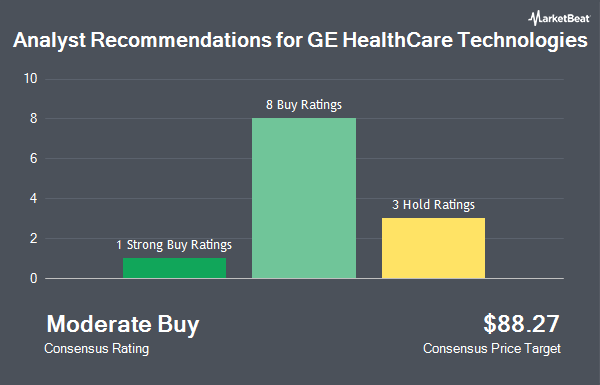

Shares of GE HealthCare Technologies Inc. (NASDAQ:GEHC - Get Free Report) have been assigned an average rating of "Moderate Buy" from the twelve brokerages that are currently covering the stock, MarketBeat.com reports. Three equities research analysts have rated the stock with a hold rating, eight have issued a buy rating and one has given a strong buy rating to the company. The average 1 year price target among brokers that have updated their coverage on the stock in the last year is $88.27.

Several brokerages recently weighed in on GEHC. Citigroup cut their price target on GE HealthCare Technologies from $105.00 to $86.00 and set a "buy" rating for the company in a research note on Wednesday, April 30th. The Goldman Sachs Group cut their price objective on GE HealthCare Technologies from $94.00 to $82.00 and set a "buy" rating for the company in a research report on Thursday, May 1st. Wall Street Zen raised GE HealthCare Technologies from a "hold" rating to a "buy" rating in a research note on Saturday, May 31st. Morgan Stanley dropped their price target on shares of GE HealthCare Technologies from $86.00 to $78.00 and set an "equal weight" rating on the stock in a research note on Tuesday, May 6th. Finally, Evercore ISI reduced their price objective on shares of GE HealthCare Technologies from $96.00 to $85.00 and set an "outperform" rating for the company in a research report on Thursday, May 1st.

Check Out Our Latest Stock Analysis on GE HealthCare Technologies

GE HealthCare Technologies Stock Performance

Shares of NASDAQ:GEHC traded down $0.31 on Friday, hitting $74.07. 2,719,298 shares of the company were exchanged, compared to its average volume of 3,512,327. The firm has a market capitalization of $33.92 billion, a P/E ratio of 15.59, a price-to-earnings-growth ratio of 2.51 and a beta of 1.14. The company has a current ratio of 0.98, a quick ratio of 0.76 and a debt-to-equity ratio of 0.73. GE HealthCare Technologies has a 1-year low of $57.65 and a 1-year high of $94.80. The stock's 50 day moving average price is $70.87 and its 200 day moving average price is $77.54.

GE HealthCare Technologies (NASDAQ:GEHC - Get Free Report) last posted its earnings results on Wednesday, April 30th. The company reported $1.01 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.91 by $0.10. GE HealthCare Technologies had a net margin of 11.02% and a return on equity of 24.95%. The company had revenue of $4.78 billion during the quarter, compared to the consensus estimate of $4.66 billion. During the same period in the previous year, the firm posted $0.90 earnings per share. The firm's quarterly revenue was up 2.7% on a year-over-year basis. Sell-side analysts predict that GE HealthCare Technologies will post 4.68 EPS for the current year.

GE HealthCare Technologies announced that its board has initiated a share repurchase plan on Wednesday, April 30th that authorizes the company to repurchase $1.00 billion in outstanding shares. This repurchase authorization authorizes the company to reacquire up to 3.1% of its shares through open market purchases. Shares repurchase plans are often an indication that the company's board believes its shares are undervalued.

Hedge Funds Weigh In On GE HealthCare Technologies

Several institutional investors and hedge funds have recently modified their holdings of GEHC. AG2R LA Mondiale Gestion D Actifs acquired a new position in shares of GE HealthCare Technologies during the 1st quarter valued at about $1,540,000. First Hawaiian Bank grew its holdings in GE HealthCare Technologies by 1.7% in the first quarter. First Hawaiian Bank now owns 30,509 shares of the company's stock valued at $2,462,000 after purchasing an additional 498 shares during the period. Modern Wealth Management LLC grew its holdings in GE HealthCare Technologies by 26.0% in the first quarter. Modern Wealth Management LLC now owns 3,014 shares of the company's stock valued at $243,000 after purchasing an additional 621 shares during the period. Strs Ohio acquired a new position in GE HealthCare Technologies during the first quarter worth approximately $30,001,000. Finally, Westbourne Investments Inc. purchased a new position in GE HealthCare Technologies during the first quarter worth approximately $2,582,000. Hedge funds and other institutional investors own 82.06% of the company's stock.

GE HealthCare Technologies Company Profile

(

Get Free ReportGE HealthCare Technologies Inc engages in the development, manufacture, and marketing of products, services, and complementary digital solutions used in the diagnosis, treatment, and monitoring of patients in the United States, Canada, and internationally. The company operates through four segments: Imaging, Ultrasound, Patient Care Solutions, and Pharmaceutical Diagnostics.

Read More

Before you consider GE HealthCare Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GE HealthCare Technologies wasn't on the list.

While GE HealthCare Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.