General Mills (NYSE:GIS - Get Free Report) updated its FY 2026 earnings guidance on Wednesday. The company provided earnings per share (EPS) guidance of 3.580-3.790 for the period, compared to the consensus estimate of 3.990. The company issued revenue guidance of -.

Analyst Ratings Changes

Several analysts have weighed in on the stock. UBS Group dropped their target price on shares of General Mills from $54.00 to $52.00 and set a "sell" rating for the company in a research report on Friday, June 6th. Mizuho dropped their target price on shares of General Mills from $62.00 to $60.00 and set a "neutral" rating on the stock in a research report on Thursday, March 20th. Royal Bank Of Canada restated a "sector perform" rating and set a $70.00 price objective on shares of General Mills in a report on Monday, March 17th. Bank of America cut their target price on shares of General Mills from $68.00 to $63.00 and set a "buy" rating for the company in a research report on Wednesday, June 18th. Finally, Piper Sandler cut their price objective on shares of General Mills from $84.00 to $71.00 and set an "overweight" rating for the company in a research report on Tuesday, February 25th. Two research analysts have rated the stock with a sell rating, twelve have given a hold rating and three have given a buy rating to the company. According to MarketBeat, General Mills has a consensus rating of "Hold" and a consensus price target of $62.63.

Read Our Latest Report on General Mills

General Mills Stock Down 0.2%

GIS opened at $53.38 on Wednesday. The company has a debt-to-equity ratio of 1.24, a quick ratio of 0.44 and a current ratio of 0.67. General Mills has a 1 year low of $52.20 and a 1 year high of $75.90. The firm has a 50 day moving average price of $54.73 and a 200 day moving average price of $58.63. The company has a market cap of $29.42 billion, a PE ratio of 11.73, a price-to-earnings-growth ratio of 1.26 and a beta of 0.02.

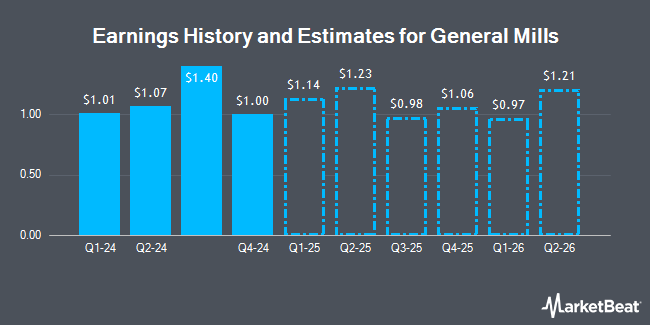

General Mills (NYSE:GIS - Get Free Report) last released its quarterly earnings results on Wednesday, June 25th. The company reported $0.74 earnings per share for the quarter, topping analysts' consensus estimates of $0.71 by $0.03. General Mills had a net margin of 13.02% and a return on equity of 26.39%. During the same quarter in the prior year, the company earned $1.01 earnings per share. Sell-side analysts expect that General Mills will post 4.36 earnings per share for the current year.

About General Mills

(

Get Free Report)

General Mills, Inc manufactures and markets branded consumer foods worldwide. The company operates through four segments: North America Retail; International; Pet; and North America Foodservice. It offers grain, ready-to-eat cereals, refrigerated yogurt, soup, meal kits, refrigerated and frozen dough products, dessert and baking mixes, bakery flour, frozen pizza and pizza snacks, snack bars, fruit and savory snacks, ice cream and frozen desserts, unbaked and fully baked frozen dough products, frozen hot snacks, ethnic meals, side dish mixes, frozen breakfast and entrees, nutrition bars, and frozen and shelf-stable vegetables.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider General Mills, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and General Mills wasn't on the list.

While General Mills currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.