Gilead Sciences (NASDAQ:GILD - Get Free Report) was upgraded by research analysts at Needham & Company LLC from a "hold" rating to a "buy" rating in a research report issued to clients and investors on Friday,Benzinga reports. The brokerage presently has a $133.00 price target on the biopharmaceutical company's stock. Needham & Company LLC's price objective would suggest a potential upside of 17.49% from the stock's current price.

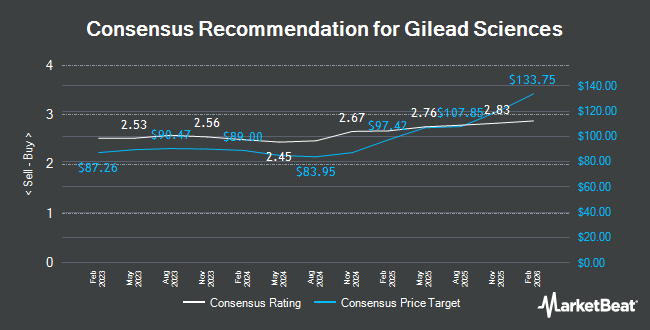

Other equities research analysts have also issued research reports about the company. JPMorgan Chase & Co. upped their target price on Gilead Sciences from $120.00 to $130.00 and gave the company an "overweight" rating in a research report on Thursday, March 27th. Cantor Fitzgerald initiated coverage on Gilead Sciences in a research note on Tuesday, April 22nd. They set an "overweight" rating and a $125.00 target price for the company. Oppenheimer reduced their target price on Gilead Sciences from $132.00 to $125.00 and set an "outperform" rating for the company in a research note on Friday, April 25th. Finally, Morgan Stanley increased their price objective on Gilead Sciences from $130.00 to $135.00 and gave the company an "overweight" rating in a research note on Friday, April 25th. Eight research analysts have rated the stock with a hold rating, fifteen have assigned a buy rating and three have assigned a strong buy rating to the company. According to data from MarketBeat, the company has an average rating of "Moderate Buy" and a consensus price target of $112.36.

Check Out Our Latest Research Report on Gilead Sciences

Gilead Sciences Trading Down 0.3%

Shares of GILD opened at $113.20 on Friday. The company has a 50 day simple moving average of $109.63 and a two-hundred day simple moving average of $105.71. Gilead Sciences has a 1 year low of $72.43 and a 1 year high of $119.96. The company has a debt-to-equity ratio of 1.16, a current ratio of 1.37 and a quick ratio of 1.23. The firm has a market cap of $140.81 billion, a P/E ratio of 23.83, a price-to-earnings-growth ratio of 0.73 and a beta of 0.29.

Gilead Sciences (NASDAQ:GILD - Get Free Report) last released its earnings results on Thursday, April 24th. The biopharmaceutical company reported $1.81 earnings per share for the quarter, topping the consensus estimate of $1.77 by $0.04. Gilead Sciences had a return on equity of 51.93% and a net margin of 20.76%. The business had revenue of $6.67 billion during the quarter, compared to the consensus estimate of $6.77 billion. During the same period last year, the company earned ($1.32) earnings per share. The business's revenue for the quarter was down .3% compared to the same quarter last year. On average, equities analysts expect that Gilead Sciences will post 7.95 earnings per share for the current fiscal year.

Insider Transactions at Gilead Sciences

In other news, CFO Andrew D. Dickinson sold 2,500 shares of the business's stock in a transaction that occurred on Tuesday, July 15th. The stock was sold at an average price of $111.03, for a total transaction of $277,575.00. Following the completion of the sale, the chief financial officer owned 162,610 shares in the company, valued at $18,054,588.30. The trade was a 1.51% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this hyperlink. Also, CEO Daniel Patrick O'day sold 10,000 shares of the business's stock in a transaction that occurred on Monday, June 30th. The stock was sold at an average price of $110.45, for a total value of $1,104,500.00. Following the sale, the chief executive officer owned 615,725 shares of the company's stock, valued at approximately $68,006,826.25. This represents a 1.60% decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders have sold 72,000 shares of company stock worth $7,844,775. Insiders own 0.27% of the company's stock.

Institutional Inflows and Outflows

Several institutional investors have recently modified their holdings of GILD. Price T Rowe Associates Inc. MD grew its holdings in Gilead Sciences by 314.6% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 14,703,103 shares of the biopharmaceutical company's stock worth $1,647,484,000 after acquiring an additional 11,156,382 shares during the period. FMR LLC grew its holdings in Gilead Sciences by 21.6% during the 4th quarter. FMR LLC now owns 40,319,432 shares of the biopharmaceutical company's stock worth $3,724,306,000 after acquiring an additional 7,157,113 shares during the period. Nuveen LLC acquired a new stake in Gilead Sciences during the 1st quarter worth about $620,415,000. GAMMA Investing LLC grew its holdings in Gilead Sciences by 13,891.1% during the 1st quarter. GAMMA Investing LLC now owns 2,550,298 shares of the biopharmaceutical company's stock worth $285,761,000 after acquiring an additional 2,532,070 shares during the period. Finally, Northern Trust Corp grew its holdings in Gilead Sciences by 19.7% during the 4th quarter. Northern Trust Corp now owns 14,915,095 shares of the biopharmaceutical company's stock worth $1,377,707,000 after acquiring an additional 2,458,954 shares during the period. 83.67% of the stock is currently owned by institutional investors and hedge funds.

About Gilead Sciences

(

Get Free Report)

Gilead Sciences, Inc, a biopharmaceutical company, discovers, develops, and commercializes medicines in the areas of unmet medical need in the United States, Europe, and internationally. The company provides Biktarvy, Genvoya, Descovy, Odefsey, Truvada, Complera/ Eviplera, Stribild, Sunlencs, and Atripla products for the treatment of HIV/AIDS; Veklury, an injection for intravenous use, for the treatment of COVID-19; and Epclusa, Harvoni, Vemlidy, and Viread for the treatment of viral hepatitis.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Gilead Sciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gilead Sciences wasn't on the list.

While Gilead Sciences currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report