Herc (NYSE:HRI - Get Free Report) is anticipated to issue its Q2 2025 quarterly earnings data before the market opens on Tuesday, July 29th. Analysts expect the company to announce earnings of $3.11 per share and revenue of $868.23 million for the quarter.

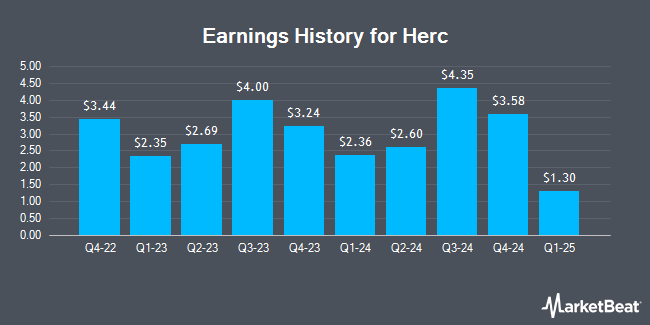

Herc (NYSE:HRI - Get Free Report) last released its quarterly earnings results on Tuesday, April 22nd. The transportation company reported $1.30 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $2.51 by ($1.21). The firm had revenue of $861.00 million during the quarter, compared to analysts' expectations of $841.67 million. Herc had a return on equity of 24.10% and a net margin of 3.53%. During the same quarter last year, the business earned $2.36 earnings per share. On average, analysts expect Herc to post $13 EPS for the current fiscal year and $15 EPS for the next fiscal year.

Herc Stock Performance

Shares of HRI stock traded down $0.46 on Friday, reaching $136.74. The stock had a trading volume of 206,570 shares, compared to its average volume of 506,683. The stock has a market cap of $3.90 billion, a P/E ratio of 30.46, a price-to-earnings-growth ratio of 2.53 and a beta of 1.86. Herc has a 1 year low of $96.18 and a 1 year high of $246.88. The company has a debt-to-equity ratio of 3.04, a quick ratio of 1.50 and a current ratio of 1.50. The company has a 50 day simple moving average of $128.85 and a 200 day simple moving average of $145.80.

Herc Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Friday, June 13th. Stockholders of record on Friday, May 30th were paid a $0.70 dividend. The ex-dividend date was Friday, May 30th. This represents a $2.80 dividend on an annualized basis and a dividend yield of 2.05%. Herc's dividend payout ratio (DPR) is currently 62.36%.

Hedge Funds Weigh In On Herc

A hedge fund recently raised its stake in Herc stock. AQR Capital Management LLC grew its holdings in Herc Holdings Inc. (NYSE:HRI - Free Report) by 176.9% during the 1st quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 25,782 shares of the transportation company's stock after acquiring an additional 16,470 shares during the period. AQR Capital Management LLC owned about 0.09% of Herc worth $3,462,000 as of its most recent filing with the Securities & Exchange Commission. Hedge funds and other institutional investors own 93.11% of the company's stock.

Analyst Ratings Changes

Several equities analysts recently weighed in on the company. Citigroup reiterated a "buy" rating and set a $140.00 target price (up from $130.00) on shares of Herc in a research report on Tuesday, June 24th. Robert W. Baird lowered their target price on Herc from $129.00 to $110.00 and set a "neutral" rating on the stock in a research report on Wednesday, April 23rd. Barclays lowered their target price on Herc from $250.00 to $160.00 and set an "overweight" rating on the stock in a research report on Thursday, April 24th. The Goldman Sachs Group reiterated a "buy" rating and set a $146.00 target price (down from $171.00) on shares of Herc in a research report on Tuesday, April 22nd. Finally, JPMorgan Chase & Co. lowered their target price on Herc from $225.00 to $140.00 and set a "neutral" rating on the stock in a research report on Monday, April 14th. Two research analysts have rated the stock with a hold rating and three have issued a buy rating to the stock. Based on data from MarketBeat.com, Herc currently has an average rating of "Moderate Buy" and a consensus target price of $139.20.

Check Out Our Latest Analysis on HRI

About Herc

(

Get Free Report)

Herc Holdings Inc, together with its subsidiaries, operates as an equipment rental supplier. It rents aerial, earthmoving, material handling, trucks and trailers, air compressors, compaction, and lighting equipment, as well as generators, and safety supplies and expendables; and provides ProSolutions, an industry specific solution based services, such as pumping solutions, power generation, climate control, remediation and restoration, and studio and production equipment.

Further Reading

Before you consider Herc, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Herc wasn't on the list.

While Herc currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.