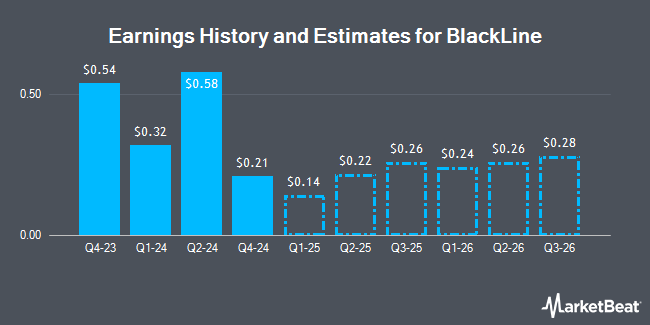

BlackLine (NASDAQ:BL - Free Report) - Analysts at DA Davidson increased their FY2026 EPS estimates for shares of BlackLine in a report released on Wednesday, August 6th. DA Davidson analyst G. Luria now expects that the technology company will post earnings of $1.21 per share for the year, up from their prior estimate of $0.92. DA Davidson currently has a "Neutral" rating and a $56.00 price objective on the stock. The consensus estimate for BlackLine's current full-year earnings is $0.90 per share.

A number of other research analysts also recently commented on BL. The Goldman Sachs Group lowered their price objective on shares of BlackLine from $51.00 to $43.00 and set a "sell" rating on the stock in a research report on Thursday, April 17th. Piper Sandler boosted their price objective on shares of BlackLine from $46.00 to $50.00 and gave the company a "neutral" rating in a research report on Wednesday, May 7th. Raymond James Financial raised shares of BlackLine from a "market perform" rating to an "outperform" rating and set a $67.00 price objective on the stock in a research report on Tuesday, July 29th. Cantor Fitzgerald initiated coverage on shares of BlackLine in a research report on Tuesday, June 3rd. They set a "neutral" rating and a $58.00 price objective on the stock. Finally, Wall Street Zen downgraded shares of BlackLine from a "buy" rating to a "hold" rating in a research report on Thursday, May 15th. Two investment analysts have rated the stock with a sell rating, six have assigned a hold rating and five have issued a buy rating to the stock. According to MarketBeat.com, the company currently has a consensus rating of "Hold" and a consensus target price of $61.08.

Read Our Latest Analysis on BL

BlackLine Trading Up 2.7%

Shares of BL stock traded up $1.29 during trading hours on Friday, reaching $49.34. 1,220,386 shares of the stock traded hands, compared to its average volume of 749,458. BlackLine has a 1-year low of $40.82 and a 1-year high of $66.25. The business has a fifty day moving average price of $55.51 and a 200 day moving average price of $52.76. The company has a quick ratio of 1.64, a current ratio of 1.64 and a debt-to-equity ratio of 1.61. The firm has a market capitalization of $3.05 billion, a PE ratio of 38.25, a PEG ratio of 6.96 and a beta of 0.91.

BlackLine (NASDAQ:BL - Get Free Report) last released its quarterly earnings results on Tuesday, August 5th. The technology company reported $0.51 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.50 by $0.01. BlackLine had a net margin of 13.05% and a return on equity of 15.95%. The business had revenue of $172.03 million for the quarter, compared to analyst estimates of $170.87 million. During the same quarter in the previous year, the business earned $0.58 earnings per share. The firm's revenue was up 7.2% compared to the same quarter last year.

Institutional Trading of BlackLine

A number of hedge funds have recently bought and sold shares of the stock. Atlantic Union Bankshares Corp acquired a new position in shares of BlackLine in the 2nd quarter valued at $27,000. Caitong International Asset Management Co. Ltd acquired a new stake in shares of BlackLine during the 2nd quarter worth about $33,000. Quadrant Capital Group LLC increased its position in shares of BlackLine by 243.5% during the 4th quarter. Quadrant Capital Group LLC now owns 584 shares of the technology company's stock worth $35,000 after purchasing an additional 414 shares in the last quarter. Huntington National Bank increased its position in shares of BlackLine by 57.5% during the 2nd quarter. Huntington National Bank now owns 1,235 shares of the technology company's stock worth $70,000 after purchasing an additional 451 shares in the last quarter. Finally, Johnson Financial Group Inc. acquired a new stake in shares of BlackLine during the 4th quarter worth about $73,000. 95.13% of the stock is owned by institutional investors.

Insider Buying and Selling at BlackLine

In related news, CRO Mark Woodhams sold 1,856 shares of the company's stock in a transaction on Wednesday, May 21st. The shares were sold at an average price of $54.65, for a total transaction of $101,430.40. Following the completion of the sale, the executive directly owned 61,390 shares of the company's stock, valued at approximately $3,354,963.50. This represents a 2.93% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, CAO Michelle D. Stalick sold 795 shares of the company's stock in a transaction on Wednesday, May 28th. The stock was sold at an average price of $55.14, for a total transaction of $43,836.30. Following the sale, the chief accounting officer directly owned 25,235 shares of the company's stock, valued at approximately $1,391,457.90. This represents a 3.05% decrease in their ownership of the stock. The disclosure for this sale can be found here. 8.60% of the stock is currently owned by corporate insiders.

BlackLine Company Profile

(

Get Free Report)

BlackLine, Inc operates a cloud-based software platform which is designed to transform accounting and finance operations for organizations of all types and sizes. Its scalable platform supports critical accounting processes such as the financial close, account reconciliations, intercompany accounting, and controls assurance.

Featured Articles

Before you consider BlackLine, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BlackLine wasn't on the list.

While BlackLine currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.