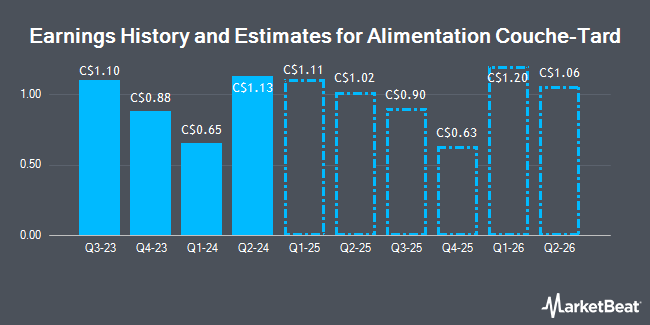

Alimentation Couche-Tard Inc. (TSE:ATD - Free Report) - Equities researchers at Stifel Canada lifted their FY2026 earnings per share (EPS) estimates for shares of Alimentation Couche-Tard in a research report issued to clients and investors on Wednesday, September 3rd. Stifel Canada analyst M. Landry now expects that the company will earn $4.00 per share for the year, up from their prior forecast of $3.92. The consensus estimate for Alimentation Couche-Tard's current full-year earnings is $4.04 per share. Stifel Canada also issued estimates for Alimentation Couche-Tard's FY2027 earnings at $4.55 EPS.

A number of other research analysts have also commented on the company. JPMorgan Chase & Co. lowered their price target on Alimentation Couche-Tard from C$88.00 to C$84.00 and set an "outperform" rating for the company in a research report on Tuesday, June 10th. Jefferies Financial Group cut their price target on Alimentation Couche-Tard from C$90.00 to C$87.00 and set a "buy" rating on the stock in a research note on Friday, June 27th. TD Securities upped their price target on Alimentation Couche-Tard from C$85.00 to C$89.00 and gave the stock a "buy" rating in a research note on Thursday, September 4th. Stifel Nicolaus upped their price target on Alimentation Couche-Tard from C$81.00 to C$85.00 and gave the stock a "buy" rating in a research note on Thursday, September 4th. Finally, Royal Bank Of Canada cut their price target on Alimentation Couche-Tard from C$94.00 to C$91.00 and set an "outperform" rating on the stock in a research note on Wednesday, September 3rd. Two equities research analysts have rated the stock with a Strong Buy rating, eleven have given a Buy rating and one has assigned a Hold rating to the company's stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Buy" and an average target price of C$85.31.

Read Our Latest Report on ATD

Alimentation Couche-Tard Trading Down 0.4%

ATD traded down C$0.27 during midday trading on Monday, reaching C$73.64. 842,123 shares of the company's stock traded hands, compared to its average volume of 1,406,559. The firm has a fifty day moving average of C$71.46 and a two-hundred day moving average of C$70.91. The stock has a market capitalization of C$69.27 billion, a price-to-earnings ratio of 27.27, a P/E/G ratio of 1.35 and a beta of 0.34. The company has a debt-to-equity ratio of 101.54, a current ratio of 0.99 and a quick ratio of 0.88. Alimentation Couche-Tard has a 52 week low of C$65.95 and a 52 week high of C$83.73.

Alimentation Couche-Tard Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, September 25th. Investors of record on Thursday, September 25th will be issued a $0.195 dividend. The ex-dividend date of this dividend is Thursday, September 11th. This represents a $0.78 annualized dividend and a dividend yield of 1.1%. Alimentation Couche-Tard's payout ratio is presently 20.27%.

Alimentation Couche-Tard Company Profile

(

Get Free Report)

Alimentation Couche-Tard Inc operates a network of convenience stores across North America, Ireland, Scandinavia, Poland, the Baltics, and Russia. The company primarily generates income through the sale of tobacco products, groceries, beverages, fresh food, quick service restaurants, car wash services, other retail products and services, road transportation fuel, stationary energy, marine fuel, and chemicals.

Read More

Before you consider Alimentation Couche-Tard, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alimentation Couche-Tard wasn't on the list.

While Alimentation Couche-Tard currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.