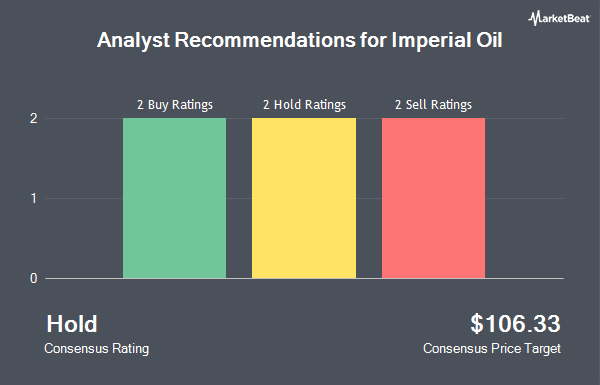

Imperial Oil Limited (NYSEAMERICAN:IMO - Get Free Report) TSE: IMO has received an average rating of "Reduce" from the seven ratings firms that are presently covering the stock, MarketBeat.com reports. Three research analysts have rated the stock with a sell rating, two have assigned a hold rating and two have issued a buy rating on the company. The average 1 year target price among analysts that have updated their coverage on the stock in the last year is $106.33.

Several equities research analysts have commented on the company. Raymond James reiterated an "outperform" rating on shares of Imperial Oil in a research note on Monday, May 5th. Desjardins downgraded shares of Imperial Oil from a "hold" rating to a "strong sell" rating in a research note on Tuesday, June 3rd. Wolfe Research raised shares of Imperial Oil from a "peer perform" rating to an "outperform" rating in a research note on Monday, April 21st. Royal Bank of Canada reissued a "sector perform" rating and issued a $101.00 target price on shares of Imperial Oil in a research note on Thursday, April 3rd. Finally, The Goldman Sachs Group cut Imperial Oil from a "neutral" rating to a "sell" rating in a report on Thursday, March 27th.

Check Out Our Latest Stock Analysis on IMO

Imperial Oil Price Performance

Shares of NYSEAMERICAN IMO traded up $2.93 during trading on Tuesday, hitting $81.91. The company had a trading volume of 640,999 shares, compared to its average volume of 452,999. The firm has a market capitalization of $41.70 billion, a price-to-earnings ratio of 12.43 and a beta of 1.44. The stock has a fifty day simple moving average of $69.23 and a two-hundred day simple moving average of $70.11. The company has a quick ratio of 1.23, a current ratio of 1.34 and a debt-to-equity ratio of 0.17. Imperial Oil has a fifty-two week low of $58.76 and a fifty-two week high of $82.39.

Imperial Oil Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Tuesday, July 1st. Investors of record on Wednesday, June 4th will be issued a $0.523 dividend. This is a positive change from Imperial Oil's previous quarterly dividend of $0.50. This represents a $2.09 annualized dividend and a yield of 2.55%. The ex-dividend date of this dividend is Wednesday, June 4th. Imperial Oil's payout ratio is 25.80%.

Hedge Funds Weigh In On Imperial Oil

Hedge funds and other institutional investors have recently bought and sold shares of the company. Janney Montgomery Scott LLC acquired a new position in shares of Imperial Oil in the fourth quarter worth $351,000. Wingate Wealth Advisors Inc. purchased a new position in Imperial Oil in the fourth quarter valued at $41,000. Blue Trust Inc. grew its stake in Imperial Oil by 7.3% during the 4th quarter. Blue Trust Inc. now owns 10,468 shares of the energy company's stock worth $645,000 after purchasing an additional 712 shares in the last quarter. Allworth Financial LP increased its holdings in Imperial Oil by 21.0% during the 4th quarter. Allworth Financial LP now owns 1,630 shares of the energy company's stock worth $100,000 after purchasing an additional 283 shares during the period. Finally, J. W. Coons Advisors LLC increased its holdings in Imperial Oil by 2.7% during the 4th quarter. J. W. Coons Advisors LLC now owns 12,369 shares of the energy company's stock worth $762,000 after purchasing an additional 320 shares during the period. 20.74% of the stock is currently owned by hedge funds and other institutional investors.

Imperial Oil Company Profile

(

Get Free ReportImperial Oil Limited engages in exploration, production, and sale of crude oil and natural gas in Canada. The company operates through three segments: Upstream, Downstream and Chemical segments. The Upstream segment explores and produces crude oil, natural gas, synthetic crude oil, and bitumen. The Downstream segment transports and refines crude oil, blends refined products, and distributes and markets of refined products.

Featured Stories

Before you consider Imperial Oil, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Imperial Oil wasn't on the list.

While Imperial Oil currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.