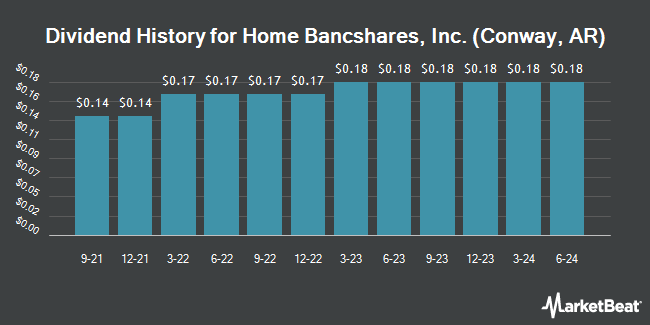

Home BancShares, Inc. (NYSE:HOMB - Get Free Report) announced a quarterly dividend on Wednesday, October 22nd. Shareholders of record on Wednesday, November 12th will be paid a dividend of 0.21 per share by the financial services provider on Wednesday, December 3rd. This represents a c) annualized dividend and a yield of 3.1%. The ex-dividend date is Wednesday, November 12th. This is a 5.0% increase from Home BancShares's previous quarterly dividend of $0.20.

Home BancShares has a dividend payout ratio of 34.6% indicating that its dividend is sufficiently covered by earnings. Equities research analysts expect Home BancShares to earn $2.23 per share next year, which means the company should continue to be able to cover its $0.80 annual dividend with an expected future payout ratio of 35.9%.

Home BancShares Price Performance

Shares of Home BancShares stock opened at $27.03 on Thursday. The company has a current ratio of 0.90, a quick ratio of 0.90 and a debt-to-equity ratio of 0.20. The company's 50-day moving average price is $28.70 and its two-hundred day moving average price is $28.34. Home BancShares has a 52 week low of $24.22 and a 52 week high of $32.90. The stock has a market cap of $5.33 billion, a PE ratio of 11.65 and a beta of 0.78.

Home BancShares (NYSE:HOMB - Get Free Report) last issued its quarterly earnings results on Wednesday, October 15th. The financial services provider reported $0.61 EPS for the quarter, topping the consensus estimate of $0.60 by $0.01. Home BancShares had a net margin of 31.20% and a return on equity of 10.94%. The firm had revenue of $277.70 million for the quarter, compared to analysts' expectations of $269.96 million. During the same period in the previous year, the business earned $0.50 earnings per share. Home BancShares's revenue for the quarter was up 7.6% compared to the same quarter last year. As a group, sell-side analysts anticipate that Home BancShares will post 2.19 EPS for the current fiscal year.

Insiders Place Their Bets

In related news, CEO John W. Allison sold 110,000 shares of the business's stock in a transaction that occurred on Tuesday, August 26th. The stock was sold at an average price of $30.02, for a total value of $3,302,200.00. Following the completion of the sale, the chief executive officer owned 5,540,776 shares of the company's stock, valued at approximately $166,334,095.52. The trade was a 1.95% decrease in their position. The sale was disclosed in a filing with the SEC, which can be accessed through this link. 6.30% of the stock is currently owned by company insiders.

Institutional Investors Weigh In On Home BancShares

Institutional investors and hedge funds have recently added to or reduced their stakes in the stock. Fenimore Asset Management Inc lifted its holdings in shares of Home BancShares by 0.3% during the third quarter. Fenimore Asset Management Inc now owns 513,828 shares of the financial services provider's stock worth $14,541,000 after buying an additional 1,785 shares during the last quarter. Merit Financial Group LLC acquired a new position in shares of Home BancShares during the third quarter worth approximately $208,000. Fort Washington Investment Advisors Inc. OH lifted its holdings in shares of Home BancShares by 1.6% during the third quarter. Fort Washington Investment Advisors Inc. OH now owns 713,618 shares of the financial services provider's stock worth $20,195,000 after buying an additional 11,235 shares during the last quarter. CWM LLC lifted its holdings in shares of Home BancShares by 68.9% during the third quarter. CWM LLC now owns 28,404 shares of the financial services provider's stock worth $804,000 after buying an additional 11,589 shares during the last quarter. Finally, Pacer Advisors Inc. acquired a new position in shares of Home BancShares during the third quarter worth approximately $683,000. 67.31% of the stock is currently owned by institutional investors and hedge funds.

Home BancShares Company Profile

(

Get Free Report)

Home Bancshares, Inc (Conway, AR) operates as the bank holding company for Centennial Bank that provides commercial and retail banking, and related financial services to businesses, real estate developers and investors, individuals, and municipalities. Its deposit products include checking, savings, and money market accounts, as well as certificates of deposit.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Home BancShares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Home BancShares wasn't on the list.

While Home BancShares currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.