Illumina (NASDAQ:ILMN - Get Free Report) was downgraded by research analysts at Daiwa America from a "strong-buy" rating to a "hold" rating in a report issued on Tuesday,Zacks.com reports.

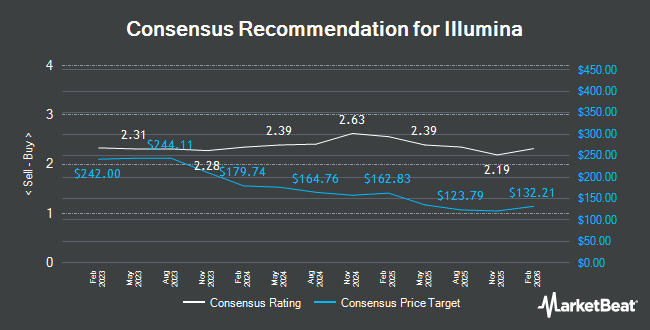

A number of other equities analysts have also recently commented on ILMN. Daiwa Capital Markets cut shares of Illumina from an "outperform" rating to a "neutral" rating and set a $94.00 price target for the company. in a research note on Tuesday. Barclays boosted their price target on shares of Illumina from $85.00 to $90.00 and gave the stock an "underweight" rating in a research note on Friday, August 1st. Piper Sandler cut their price target on shares of Illumina from $190.00 to $185.00 and set an "overweight" rating for the company in a research note on Thursday, May 15th. Robert W. Baird boosted their price target on shares of Illumina from $84.00 to $105.00 and gave the stock a "neutral" rating in a research note on Monday, July 28th. Finally, Evercore ISI boosted their price target on shares of Illumina from $116.00 to $128.00 and gave the stock an "outperform" rating in a research note on Tuesday, July 8th. Two investment analysts have rated the stock with a sell rating, twelve have issued a hold rating and seven have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, the company presently has an average rating of "Hold" and a consensus price target of $124.58.

View Our Latest Research Report on Illumina

Illumina Price Performance

Illumina stock traded up $0.02 during midday trading on Tuesday, reaching $100.11. 1,534,729 shares of the stock were exchanged, compared to its average volume of 2,192,190. The company's fifty day moving average is $96.81 and its 200-day moving average is $90.15. The company has a debt-to-equity ratio of 0.66, a quick ratio of 1.41 and a current ratio of 1.81. The firm has a market cap of $15.39 billion, a PE ratio of 12.67, a PEG ratio of 2.25 and a beta of 1.37. Illumina has a 52 week low of $68.70 and a 52 week high of $156.66.

Illumina (NASDAQ:ILMN - Get Free Report) last posted its earnings results on Thursday, July 31st. The life sciences company reported $1.19 earnings per share for the quarter, topping analysts' consensus estimates of $1.02 by $0.17. Illumina had a net margin of 29.36% and a return on equity of 28.93%. The business had revenue of $1.06 billion for the quarter, compared to analyst estimates of $1.12 billion. During the same quarter in the prior year, the firm posted $0.36 EPS. Illumina's revenue was down 4.8% on a year-over-year basis. On average, sell-side analysts forecast that Illumina will post 4.51 EPS for the current year.

Institutional Inflows and Outflows

Several institutional investors have recently added to or reduced their stakes in ILMN. Capital World Investors increased its stake in shares of Illumina by 408.6% in the 4th quarter. Capital World Investors now owns 18,025,301 shares of the life sciences company's stock worth $2,408,721,000 after acquiring an additional 14,481,232 shares in the last quarter. Corvex Management LP increased its stake in shares of Illumina by 125.2% in the 1st quarter. Corvex Management LP now owns 3,829,608 shares of the life sciences company's stock worth $303,841,000 after acquiring an additional 2,129,449 shares in the last quarter. Brown Advisory Inc. increased its stake in shares of Illumina by 54,220.9% in the 4th quarter. Brown Advisory Inc. now owns 1,912,639 shares of the life sciences company's stock worth $255,586,000 after acquiring an additional 1,909,118 shares in the last quarter. AQR Capital Management LLC increased its stake in shares of Illumina by 361.7% in the 1st quarter. AQR Capital Management LLC now owns 2,121,585 shares of the life sciences company's stock worth $165,484,000 after acquiring an additional 1,662,093 shares in the last quarter. Finally, Jacobs Levy Equity Management Inc. increased its stake in shares of Illumina by 11,714.9% in the 1st quarter. Jacobs Levy Equity Management Inc. now owns 1,161,882 shares of the life sciences company's stock worth $92,184,000 after acquiring an additional 1,152,048 shares in the last quarter. 89.42% of the stock is currently owned by institutional investors.

About Illumina

(

Get Free Report)

Illumina, Inc offers sequencing- and array-based solutions for genetic and genomic analysis in the United States, Singapore, the United Kingdom, and internationally. It operates through Core Illumina and GRAIL segments. The company offers sequencing and array-based instruments and consumables, which include reagents, flow cells, and library preparation; whole-genome sequencing kits, which sequence entire genomes of various size and complexity; and targeted resequencing kits, which sequence exomes, specific genes, and RNA or other genomic regions of interest.

Further Reading

Before you consider Illumina, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Illumina wasn't on the list.

While Illumina currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.