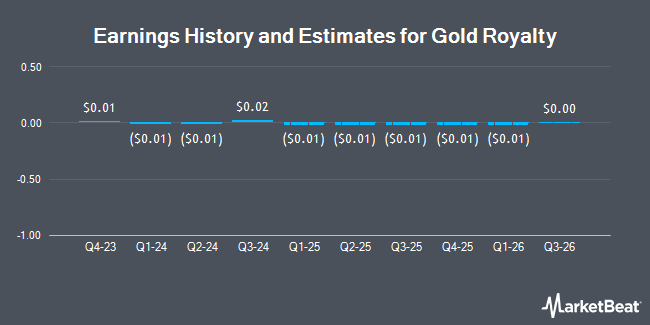

Gold Royalty Corp. (NYSE:GROY - Free Report) - Investment analysts at National Bank Financial lifted their FY2025 earnings estimates for Gold Royalty in a research report issued to clients and investors on Tuesday, September 23rd. National Bank Financial analyst S. Nagle now expects that the company will post earnings per share of ($0.02) for the year, up from their prior estimate of ($0.03). The consensus estimate for Gold Royalty's current full-year earnings is ($0.01) per share. National Bank Financial also issued estimates for Gold Royalty's FY2026 earnings at ($0.01) EPS.

A number of other equities research analysts also recently issued reports on GROY. Scotiabank reissued an "outperform" rating on shares of Gold Royalty in a research report on Monday, August 11th. Canaccord Genuity Group initiated coverage on Gold Royalty in a research report on Wednesday, June 11th. They set a "buy" rating and a $3.00 target price on the stock. Maxim Group began coverage on Gold Royalty in a research report on Thursday, September 11th. They issued a "buy" rating and a $6.00 price target for the company. HC Wainwright raised their price objective on Gold Royalty from $5.75 to $6.25 and gave the stock a "buy" rating in a research note on Thursday, August 7th. Finally, National Bankshares restated an "outperform" rating on shares of Gold Royalty in a research note on Wednesday, July 16th. Five analysts have rated the stock with a Buy rating, Based on data from MarketBeat.com, Gold Royalty currently has a consensus rating of "Buy" and an average price target of $4.64.

Read Our Latest Report on Gold Royalty

Gold Royalty Stock Up 1.9%

Shares of GROY stock opened at $3.72 on Friday. The company has a current ratio of 1.63, a quick ratio of 1.63 and a debt-to-equity ratio of 0.09. Gold Royalty has a 12 month low of $1.16 and a 12 month high of $4.04. The stock has a market cap of $634.15 million, a P/E ratio of -28.62 and a beta of 0.99. The company has a 50 day simple moving average of $3.22 and a two-hundred day simple moving average of $2.28.

Institutional Investors Weigh In On Gold Royalty

Several institutional investors and hedge funds have recently modified their holdings of the stock. Financial Sense Advisors Inc. boosted its position in shares of Gold Royalty by 1,022.0% during the first quarter. Financial Sense Advisors Inc. now owns 112,200 shares of the company's stock worth $162,000 after acquiring an additional 102,200 shares during the last quarter. GSA Capital Partners LLP boosted its holdings in shares of Gold Royalty by 19.5% during the 1st quarter. GSA Capital Partners LLP now owns 916,940 shares of the company's stock valued at $1,320,000 after purchasing an additional 149,406 shares during the last quarter. XTX Topco Ltd bought a new position in shares of Gold Royalty during the 1st quarter valued at about $91,000. Zazove Associates LLC grew its position in shares of Gold Royalty by 42.8% during the first quarter. Zazove Associates LLC now owns 629,758 shares of the company's stock valued at $907,000 after purchasing an additional 188,758 shares in the last quarter. Finally, Groupe la Francaise bought a new stake in shares of Gold Royalty in the first quarter worth about $129,000. Institutional investors own 33.75% of the company's stock.

About Gold Royalty

(

Get Free Report)

Gold Royalty Corp., a precious metals-focused royalty company, provides financing solutions to the metals and mining industry. It focuses on acquiring royalties, streams, and similar interests at varying stages of the mine life cycle to build a portfolio offering near, medium, and longer-term returns for its investors.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Gold Royalty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gold Royalty wasn't on the list.

While Gold Royalty currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.