Halliburton (NYSE:HAL - Get Free Report) was upgraded by equities researchers at Hsbc Global Res to a "hold" rating in a report issued on Wednesday,Zacks.com reports.

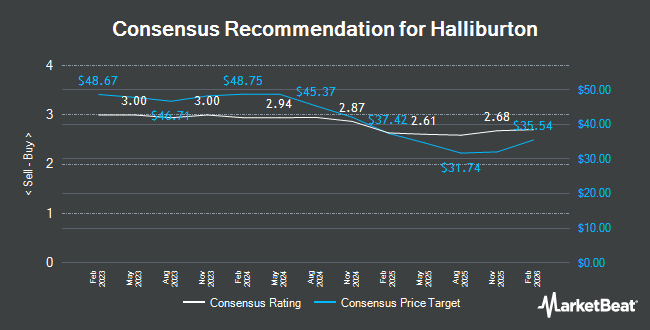

Several other research firms also recently commented on HAL. Royal Bank of Canada reissued a "sector perform" rating and issued a $34.00 target price on shares of Halliburton in a report on Thursday, January 23rd. Wells Fargo & Company lowered their price target on Halliburton from $29.00 to $27.00 and set an "overweight" rating on the stock in a report on Wednesday, April 23rd. Stifel Nicolaus lowered their price target on Halliburton from $37.00 to $32.00 and set a "buy" rating on the stock in a report on Wednesday, April 23rd. Susquehanna lowered their price target on Halliburton from $32.00 to $30.00 and set a "positive" rating on the stock in a report on Wednesday, April 23rd. Finally, Benchmark decreased their price objective on Halliburton from $40.00 to $35.00 and set a "buy" rating on the stock in a research note on Thursday, January 23rd. Eight equities research analysts have rated the stock with a hold rating and fourteen have issued a buy rating to the company's stock. Based on data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and a consensus target price of $34.68.

View Our Latest Stock Analysis on HAL

Halliburton Trading Down 0.7 %

Halliburton stock traded down $0.15 during trading hours on Wednesday, reaching $20.51. The company had a trading volume of 4,509,944 shares, compared to its average volume of 9,931,011. The company has a debt-to-equity ratio of 0.68, a current ratio of 2.05 and a quick ratio of 1.54. Halliburton has a 12-month low of $18.72 and a 12-month high of $38.89. The firm has a market cap of $17.67 billion, a price-to-earnings ratio of 7.24, a P/E/G ratio of 3.79 and a beta of 1.45. The company has a 50-day moving average price of $23.62 and a 200 day moving average price of $26.68.

Halliburton (NYSE:HAL - Get Free Report) last released its quarterly earnings results on Tuesday, April 22nd. The oilfield services company reported $0.60 earnings per share for the quarter, meeting the consensus estimate of $0.60. Halliburton had a return on equity of 26.03% and a net margin of 10.90%. The company had revenue of $5.42 billion for the quarter, compared to analyst estimates of $5.28 billion. Equities analysts forecast that Halliburton will post 2.64 earnings per share for the current year.

Insider Buying and Selling

In other news, Director Margaret Katherine Banks sold 3,900 shares of the business's stock in a transaction that occurred on Tuesday, March 4th. The stock was sold at an average price of $24.04, for a total transaction of $93,756.00. Following the transaction, the director now directly owns 10,551 shares in the company, valued at $253,646.04. The trade was a 26.99 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, CFO Eric Carre sold 141,206 shares of the business's stock in a transaction on Tuesday, February 11th. The shares were sold at an average price of $26.13, for a total value of $3,689,712.78. Following the completion of the sale, the chief financial officer now owns 127,101 shares in the company, valued at $3,321,149.13. This represents a 52.63 % decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders have sold 206,782 shares of company stock worth $5,321,170. Insiders own 0.61% of the company's stock.

Institutional Trading of Halliburton

A number of large investors have recently made changes to their positions in HAL. Mascagni Wealth Management Inc. acquired a new stake in Halliburton during the 4th quarter worth approximately $28,000. Horrell Capital Management Inc. acquired a new stake in Halliburton during the 4th quarter worth approximately $33,000. Sierra Ocean LLC acquired a new stake in Halliburton during the 4th quarter worth approximately $36,000. Modus Advisors LLC acquired a new stake in Halliburton in the fourth quarter valued at $38,000. Finally, Vermillion Wealth Management Inc. acquired a new stake in Halliburton in the fourth quarter valued at $39,000. 85.23% of the stock is owned by institutional investors and hedge funds.

Halliburton Company Profile

(

Get Free Report)

Halliburton Company provides products and services to the energy industry worldwide. It operates through two segments, Completion and Production, and Drilling and Evaluation. The Completion and Production segment offers production enhancement services that include stimulation and sand control services; cementing services, such as well bonding and casing, and casing equipment; and completion tools that offer downhole solutions and services, including well completion products and services, intelligent well completions, and service tools, as well as liner hanger, sand control, and multilateral systems.

Further Reading

Before you consider Halliburton, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Halliburton wasn't on the list.

While Halliburton currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.