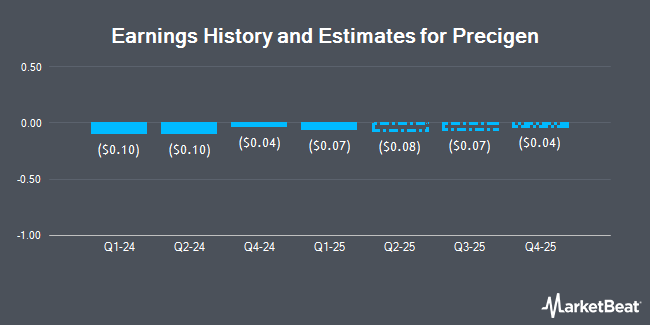

Precigen, Inc. (NASDAQ:PGEN - Free Report) - Analysts at HC Wainwright cut their FY2025 earnings per share (EPS) estimates for shares of Precigen in a research note issued on Wednesday, August 13th. HC Wainwright analyst S. Ramakanth now expects that the biotechnology company will post earnings per share of ($0.31) for the year, down from their previous forecast of ($0.26). HC Wainwright currently has a "Buy" rating and a $8.50 target price on the stock. The consensus estimate for Precigen's current full-year earnings is ($0.32) per share.

A number of other research analysts have also recently commented on the company. Cantor Fitzgerald reaffirmed an "overweight" rating on shares of Precigen in a research note on Thursday, May 15th. Citigroup reaffirmed an "outperform" rating on shares of Precigen in a research note on Tuesday. JPMorgan Chase & Co. raised Precigen from an "underweight" rating to a "neutral" rating in a research note on Friday, August 15th. JMP Securities upped their target price on Precigen from $6.00 to $8.00 and gave the company a "market outperform" rating in a research note on Tuesday. Finally, Wall Street Zen raised shares of Precigen from a "sell" rating to a "hold" rating in a research note on Saturday, July 12th. Four analysts have rated the stock with a Buy rating and one has given a Hold rating to the stock. According to data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average price target of $8.25.

Read Our Latest Report on PGEN

Precigen Price Performance

Shares of PGEN traded up $0.54 during mid-day trading on Monday, reaching $4.18. 24,184,755 shares of the company's stock traded hands, compared to its average volume of 14,296,194. The stock has a market cap of $1.25 billion, a P/E ratio of -9.95 and a beta of 1.87. The stock's 50-day moving average is $1.87 and its two-hundred day moving average is $1.67. Precigen has a 12 month low of $0.65 and a 12 month high of $4.21.

Precigen (NASDAQ:PGEN - Get Free Report) last released its earnings results on Tuesday, August 12th. The biotechnology company reported ($0.11) EPS for the quarter, beating analysts' consensus estimates of ($0.14) by $0.03. The firm had revenue of $0.86 million for the quarter, compared to analysts' expectations of $0.67 million. Precigen had a negative return on equity of 842.83% and a negative net margin of 2,868.66%.

Institutional Trading of Precigen

Institutional investors and hedge funds have recently modified their holdings of the stock. BNP Paribas Financial Markets bought a new stake in shares of Precigen during the fourth quarter valued at approximately $27,000. Envestnet Asset Management Inc. boosted its stake in shares of Precigen by 29.0% during the fourth quarter. Envestnet Asset Management Inc. now owns 26,343 shares of the biotechnology company's stock valued at $30,000 after purchasing an additional 5,915 shares in the last quarter. Boothbay Fund Management LLC bought a new position in shares of Precigen during the fourth quarter valued at approximately $35,000. Apella Capital LLC bought a new position in shares of Precigen during the first quarter valued at approximately $40,000. Finally, Invesco Ltd. boosted its stake in shares of Precigen by 14.6% during the fourth quarter. Invesco Ltd. now owns 47,307 shares of the biotechnology company's stock valued at $53,000 after purchasing an additional 6,040 shares in the last quarter. Institutional investors own 33.51% of the company's stock.

Precigen Company Profile

(

Get Free Report)

Precigen, Inc operates as a discovery and clinical-stage biopharmaceutical company that develops gene and cell therapies using precision technology to target diseases in therapeutic areas of immuno-oncology, autoimmune disorders, and infectious diseases. It operates through two segments, Biopharmaceuticals and Exemplar.

Featured Stories

Before you consider Precigen, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Precigen wasn't on the list.

While Precigen currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.