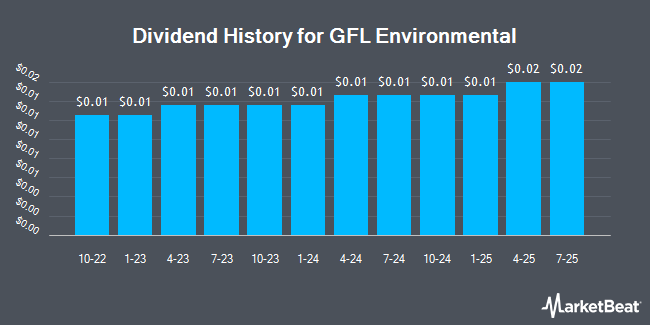

GFL Environmental Inc. (NYSE:GFL - Get Free Report) announced a quarterly dividend on Thursday, October 2nd, RTT News reports. Investors of record on Wednesday, October 15th will be given a dividend of 0.0154 per share on Friday, October 31st. This represents a c) dividend on an annualized basis and a yield of 0.1%.

GFL Environmental has a dividend payout ratio of 9.8% indicating that its dividend is sufficiently covered by earnings. Equities analysts expect GFL Environmental to earn $1.06 per share next year, which means the company should continue to be able to cover its $0.06 annual dividend with an expected future payout ratio of 5.7%.

GFL Environmental Stock Performance

GFL stock traded up $0.04 during trading on Thursday, reaching $46.67. The company had a trading volume of 417,887 shares, compared to its average volume of 1,588,997. The firm has a 50-day simple moving average of $48.66 and a 200-day simple moving average of $48.65. The company has a market cap of $16.96 billion, a price-to-earnings ratio of 7.36 and a beta of 1.17. The company has a debt-to-equity ratio of 0.89, a quick ratio of 0.67 and a current ratio of 0.67. GFL Environmental has a twelve month low of $39.10 and a twelve month high of $52.00.

GFL Environmental (NYSE:GFL - Get Free Report) last released its earnings results on Wednesday, July 30th. The company reported $0.19 EPS for the quarter, hitting analysts' consensus estimates of $0.19. The company had revenue of $1.23 billion during the quarter, compared to analysts' expectations of $1.68 billion. GFL Environmental had a net margin of 48.53% and a return on equity of 3.71%. GFL Environmental's revenue for the quarter was up 5.9% on a year-over-year basis. During the same period last year, the business earned $0.29 EPS. GFL Environmental has set its FY 2025 guidance at EPS. As a group, sell-side analysts expect that GFL Environmental will post 0.58 earnings per share for the current year.

About GFL Environmental

(

Get Free Report)

GFL Environmental Inc offers non-hazardous solid waste management and environmental services in Canada and the United States. It offers solid waste management, liquid waste management, and soil remediation services, including collection, transportation, transfer, recycling, and disposal services for municipal, residential, and commercial, and industrial customers.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider GFL Environmental, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GFL Environmental wasn't on the list.

While GFL Environmental currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.