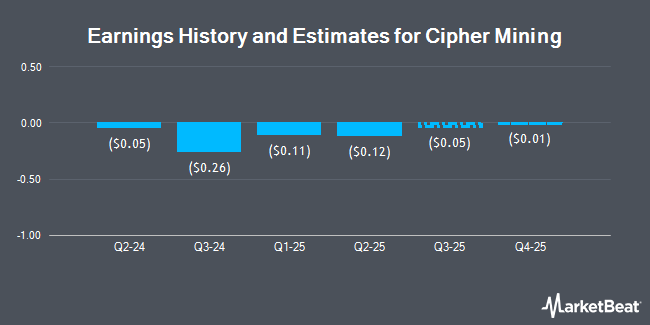

Cipher Mining Inc. (NASDAQ:CIFR - Free Report) - Analysts at HC Wainwright dropped their FY2025 earnings estimates for Cipher Mining in a report released on Monday, September 29th. HC Wainwright analyst M. Colonnese now anticipates that the company will post earnings of ($0.29) per share for the year, down from their previous forecast of ($0.27). HC Wainwright currently has a "Buy" rating and a $17.00 price target on the stock. The consensus estimate for Cipher Mining's current full-year earnings is ($0.31) per share. HC Wainwright also issued estimates for Cipher Mining's Q4 2025 earnings at ($0.01) EPS, Q1 2026 earnings at ($0.01) EPS, Q2 2026 earnings at ($0.06) EPS, Q3 2026 earnings at ($0.06) EPS and FY2026 earnings at ($0.08) EPS.

Cipher Mining (NASDAQ:CIFR - Get Free Report) last announced its quarterly earnings results on Thursday, August 7th. The company reported ($0.12) earnings per share (EPS) for the quarter, meeting the consensus estimate of ($0.12). Cipher Mining had a negative net margin of 96.95% and a negative return on equity of 21.71%. The company had revenue of $43.57 million for the quarter, compared to analysts' expectations of $51.89 million.

CIFR has been the topic of several other research reports. Northland Securities set a $14.50 price target on shares of Cipher Mining in a research report on Monday. Rosenblatt Securities upped their target price on shares of Cipher Mining from $9.00 to $14.00 and gave the stock a "buy" rating in a research note on Monday. Compass Point started coverage on shares of Cipher Mining in a research note on Monday, September 15th. They issued a "buy" rating on the stock. Cantor Fitzgerald upped their target price on shares of Cipher Mining from $4.00 to $6.00 and gave the stock an "overweight" rating in a research note on Thursday, June 5th. Finally, Arete Research started coverage on shares of Cipher Mining in a research note on Wednesday, September 24th. They issued a "buy" rating and a $24.00 target price on the stock. Twelve analysts have rated the stock with a Buy rating and two have issued a Hold rating to the company's stock. According to MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $15.23.

Read Our Latest Report on CIFR

Cipher Mining Price Performance

Shares of NASDAQ CIFR opened at $12.60 on Thursday. Cipher Mining has a 1 year low of $1.86 and a 1 year high of $15.54. The company has a debt-to-equity ratio of 0.23, a current ratio of 4.18 and a quick ratio of 4.18. The company's 50-day moving average is $8.11 and its 200 day moving average is $5.21. The stock has a market capitalization of $4.96 billion, a P/E ratio of -29.30 and a beta of 2.87.

Insider Buying and Selling at Cipher Mining

In other news, major shareholder Holding Ltd V3 sold 2,000,000 shares of the firm's stock in a transaction on Monday, September 29th. The shares were sold at an average price of $12.08, for a total transaction of $24,160,000.00. Following the sale, the insider directly owned 67,852,537 shares in the company, valued at $819,658,646.96. This trade represents a 2.86% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this hyperlink. Also, COO Patrick Arthur Kelly sold 44,870 shares of the firm's stock in a transaction on Monday, September 15th. The shares were sold at an average price of $10.80, for a total transaction of $484,596.00. Following the transaction, the chief operating officer directly owned 1,044,390 shares of the company's stock, valued at $11,279,412. The trade was a 4.12% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 20,901,254 shares of company stock worth $210,570,720 over the last 90 days. Insiders own 2.89% of the company's stock.

Institutional Investors Weigh In On Cipher Mining

Several large investors have recently modified their holdings of the business. Geode Capital Management LLC grew its position in shares of Cipher Mining by 18.1% in the 2nd quarter. Geode Capital Management LLC now owns 7,242,210 shares of the company's stock worth $34,621,000 after buying an additional 1,108,850 shares during the last quarter. Tidal Investments LLC lifted its stake in Cipher Mining by 28.3% during the 2nd quarter. Tidal Investments LLC now owns 6,984,438 shares of the company's stock valued at $33,386,000 after acquiring an additional 1,541,138 shares during the period. Vident Advisory LLC lifted its stake in shares of Cipher Mining by 11.9% in the 1st quarter. Vident Advisory LLC now owns 4,753,772 shares of the company's stock valued at $10,934,000 after purchasing an additional 503,694 shares during the period. Goldman Sachs Group Inc. lifted its stake in shares of Cipher Mining by 52.4% in the 1st quarter. Goldman Sachs Group Inc. now owns 4,680,219 shares of the company's stock valued at $10,765,000 after purchasing an additional 1,610,073 shares during the period. Finally, Helix Partners Management LP raised its position in Cipher Mining by 95.8% during the first quarter. Helix Partners Management LP now owns 4,400,000 shares of the company's stock worth $10,120,000 after acquiring an additional 2,153,058 shares during the period. Institutional investors own 12.26% of the company's stock.

About Cipher Mining

(

Get Free Report)

Cipher Mining Inc, together with its subsidiaries, engages in the development and operation of industrial scale bitcoin mining data centers in the United States. The company was incorporated in 2020 and is based in New York, New York. Cipher Mining Inc operates as a subsidiary of Bitfury Holding B.V.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Cipher Mining, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cipher Mining wasn't on the list.

While Cipher Mining currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.