Grocery Outlet (NASDAQ:GO - Get Free Report) issued an update on its FY 2025 earnings guidance on Tuesday morning. The company provided earnings per share (EPS) guidance of 0.750-0.800 for the period, compared to the consensus estimate of 0.741. The company issued revenue guidance of $4.7 billion-$4.8 billion, compared to the consensus revenue estimate of $4.7 billion.

Grocery Outlet Stock Up 0.6%

Shares of NASDAQ:GO traded up $0.11 on Friday, hitting $18.54. 5,619,094 shares of the company traded hands, compared to its average volume of 3,697,051. Grocery Outlet has a 52 week low of $10.26 and a 52 week high of $21.67. The company has a quick ratio of 0.25, a current ratio of 1.21 and a debt-to-equity ratio of 0.38. The stock has a 50 day simple moving average of $13.67 and a 200-day simple moving average of $14.23. The company has a market cap of $1.82 billion, a PE ratio of 264.89, a PEG ratio of 4.25 and a beta of 0.27.

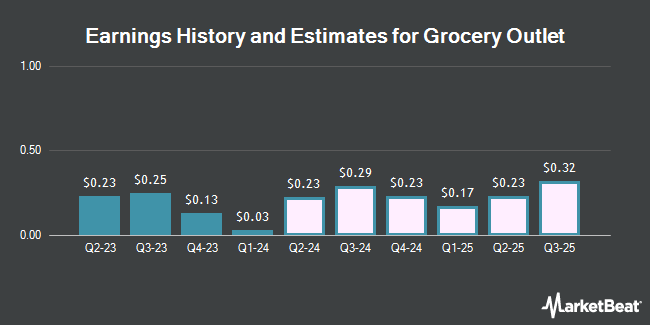

Grocery Outlet (NASDAQ:GO - Get Free Report) last released its quarterly earnings data on Tuesday, August 5th. The company reported $0.23 EPS for the quarter, topping the consensus estimate of $0.17 by $0.06. Grocery Outlet had a return on equity of 6.34% and a net margin of 0.18%. The company had revenue of $1.18 billion during the quarter, compared to the consensus estimate of $1.20 billion. During the same period last year, the company earned $0.25 EPS. Grocery Outlet's revenue for the quarter was up 4.5% on a year-over-year basis. As a group, research analysts expect that Grocery Outlet will post 0.63 earnings per share for the current year.

Analyst Ratings Changes

Several research analysts have issued reports on the company. Craig Hallum raised Grocery Outlet from a "hold" rating to a "buy" rating and set a $17.00 target price on the stock in a research report on Wednesday. Jefferies Financial Group raised Grocery Outlet from a "hold" rating to a "buy" rating and raised their target price for the stock from $13.00 to $18.00 in a research report on Wednesday, April 16th. UBS Group raised their target price on Grocery Outlet from $14.50 to $17.00 and gave the stock a "neutral" rating in a research report on Wednesday, May 7th. Telsey Advisory Group reaffirmed a "market perform" rating and set a $16.00 price objective on shares of Grocery Outlet in a research report on Wednesday. Finally, Morgan Stanley raised Grocery Outlet from an "underweight" rating to an "equal weight" rating and lifted their price objective for the company from $13.00 to $16.00 in a research report on Wednesday. One equities research analyst has rated the stock with a sell rating, nine have issued a hold rating and three have issued a buy rating to the company. According to MarketBeat, the company has a consensus rating of "Hold" and an average target price of $16.08.

Check Out Our Latest Analysis on Grocery Outlet

Hedge Funds Weigh In On Grocery Outlet

A number of large investors have recently bought and sold shares of the business. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC lifted its holdings in shares of Grocery Outlet by 14.1% in the 1st quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 357,856 shares of the company's stock worth $5,003,000 after buying an additional 44,214 shares during the period. Royal Bank of Canada lifted its holdings in shares of Grocery Outlet by 5.8% in the 1st quarter. Royal Bank of Canada now owns 122,565 shares of the company's stock worth $1,713,000 after buying an additional 6,736 shares during the period. Finally, Creative Planning lifted its holdings in shares of Grocery Outlet by 25.4% in the 2nd quarter. Creative Planning now owns 16,104 shares of the company's stock worth $200,000 after buying an additional 3,263 shares during the period. Hedge funds and other institutional investors own 99.87% of the company's stock.

About Grocery Outlet

(

Get Free Report)

Grocery Outlet Holding Corp. operates as a retailer of consumables and fresh products sold through independently operated stores in the United States. Its stores offer products in various categories, such as dairy and deli, produce, floral, fresh meat, seafood products, grocery, general merchandise, health and beauty care, frozen food, beer and wine, and ethnic products.

Further Reading

Before you consider Grocery Outlet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Grocery Outlet wasn't on the list.

While Grocery Outlet currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.