Gildan Activewear (NYSE:GIL - Get Free Report) TSE: GIL was upgraded by equities research analysts at Cfra Research to a "hold" rating in a report released on Monday,Zacks.com reports.

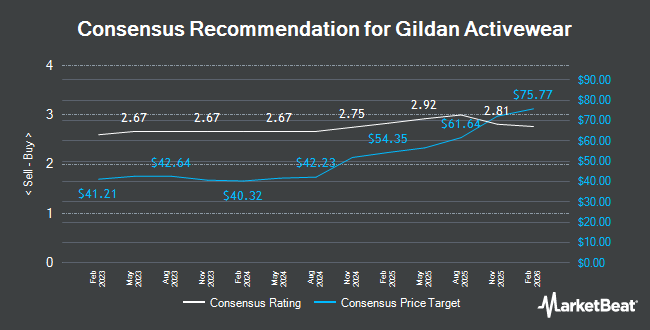

Several other research firms have also issued reports on GIL. Scotiabank upped their target price on Gildan Activewear from $55.00 to $59.00 and gave the company a "sector outperform" rating in a report on Friday, August 1st. Barclays increased their price objective on Gildan Activewear from $51.00 to $56.00 and gave the company an "overweight" rating in a report on Friday, August 1st. TD Securities increased their price objective on Gildan Activewear from $56.00 to $60.00 and gave the company a "buy" rating in a report on Wednesday, April 30th. UBS Group increased their price objective on Gildan Activewear from $56.00 to $70.00 and gave the company a "buy" rating in a report on Tuesday, July 29th. Finally, National Bankshares increased their price objective on Gildan Activewear from $78.00 to $80.00 and gave the company an "outperform" rating in a report on Friday, August 1st. One investment analyst has rated the stock with a hold rating and eleven have given a buy rating to the company's stock. According to MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $62.33.

View Our Latest Stock Report on GIL

Gildan Activewear Stock Performance

GIL stock opened at $52.83 on Monday. The firm has a market cap of $7.92 billion, a PE ratio of 16.77, a P/E/G ratio of 1.68 and a beta of 1.17. The company has a quick ratio of 1.67, a current ratio of 3.87 and a debt-to-equity ratio of 1.37. The business has a 50 day moving average of $49.60 and a 200-day moving average of $48.29. Gildan Activewear has a 12-month low of $37.16 and a 12-month high of $55.39.

Gildan Activewear (NYSE:GIL - Get Free Report) TSE: GIL last released its earnings results on Thursday, July 31st. The textile maker reported $0.97 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.96 by $0.01. The company had revenue of $918.50 million during the quarter, compared to analyst estimates of $908.41 million. Gildan Activewear had a return on equity of 34.31% and a net margin of 14.55%. Gildan Activewear's quarterly revenue was up 6.5% on a year-over-year basis. During the same period in the prior year, the company posted $0.74 earnings per share. As a group, sell-side analysts expect that Gildan Activewear will post 3.48 earnings per share for the current year.

Institutional Investors Weigh In On Gildan Activewear

A number of institutional investors and hedge funds have recently made changes to their positions in GIL. Maseco LLP purchased a new stake in shares of Gildan Activewear in the second quarter worth $26,000. Olde Wealth Management LLC bought a new position in Gildan Activewear in the first quarter valued at $29,000. Twin Tree Management LP bought a new position in Gildan Activewear in the first quarter valued at $29,000. Versant Capital Management Inc increased its stake in Gildan Activewear by 510.7% in the first quarter. Versant Capital Management Inc now owns 745 shares of the textile maker's stock valued at $33,000 after acquiring an additional 623 shares during the last quarter. Finally, GAMMA Investing LLC increased its stake in Gildan Activewear by 4,323.5% in the first quarter. GAMMA Investing LLC now owns 752 shares of the textile maker's stock valued at $33,000 after acquiring an additional 735 shares during the last quarter. Hedge funds and other institutional investors own 82.83% of the company's stock.

About Gildan Activewear

(

Get Free Report)

Gildan Activewear Inc manufactures and sells various apparel products in the United States, North America, Europe, Asia-Pacific, and Latin America. It provides various activewear products, including T-shirts, fleece tops and bottoms, and sports shirts under the Gildan, Gildan Performance, Gildan Hammer, Glidan Softstyle, Gildan Heavy Cotton, Gildan Ultra Cotton, Gildan DryBlend, Gildan HeavyBlend, Comfort Colors, and American Apparel brands.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Gildan Activewear, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gildan Activewear wasn't on the list.

While Gildan Activewear currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.