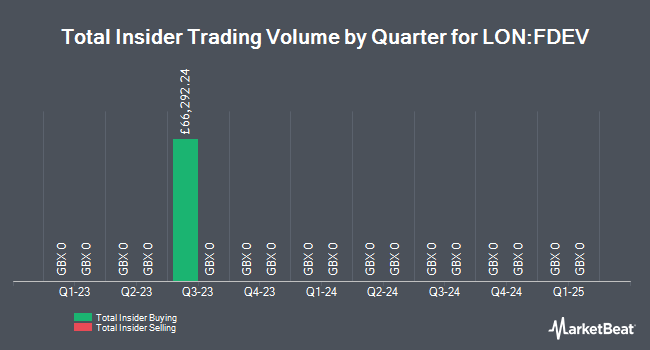

Frontier Developments plc (LON:FDEV - Get Free Report) insider David John Braben sold 7,643 shares of the company's stock in a transaction on Wednesday, September 10th. The shares were sold at an average price of GBX 388, for a total value of £29,654.84.

David John Braben also recently made the following trade(s):

- On Friday, September 12th, David John Braben bought 8,744 shares of Frontier Developments stock. The shares were bought at an average cost of GBX 384 per share, for a total transaction of £33,576.96.

- On Thursday, September 11th, David John Braben sold 8,850 shares of Frontier Developments stock. The shares were sold at an average price of GBX 388, for a total value of £34,338.

- On Tuesday, September 9th, David John Braben sold 8,605 shares of Frontier Developments stock. The shares were sold at an average price of GBX 377, for a total value of £32,440.85.

- On Monday, September 8th, David John Braben sold 7,329 shares of Frontier Developments stock. The shares were sold at an average price of GBX 379, for a total value of £27,776.91.

- On Friday, September 5th, David John Braben sold 6,769 shares of Frontier Developments stock. The shares were sold at an average price of GBX 376, for a total value of £25,451.44.

- On Thursday, September 4th, David John Braben sold 10,000 shares of Frontier Developments stock. The shares were sold at an average price of GBX 371, for a total value of £37,100.

- On Wednesday, September 3rd, David John Braben sold 15,000 shares of Frontier Developments stock. The shares were sold at an average price of GBX 360, for a total value of £54,000.

- On Tuesday, September 2nd, David John Braben sold 14,750 shares of Frontier Developments stock. The stock was sold at an average price of GBX 360, for a total value of £53,100.

- On Monday, September 1st, David John Braben sold 15,000 shares of Frontier Developments stock. The stock was sold at an average price of GBX 370, for a total value of £55,500.

- On Thursday, August 28th, David John Braben sold 22,000 shares of Frontier Developments stock. The stock was sold at an average price of GBX 380, for a total value of £83,600.

Frontier Developments Stock Performance

Shares of FDEV stock traded down GBX 1.50 during mid-day trading on Wednesday, reaching GBX 406.50. The stock had a trading volume of 299,003 shares, compared to its average volume of 86,806. The company has a quick ratio of 2.61, a current ratio of 2.93 and a debt-to-equity ratio of 27.70. The firm has a market cap of £151.78 million, a PE ratio of 986.65, a P/E/G ratio of 2.11 and a beta of 0.03. Frontier Developments plc has a one year low of GBX 175.60 and a one year high of GBX 417.53. The firm's 50 day simple moving average is GBX 372.84 and its 200 day simple moving average is GBX 280.20.

Frontier Developments (LON:FDEV - Get Free Report) last posted its earnings results on Wednesday, September 10th. The company reported GBX 42.40 EPS for the quarter. Frontier Developments had a negative return on equity of 30.43% and a negative net margin of 24.05%. On average, analysts forecast that Frontier Developments plc will post 7.0917759 EPS for the current year.

Wall Street Analysts Forecast Growth

Several equities analysts recently commented on the company. Deutsche Bank Aktiengesellschaft raised their target price on Frontier Developments from GBX 310 to GBX 390 and gave the stock a "hold" rating in a research report on Friday, September 12th. Berenberg Bank raised their price target on Frontier Developments from GBX 330 to GBX 450 and gave the company a "buy" rating in a report on Wednesday, September 10th. Finally, Shore Capital reaffirmed a "buy" rating on shares of Frontier Developments in a report on Wednesday, September 10th. Two analysts have rated the stock with a Buy rating and one has issued a Hold rating to the company. According to MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus price target of GBX 420.

Read Our Latest Report on Frontier Developments

Frontier Developments Company Profile

(

Get Free Report)

Frontier is a leading independent developer and publisher of video games for PC and console, creating immersive and fun gameplay, with unparalleled artistic quality.

At Frontier, we specialise in creating endless possibilities in playful, fun and creative worlds. From some of the world's biggest licensed entertainment and sporting franchises, to intricately crafted worlds where players can explore and make their mark, our games are all underpinned by our unwavering passion for creating compelling and innovative experiences that continue to inspire and delight our players.

We have created games that have defined genres, been critically acclaimed, and reached many millions of players.

Further Reading

Before you consider Frontier Developments, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Frontier Developments wasn't on the list.

While Frontier Developments currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.