Independent Bank (NASDAQ:INDB - Get Free Report) is expected to release its Q3 2025 results before the market opens on Thursday, October 16th. Analysts expect the company to announce earnings of $1.54 per share and revenue of $242.6480 million for the quarter. Interested persons can find conference call details on the company's upcoming Q3 2025 earningreport page for the latest details on the call scheduled for Friday, October 17, 2025 at 10:00 AM ET.

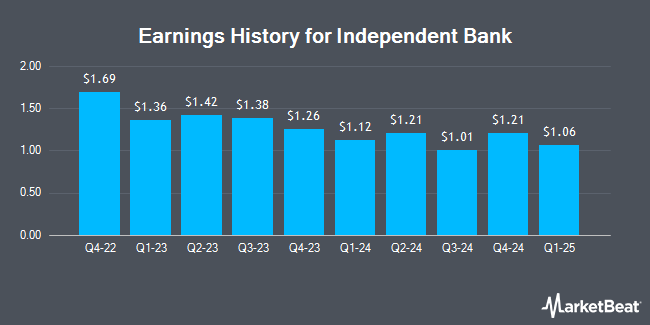

Independent Bank (NASDAQ:INDB - Get Free Report) last released its earnings results on Thursday, July 17th. The bank reported $1.25 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.20 by $0.05. The firm had revenue of $181.80 million during the quarter, compared to analyst estimates of $179.47 million. Independent Bank had a return on equity of 6.39% and a net margin of 18.93%. On average, analysts expect Independent Bank to post $5 EPS for the current fiscal year and $7 EPS for the next fiscal year.

Independent Bank Trading Down 0.8%

NASDAQ:INDB opened at $69.50 on Thursday. The stock has a fifty day moving average price of $68.89 and a 200 day moving average price of $64.50. The company has a current ratio of 0.96, a quick ratio of 0.96 and a debt-to-equity ratio of 0.25. The firm has a market cap of $3.47 billion, a PE ratio of 15.69 and a beta of 0.85. Independent Bank has a 12-month low of $52.15 and a 12-month high of $77.23.

Independent Bank Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Tuesday, October 7th. Investors of record on Monday, September 29th were paid a $0.59 dividend. The ex-dividend date was Monday, September 29th. This represents a $2.36 dividend on an annualized basis and a yield of 3.4%. Independent Bank's payout ratio is currently 53.27%.

Hedge Funds Weigh In On Independent Bank

Institutional investors and hedge funds have recently made changes to their positions in the business. EverSource Wealth Advisors LLC boosted its stake in shares of Independent Bank by 233.3% during the 2nd quarter. EverSource Wealth Advisors LLC now owns 550 shares of the bank's stock valued at $35,000 after buying an additional 385 shares during the last quarter. Osaic Holdings Inc. lifted its position in shares of Independent Bank by 23.3% during the second quarter. Osaic Holdings Inc. now owns 1,116 shares of the bank's stock worth $70,000 after purchasing an additional 211 shares during the last quarter. iSAM Funds UK Ltd bought a new position in Independent Bank during the 2nd quarter worth approximately $201,000. Tower Research Capital LLC TRC lifted its stake in Independent Bank by 103.3% during the second quarter. Tower Research Capital LLC TRC now owns 4,171 shares of the bank's stock worth $262,000 after purchasing an additional 2,119 shares during the last quarter. Finally, Brevan Howard Capital Management LP bought a new position in Independent Bank during the second quarter worth $291,000. 83.40% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

Several equities research analysts have recently issued reports on INDB shares. Wall Street Zen raised shares of Independent Bank from a "sell" rating to a "hold" rating in a research report on Sunday, August 10th. Weiss Ratings restated a "hold (c+)" rating on shares of Independent Bank in a research note on Wednesday. Finally, Zacks Research cut Independent Bank from a "strong-buy" rating to a "hold" rating in a research note on Tuesday, August 19th. One research analyst has rated the stock with a Strong Buy rating and four have assigned a Hold rating to the company. Based on data from MarketBeat.com, Independent Bank presently has a consensus rating of "Hold" and an average target price of $71.00.

View Our Latest Report on INDB

Independent Bank Company Profile

(

Get Free Report)

Independent Bank Corp. operates as the bank holding company for Rockland Trust Company that provides commercial banking products and services to individuals and small-to-medium sized businesses in the United States. The company provides interest checking, money market, and savings accounts, as well as demand deposits and time certificates of deposit.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Independent Bank, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Independent Bank wasn't on the list.

While Independent Bank currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.