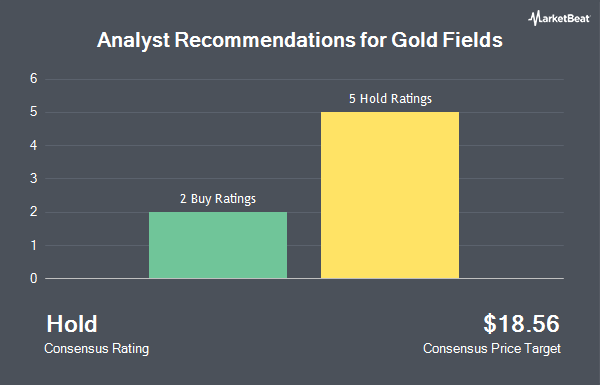

Gold Fields Limited (NYSE:GFI - Get Free Report) has been given an average rating of "Hold" by the six research firms that are presently covering the stock, MarketBeat reports. Four investment analysts have rated the stock with a hold rating and two have issued a buy rating on the company. The average 1 year price objective among brokerages that have issued a report on the stock in the last year is $19.70.

A number of equities research analysts have recently issued reports on the stock. Hsbc Global Res raised shares of Gold Fields to a "hold" rating in a research note on Thursday, April 17th. Wall Street Zen cut shares of Gold Fields from a "strong-buy" rating to a "buy" rating in a research note on Friday, May 30th. Scotiabank upped their price objective on shares of Gold Fields from $20.00 to $23.00 and gave the company a "sector perform" rating in a research note on Monday, April 14th. Finally, HSBC reaffirmed a "hold" rating and issued a $21.00 price objective on shares of Gold Fields in a research note on Thursday, April 17th.

View Our Latest Research Report on Gold Fields

Institutional Investors Weigh In On Gold Fields

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in the company. Massachusetts Financial Services Co. MA raised its holdings in Gold Fields by 1.0% during the 1st quarter. Massachusetts Financial Services Co. MA now owns 4,507,327 shares of the company's stock valued at $99,567,000 after buying an additional 45,171 shares during the last quarter. Amundi raised its holdings in Gold Fields by 17.8% during the 1st quarter. Amundi now owns 3,661,529 shares of the company's stock valued at $82,934,000 after buying an additional 554,160 shares during the last quarter. American Century Companies Inc. raised its holdings in Gold Fields by 6.0% during the 1st quarter. American Century Companies Inc. now owns 3,154,846 shares of the company's stock valued at $69,691,000 after buying an additional 178,842 shares during the last quarter. RWC Asset Management LLP raised its holdings in Gold Fields by 9.2% during the 4th quarter. RWC Asset Management LLP now owns 2,710,910 shares of the company's stock valued at $35,784,000 after buying an additional 227,704 shares during the last quarter. Finally, Deutsche Bank AG raised its holdings in Gold Fields by 21.5% during the 1st quarter. Deutsche Bank AG now owns 2,642,663 shares of the company's stock valued at $58,376,000 after buying an additional 467,579 shares during the last quarter. 24.81% of the stock is currently owned by institutional investors.

Gold Fields Price Performance

GFI stock traded down $0.18 during midday trading on Monday, reaching $23.83. The company had a trading volume of 2,643,978 shares, compared to its average volume of 2,922,079. The company has a debt-to-equity ratio of 0.40, a current ratio of 1.14 and a quick ratio of 0.73. Gold Fields has a 1 year low of $12.98 and a 1 year high of $26.36. The company has a market capitalization of $21.33 billion, a P/E ratio of 10.14, a P/E/G ratio of 0.26 and a beta of 0.55. The firm has a 50-day moving average price of $23.11 and a 200-day moving average price of $19.74.

About Gold Fields

(

Get Free ReportGold Fields Limited operates as a gold producer with reserves and resources in Chile, South Africa, Ghana, Canada, Australia, and Peru. It also explores for copper and silver deposits. The company was founded in 1887 and is based in Sandton, South Africa.

Read More

Before you consider Gold Fields, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gold Fields wasn't on the list.

While Gold Fields currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.