H. B. Fuller (NYSE:FUL - Get Free Report) is anticipated to issue its Q3 2025 results after the market closes on Wednesday, September 24th. Analysts expect H. B. Fuller to post earnings of $1.24 per share and revenue of $894.60 million for the quarter. H. B. Fuller has set its FY 2025 guidance at 4.100-4.30 EPS.Interested persons may visit the the company's upcoming Q3 2025 earningresults page for the latest details on the call scheduled for Thursday, September 25, 2025 at 10:30 AM ET.

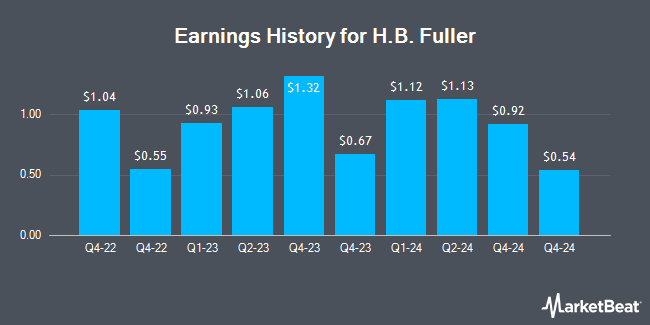

H. B. Fuller (NYSE:FUL - Get Free Report) last released its quarterly earnings results on Wednesday, June 25th. The specialty chemicals company reported $1.18 earnings per share for the quarter, beating the consensus estimate of $1.10 by $0.08. The business had revenue of $898.10 million during the quarter, compared to analysts' expectations of $894.87 million. H. B. Fuller had a return on equity of 11.50% and a net margin of 2.92%.The firm's revenue for the quarter was down 2.1% compared to the same quarter last year. During the same quarter last year, the business posted $1.12 EPS. On average, analysts expect H. B. Fuller to post $4 EPS for the current fiscal year and $5 EPS for the next fiscal year.

H. B. Fuller Trading Down 1.2%

Shares of NYSE:FUL traded down $0.75 during trading on Friday, hitting $60.86. The company had a trading volume of 935,872 shares, compared to its average volume of 385,899. The stock has a market cap of $3.28 billion, a price-to-earnings ratio of 32.90, a price-to-earnings-growth ratio of 1.01 and a beta of 1.14. H. B. Fuller has a one year low of $47.56 and a one year high of $83.96. The company has a fifty day simple moving average of $59.86 and a two-hundred day simple moving average of $57.13. The company has a debt-to-equity ratio of 1.13, a current ratio of 1.87 and a quick ratio of 1.15.

H. B. Fuller Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Thursday, August 14th. Stockholders of record on Thursday, July 31st were given a $0.235 dividend. This represents a $0.94 annualized dividend and a dividend yield of 1.5%. The ex-dividend date of this dividend was Thursday, July 31st. H. B. Fuller's payout ratio is presently 50.81%.

Wall Street Analyst Weigh In

FUL has been the subject of several analyst reports. Robert W. Baird boosted their price objective on H. B. Fuller from $60.00 to $75.00 and gave the company an "outperform" rating in a report on Friday, June 27th. JPMorgan Chase & Co. lifted their price target on shares of H. B. Fuller from $50.00 to $54.00 and gave the company an "underweight" rating in a research report on Friday, June 27th. One analyst has rated the stock with a Strong Buy rating, two have assigned a Buy rating, three have assigned a Hold rating and one has given a Sell rating to the stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Hold" and an average price target of $67.25.

View Our Latest Stock Analysis on FUL

Insider Buying and Selling

In related news, VP Joao Magalhaes sold 1,099 shares of the business's stock in a transaction that occurred on Friday, August 8th. The stock was sold at an average price of $56.31, for a total transaction of $61,884.69. Following the sale, the vice president owned 3,285 shares of the company's stock, valued at $184,978.35. The trade was a 25.07% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, VP Robert J. Martsching sold 9,546 shares of the business's stock in a transaction that occurred on Thursday, July 10th. The stock was sold at an average price of $64.30, for a total value of $613,807.80. Following the sale, the vice president directly owned 14,980 shares in the company, valued at approximately $963,214. The trade was a 38.92% decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders have sold 11,691 shares of company stock worth $734,478. Corporate insiders own 1.99% of the company's stock.

Hedge Funds Weigh In On H. B. Fuller

Several institutional investors and hedge funds have recently added to or reduced their stakes in the company. Public Sector Pension Investment Board grew its holdings in shares of H. B. Fuller by 6.5% during the 2nd quarter. Public Sector Pension Investment Board now owns 184,733 shares of the specialty chemicals company's stock valued at $11,112,000 after acquiring an additional 11,297 shares in the last quarter. Tower Research Capital LLC TRC boosted its holdings in H. B. Fuller by 238.4% during the second quarter. Tower Research Capital LLC TRC now owns 4,473 shares of the specialty chemicals company's stock valued at $269,000 after acquiring an additional 3,151 shares during the period. Corient Private Wealth LLC boosted its holdings in H. B. Fuller by 1.3% during the second quarter. Corient Private Wealth LLC now owns 23,835 shares of the specialty chemicals company's stock valued at $1,434,000 after acquiring an additional 303 shares during the period. State of Tennessee Department of Treasury raised its position in shares of H. B. Fuller by 41.2% during the second quarter. State of Tennessee Department of Treasury now owns 25,831 shares of the specialty chemicals company's stock valued at $1,554,000 after buying an additional 7,537 shares during the last quarter. Finally, Vident Advisory LLC acquired a new position in shares of H. B. Fuller during the second quarter valued at about $215,000. 95.93% of the stock is currently owned by hedge funds and other institutional investors.

H. B. Fuller Company Profile

(

Get Free Report)

H.B. Fuller Company, together with its subsidiaries, formulates, manufactures, and markets adhesives, sealants, coatings, polymers, tapes, encapsulants, additives, and other specialty chemical products. It operates through three segments: Hygiene, Health and Consumable Adhesives; Engineering Adhesives; and Construction Adhesives.

Further Reading

Before you consider H. B. Fuller, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and H. B. Fuller wasn't on the list.

While H. B. Fuller currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.