Ingredion (NYSE:INGR - Get Free Report) was upgraded by equities research analysts at Wall Street Zen from a "hold" rating to a "buy" rating in a note issued to investors on Saturday.

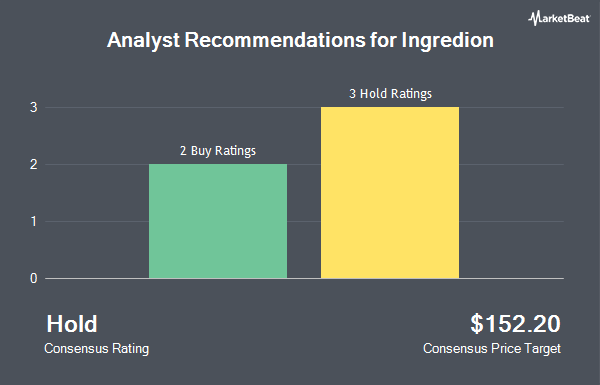

Separately, UBS Group raised their target price on Ingredion from $149.00 to $151.00 and gave the stock a "neutral" rating in a research note on Wednesday, July 9th. Two research analysts have rated the stock with a Buy rating and three have issued a Hold rating to the stock. According to data from MarketBeat.com, Ingredion has an average rating of "Hold" and an average target price of $151.40.

Read Our Latest Research Report on INGR

Ingredion Stock Down 0.5%

NYSE INGR opened at $126.25 on Friday. The business has a fifty day moving average price of $129.91 and a 200 day moving average price of $132.72. Ingredion has a one year low of $120.51 and a one year high of $155.44. The company has a debt-to-equity ratio of 0.41, a quick ratio of 1.81 and a current ratio of 2.78. The company has a market cap of $8.10 billion, a P/E ratio of 12.32, a P/E/G ratio of 1.02 and a beta of 0.77.

Ingredion (NYSE:INGR - Get Free Report) last posted its quarterly earnings data on Friday, August 1st. The company reported $2.87 EPS for the quarter, beating the consensus estimate of $2.78 by $0.09. Ingredion had a return on equity of 19.04% and a net margin of 9.24%.The firm had revenue of $1.83 billion during the quarter, compared to the consensus estimate of $1.89 billion. During the same period in the prior year, the company earned $2.87 EPS. The firm's revenue was down 2.4% compared to the same quarter last year. Ingredion has set its FY 2025 guidance at 11.100-11.600 EPS. Research analysts anticipate that Ingredion will post 11.14 EPS for the current fiscal year.

Insiders Place Their Bets

In other news, CEO James P. Zallie sold 36,287 shares of the stock in a transaction on Tuesday, August 12th. The stock was sold at an average price of $126.52, for a total transaction of $4,591,031.24. Following the completion of the transaction, the chief executive officer directly owned 50,129 shares in the company, valued at approximately $6,342,321.08. This represents a 41.99% decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, SVP Larry Fernandes sold 850 shares of the stock in a transaction on Monday, August 4th. The stock was sold at an average price of $128.39, for a total value of $109,131.50. Following the transaction, the senior vice president owned 31,171 shares of the company's stock, valued at approximately $4,002,044.69. This represents a 2.65% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 37,137 shares of company stock valued at $4,700,163. Company insiders own 2.30% of the company's stock.

Hedge Funds Weigh In On Ingredion

A number of hedge funds have recently modified their holdings of the business. Vanguard Group Inc. grew its holdings in shares of Ingredion by 0.3% during the 2nd quarter. Vanguard Group Inc. now owns 7,266,873 shares of the company's stock worth $985,533,000 after purchasing an additional 22,487 shares during the period. Dimensional Fund Advisors LP grew its holdings in shares of Ingredion by 6.9% during the 1st quarter. Dimensional Fund Advisors LP now owns 2,755,683 shares of the company's stock worth $372,594,000 after purchasing an additional 177,387 shares during the period. Massachusetts Financial Services Co. MA grew its holdings in shares of Ingredion by 10.0% during the 2nd quarter. Massachusetts Financial Services Co. MA now owns 1,340,015 shares of the company's stock worth $181,733,000 after purchasing an additional 121,387 shares during the period. Allianz Asset Management GmbH grew its holdings in shares of Ingredion by 42.9% during the 1st quarter. Allianz Asset Management GmbH now owns 1,204,347 shares of the company's stock worth $162,840,000 after purchasing an additional 361,584 shares during the period. Finally, Northern Trust Corp boosted its holdings in Ingredion by 37.0% during the 1st quarter. Northern Trust Corp now owns 982,789 shares of the company's stock valued at $132,883,000 after acquiring an additional 265,263 shares during the period. 85.27% of the stock is currently owned by hedge funds and other institutional investors.

Ingredion Company Profile

(

Get Free Report)

Ingredion Incorporated, together with its subsidiaries, manufactures and sells sweeteners, starches, nutrition ingredients, and biomaterial solutions derived from wet milling and processing corn, and other starch-based materials to a range of industries in North America, South America, the Asia Pacific, Europe, the Middle East, and Africa.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Ingredion, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ingredion wasn't on the list.

While Ingredion currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.