Genmab A/S (NASDAQ:GMAB - Get Free Report) was downgraded by investment analysts at Sanford C. Bernstein from a "market perform" rating to an "underperform" rating in a research report issued to clients and investors on Tuesday, MarketBeat reports.

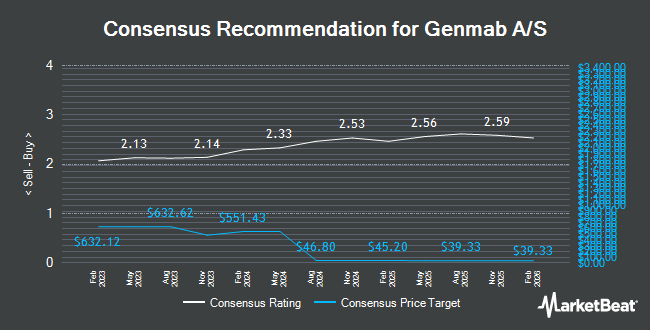

Several other analysts also recently issued reports on GMAB. Leerink Partnrs raised shares of Genmab A/S from a "hold" rating to a "strong-buy" rating in a research note on Thursday, February 13th. BNP Paribas upgraded Genmab A/S from a "strong sell" rating to a "hold" rating in a report on Tuesday, February 11th. Leerink Partners upgraded shares of Genmab A/S from a "market perform" rating to an "outperform" rating and set a $27.00 price target on the stock in a report on Thursday, February 13th. Truist Financial decreased their price objective on shares of Genmab A/S from $50.00 to $45.00 and set a "buy" rating for the company in a report on Tuesday, March 11th. Finally, HC Wainwright restated a "buy" rating and issued a $50.00 target price on shares of Genmab A/S in a research note on Thursday, January 23rd. One equities research analyst has rated the stock with a sell rating, three have issued a hold rating, eight have issued a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average price target of $41.33.

Get Our Latest Report on GMAB

Genmab A/S Stock Performance

GMAB stock traded down $0.85 during trading on Tuesday, hitting $18.39. 2,472,572 shares of the company's stock traded hands, compared to its average volume of 981,947. Genmab A/S has a 52 week low of $18.30 and a 52 week high of $30.41. The stock has a market capitalization of $12.17 billion, a price-to-earnings ratio of 10.57, a P/E/G ratio of 2.65 and a beta of 1.07. The business has a fifty day simple moving average of $20.67 and a 200 day simple moving average of $21.64.

Genmab A/S (NASDAQ:GMAB - Get Free Report) last issued its quarterly earnings data on Wednesday, February 12th. The company reported $0.57 earnings per share for the quarter, topping the consensus estimate of $0.28 by $0.29. Genmab A/S had a return on equity of 16.78% and a net margin of 36.30%. Research analysts forecast that Genmab A/S will post 1.45 earnings per share for the current fiscal year.

Institutional Investors Weigh In On Genmab A/S

Institutional investors have recently bought and sold shares of the company. Versant Capital Management Inc boosted its position in shares of Genmab A/S by 1,108.3% in the 1st quarter. Versant Capital Management Inc now owns 8,724 shares of the company's stock worth $171,000 after purchasing an additional 8,002 shares in the last quarter. Marotta Asset Management raised its stake in Genmab A/S by 5.8% in the first quarter. Marotta Asset Management now owns 13,532 shares of the company's stock valued at $265,000 after buying an additional 739 shares during the last quarter. Employees Retirement System of Texas acquired a new stake in Genmab A/S in the fourth quarter worth about $1,648,000. Mackenzie Financial Corp purchased a new stake in shares of Genmab A/S during the fourth quarter worth about $689,000. Finally, GTS Securities LLC acquired a new position in shares of Genmab A/S during the fourth quarter valued at about $1,552,000. 7.07% of the stock is currently owned by institutional investors and hedge funds.

Genmab A/S Company Profile

(

Get Free Report)

Genmab A/S develops antibody therapeutics for the treatment of cancer and other diseases primarily in Denmark. The company markets DARZALEX, a human monoclonal antibody for the treatment of patients with multiple myeloma (MM); teprotumumab for the treatment of thyroid eye disease; and Amivantamab for advanced or metastatic gastric or esophageal cancer and NSCLC.

See Also

Before you consider Genmab A/S, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Genmab A/S wasn't on the list.

While Genmab A/S currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.