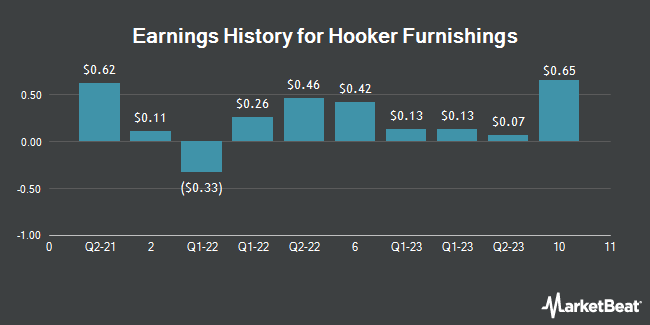

Hooker Furnishings (NASDAQ:HOFT - Get Free Report) released its quarterly earnings results on Thursday. The company reported ($0.29) EPS for the quarter, missing the consensus estimate of ($0.16) by ($0.13), Zacks reports. Hooker Furnishings had a negative return on equity of 3.51% and a negative net margin of 2.46%. The business had revenue of $85.32 million during the quarter, compared to analyst estimates of $88.87 million.

Hooker Furnishings Stock Up 0.4%

NASDAQ HOFT traded up $0.04 on Friday, hitting $10.18. 120,274 shares of the stock traded hands, compared to its average volume of 48,663. The stock has a 50-day moving average of $9.45 and a 200 day moving average of $11.95. Hooker Furnishings has a twelve month low of $7.34 and a twelve month high of $19.79. The company has a market capitalization of $108.96 million, a P/E ratio of -11.19, a price-to-earnings-growth ratio of 0.85 and a beta of 1.37. The company has a current ratio of 3.16, a quick ratio of 1.76 and a debt-to-equity ratio of 0.10.

Hooker Furnishings Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Monday, June 30th. Shareholders of record on Monday, June 16th will be paid a dividend of $0.23 per share. This represents a $0.92 annualized dividend and a yield of 9.04%. The ex-dividend date is Monday, June 16th. Hooker Furnishings's payout ratio is currently -77.31%.

Institutional Trading of Hooker Furnishings

Several institutional investors and hedge funds have recently bought and sold shares of the company. Empowered Funds LLC raised its stake in Hooker Furnishings by 7.2% during the first quarter. Empowered Funds LLC now owns 55,319 shares of the company's stock valued at $555,000 after buying an additional 3,696 shares in the last quarter. Jane Street Group LLC acquired a new stake in shares of Hooker Furnishings during the 1st quarter worth approximately $146,000. Finally, Strs Ohio acquired a new stake in shares of Hooker Furnishings during the 1st quarter worth approximately $124,000. Institutional investors and hedge funds own 73.63% of the company's stock.

Wall Street Analysts Forecast Growth

Separately, Wall Street Zen cut Hooker Furnishings from a "hold" rating to a "sell" rating in a research note on Sunday, April 20th.

Read Our Latest Report on Hooker Furnishings

About Hooker Furnishings

(

Get Free Report)

Hooker Furnishings Corporation designs, manufactures, imports, and markets residential household, hospitality, and contract furniture. It operates in three segments: Hooker Branded, Home Meridian, and Domestic Upholstery. The Hooker Branded segment offers design categories, including home entertainment, home office, accent, dining, and bedroom furniture under the Hooker Furniture brand; and imported upholstered furniture under the Hooker Upholstery brand.

Recommended Stories

Before you consider Hooker Furnishings, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hooker Furnishings wasn't on the list.

While Hooker Furnishings currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.