Haemonetics (NYSE:HAE - Get Free Report) was upgraded by analysts at Baird R W to a "strong-buy" rating in a research report issued on Wednesday,Zacks.com reports.

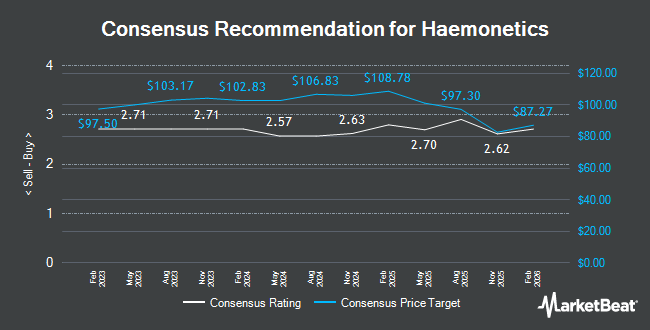

HAE has been the subject of several other research reports. Robert W. Baird assumed coverage on shares of Haemonetics in a research report on Thursday. They issued an "outperform" rating and a $87.00 price target for the company. Needham & Company LLC decreased their price target on shares of Haemonetics from $104.00 to $84.00 and set a "buy" rating for the company in a research report on Thursday, May 8th. Raymond James Financial reissued a "strong-buy" rating and issued a $105.00 price target (down previously from $115.00) on shares of Haemonetics in a research report on Friday, May 9th. Wall Street Zen cut shares of Haemonetics from a "buy" rating to a "hold" rating in a research report on Tuesday, May 13th. Finally, JMP Securities reissued a "market outperform" rating and issued a $100.00 price target on shares of Haemonetics in a research report on Tuesday, May 20th. One equities research analyst has rated the stock with a sell rating, two have assigned a hold rating, seven have assigned a buy rating and two have assigned a strong buy rating to the company's stock. According to MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $96.80.

Read Our Latest Research Report on HAE

Haemonetics Trading Up 1.3%

Shares of NYSE:HAE traded up $0.97 during mid-day trading on Wednesday, reaching $74.77. 472,462 shares of the company were exchanged, compared to its average volume of 669,595. The company has a debt-to-equity ratio of 1.12, a current ratio of 1.62 and a quick ratio of 0.99. The firm has a market cap of $3.59 billion, a price-to-earnings ratio of 22.59, a P/E/G ratio of 1.20 and a beta of 0.36. The firm's 50-day simple moving average is $68.16 and its 200 day simple moving average is $68.02. Haemonetics has a 1 year low of $55.30 and a 1 year high of $94.99.

Haemonetics (NYSE:HAE - Get Free Report) last posted its quarterly earnings data on Thursday, May 8th. The medical instruments supplier reported $1.24 earnings per share for the quarter, topping analysts' consensus estimates of $1.22 by $0.02. The firm had revenue of $330.60 million during the quarter, compared to analysts' expectations of $329.38 million. Haemonetics had a net margin of 12.32% and a return on equity of 26.37%. The firm's quarterly revenue was down 3.5% on a year-over-year basis. During the same quarter last year, the company posted $0.90 EPS. Equities research analysts forecast that Haemonetics will post 4.55 EPS for the current year.

Institutional Trading of Haemonetics

Hedge funds and other institutional investors have recently made changes to their positions in the company. TD Waterhouse Canada Inc. acquired a new stake in shares of Haemonetics during the fourth quarter worth about $25,000. Quarry LP increased its position in shares of Haemonetics by 63.4% during the first quarter. Quarry LP now owns 495 shares of the medical instruments supplier's stock worth $31,000 after purchasing an additional 192 shares in the last quarter. Covestor Ltd increased its position in shares of Haemonetics by 146.8% during the fourth quarter. Covestor Ltd now owns 738 shares of the medical instruments supplier's stock worth $58,000 after purchasing an additional 439 shares in the last quarter. Whittier Trust Co. acquired a new stake in shares of Haemonetics during the fourth quarter worth about $62,000. Finally, University of Texas Texas AM Investment Management Co. purchased a new position in shares of Haemonetics during the first quarter worth about $65,000. Institutional investors and hedge funds own 99.67% of the company's stock.

Haemonetics Company Profile

(

Get Free Report)

Haemonetics Corporation, a healthcare company, provides suite of medical products and solutions in the United States and internationally. The company offers automated plasma collection systems, donor management software, and supporting software solutions including NexSys PCS and PCS2 plasmapheresis equipment and related disposables and solutions, as well as integrated information technology platforms for plasma customers to manage their donors, operations, and supply chain; and NexLynk DMS donor management system and Donor360 app.

Featured Articles

Before you consider Haemonetics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Haemonetics wasn't on the list.

While Haemonetics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.