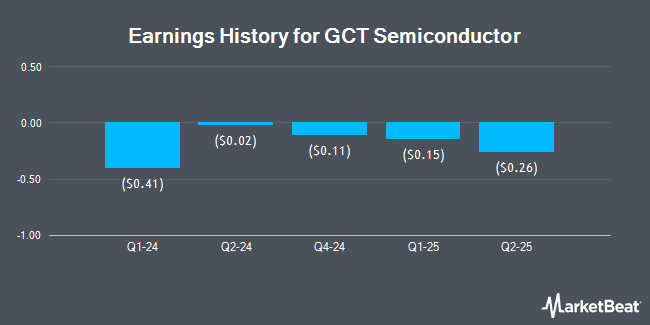

GCT Semiconductor (NYSE:GCTS - Get Free Report) posted its quarterly earnings data on Tuesday. The company reported ($0.26) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.14) by ($0.12), Zacks reports.

GCT Semiconductor Stock Performance

GCT Semiconductor stock traded down $0.04 during mid-day trading on Tuesday, hitting $1.33. The company's stock had a trading volume of 331,574 shares, compared to its average volume of 363,605. The company has a 50 day moving average of $1.39 and a 200-day moving average of $1.58. The stock has a market cap of $64.23 million, a PE ratio of -3.01 and a beta of 1.20. GCT Semiconductor has a one year low of $0.90 and a one year high of $3.98.

Insider Activity

In other news, Director Hyunsoo Shin bought 86,000 shares of GCT Semiconductor stock in a transaction that occurred on Tuesday, May 20th. The stock was bought at an average price of $1.18 per share, for a total transaction of $101,480.00. Following the purchase, the director directly owned 170,248 shares of the company's stock, valued at approximately $200,892.64. The trade was a 102.08% increase in their position. The transaction was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. Insiders have purchased 248,000 shares of company stock worth $281,860 in the last 90 days. 5.40% of the stock is currently owned by company insiders.

Institutional Inflows and Outflows

A hedge fund recently raised its stake in GCT Semiconductor stock. Goldman Sachs Group Inc. lifted its holdings in GCT Semiconductor Holding, Inc. (NYSE:GCTS - Free Report) by 57.5% during the first quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 69,917 shares of the company's stock after buying an additional 25,535 shares during the quarter. Goldman Sachs Group Inc. owned 0.14% of GCT Semiconductor worth $115,000 as of its most recent SEC filing. 28.06% of the stock is owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

Separately, Wall Street Zen downgraded GCT Semiconductor from a "hold" rating to a "strong sell" rating in a research note on Thursday, May 22nd.

Check Out Our Latest Research Report on GCT Semiconductor

About GCT Semiconductor

(

Get Free Report)

GCT Semiconductor Holding, Inc, operates as a fabless semiconductor company, designs, develops, and markets integrated circuits for the wireless semiconductor industry. The company provides RF and modem chipsets based on 4G LTE technology, including 4G LTE, 4.5G LTE Advanced, and 4.75G LTE Advanced-Pro.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider GCT Semiconductor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GCT Semiconductor wasn't on the list.

While GCT Semiconductor currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.