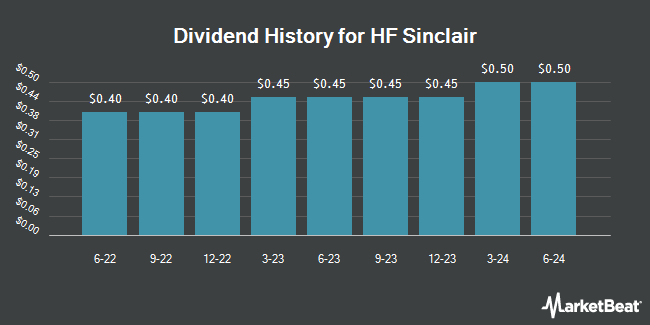

HF Sinclair Corporation (NYSE:DINO - Get Free Report) announced a quarterly dividend on Friday, August 1st, Wall Street Journal reports. Shareholders of record on Thursday, August 21st will be paid a dividend of 0.50 per share on Thursday, September 4th. This represents a c) dividend on an annualized basis and a yield of 4.6%. The ex-dividend date is Thursday, August 21st.

HF Sinclair has a dividend payout ratio of 63.3% meaning its dividend is sufficiently covered by earnings. Analysts expect HF Sinclair to earn $4.19 per share next year, which means the company should continue to be able to cover its $2.00 annual dividend with an expected future payout ratio of 47.7%.

HF Sinclair Stock Performance

DINO traded down $0.59 during mid-day trading on Tuesday, reaching $43.20. 622,763 shares of the company traded hands, compared to its average volume of 2,964,561. The stock has a market capitalization of $8.08 billion, a P/E ratio of -93.98 and a beta of 0.97. The company has a quick ratio of 0.83, a current ratio of 1.82 and a debt-to-equity ratio of 0.29. The company's fifty day moving average price is $41.50 and its 200-day moving average price is $36.25. HF Sinclair has a 52-week low of $24.66 and a 52-week high of $49.92.

HF Sinclair (NYSE:DINO - Get Free Report) last issued its quarterly earnings results on Thursday, July 31st. The company reported $1.70 earnings per share for the quarter, topping the consensus estimate of $1.09 by $0.61. The business had revenue of $6.78 billion for the quarter, compared to analysts' expectations of $6.93 billion. HF Sinclair had a negative net margin of 0.32% and a positive return on equity of 1.89%. The company's revenue was down 13.5% compared to the same quarter last year. During the same quarter last year, the company posted $0.78 EPS. On average, sell-side analysts expect that HF Sinclair will post 2.39 EPS for the current year.

HF Sinclair Company Profile

(

Get Free Report)

HF Sinclair Corporation operates as an independent energy company. The company produces and markets gasoline, diesel fuel, jet fuel, renewable diesel, specialty lubricant products, specialty chemicals, specialty and modified asphalt, and others. It owns and operates refineries located in Kansas, Oklahoma, New Mexico, Utah, Washington, and Wyoming; and markets its refined products principally in the Southwest United States and Rocky Mountains, Pacific Northwest, and in other neighboring Plains states.

See Also

Before you consider HF Sinclair, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HF Sinclair wasn't on the list.

While HF Sinclair currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.