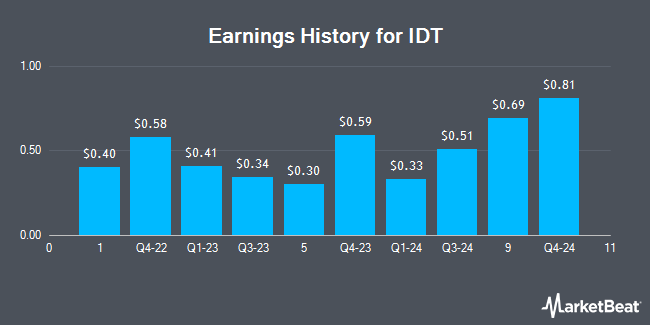

IDT (NYSE:IDT - Get Free Report) issued its earnings results on Monday. The utilities provider reported $0.76 EPS for the quarter, Zacks reports. IDT had a net margin of 7.85% and a return on equity of 26.38%.

IDT Stock Up 2.5%

IDT stock traded up $1.55 during trading on Monday, hitting $64.12. 256,447 shares of the company's stock traded hands, compared to its average volume of 150,797. The stock has a fifty day moving average price of $62.35 and a two-hundred day moving average price of $59.00. The stock has a market capitalization of $1.62 billion, a price-to-earnings ratio of 16.92 and a beta of 0.79. IDT has a 52 week low of $37.45 and a 52 week high of $71.12.

IDT Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Friday, October 10th. Investors of record on Tuesday, September 30th will be issued a $0.06 dividend. The ex-dividend date of this dividend is Tuesday, September 30th. This represents a $0.24 annualized dividend and a yield of 0.4%. IDT's dividend payout ratio is currently 6.33%.

Hedge Funds Weigh In On IDT

Hedge funds and other institutional investors have recently added to or reduced their stakes in the business. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. increased its stake in shares of IDT by 4.3% in the 1st quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 9,156 shares of the utilities provider's stock valued at $470,000 after acquiring an additional 381 shares during the last quarter. Gabelli Funds LLC acquired a new position in IDT during the second quarter worth about $239,000. AQR Capital Management LLC boosted its holdings in IDT by 40.2% in the first quarter. AQR Capital Management LLC now owns 58,197 shares of the utilities provider's stock valued at $2,986,000 after acquiring an additional 16,678 shares during the last quarter. Lazard Asset Management LLC boosted its holdings in shares of IDT by 310.8% during the 2nd quarter. Lazard Asset Management LLC now owns 53,340 shares of the utilities provider's stock worth $3,643,000 after buying an additional 40,357 shares in the last quarter. Finally, Marshall Wace LLP raised its position in IDT by 1,436.4% in the 2nd quarter. Marshall Wace LLP now owns 94,674 shares of the utilities provider's stock valued at $6,468,000 after buying an additional 88,512 shares during the last quarter. Institutional investors own 59.34% of the company's stock.

Analyst Ratings Changes

Separately, Wall Street Zen lowered shares of IDT from a "strong-buy" rating to a "buy" rating in a report on Saturday, June 14th.

View Our Latest Stock Report on IDT

About IDT

(

Get Free Report)

IDT Corporation provides communications and payment services in the United States, the United Kingdom, and internationally. It operates through Fintech, National Retail Solutions, net2phone, and Traditional Communications segments. The company operates point of sale, a terminal-based platform which provides independent retailers store management software, electronic payment processing, and other ancillary merchant services; and provides marketers with digital out-of-home advertising and transaction data.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider IDT, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IDT wasn't on the list.

While IDT currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.