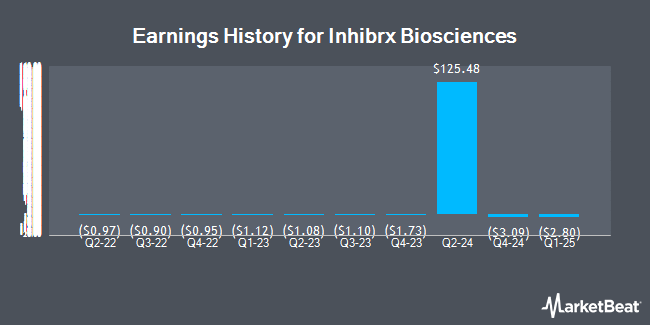

Inhibrx Biosciences (NASDAQ:INBX - Get Free Report) is expected to announce its Q2 2025 earnings results before the market opens on Tuesday, August 12th. Analysts expect the company to announce earnings of ($2.92) per share for the quarter.

Inhibrx Biosciences (NASDAQ:INBX - Get Free Report) last announced its quarterly earnings data on Wednesday, May 14th. The company reported ($2.80) earnings per share (EPS) for the quarter, missing the consensus estimate of ($2.55) by ($0.25). On average, analysts expect Inhibrx Biosciences to post $105 EPS for the current fiscal year and $-12 EPS for the next fiscal year.

Inhibrx Biosciences Trading Down 1.3%

Shares of Inhibrx Biosciences stock traded down $0.28 during mid-day trading on Friday, hitting $21.06. The stock had a trading volume of 80,424 shares, compared to its average volume of 108,785. The firm has a 50-day moving average of $18.41 and a two-hundred day moving average of $14.75. Inhibrx Biosciences has a 12-month low of $10.80 and a 12-month high of $25.29. The company has a quick ratio of 5.12, a current ratio of 5.12 and a debt-to-equity ratio of 1.04. The firm has a market cap of $304.95 million, a P/E ratio of 0.18 and a beta of 0.24.

Institutional Inflows and Outflows

An institutional investor recently bought a new position in Inhibrx Biosciences stock. Strs Ohio bought a new stake in Inhibrx Biosciences, Inc. (NASDAQ:INBX - Free Report) during the 1st quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund bought 1,900 shares of the company's stock, valued at approximately $27,000. Hedge funds and other institutional investors own 82.46% of the company's stock.

Analysts Set New Price Targets

Separately, JMP Securities reiterated a "market perform" rating on shares of Inhibrx Biosciences in a report on Thursday, May 15th.

Get Our Latest Research Report on Inhibrx Biosciences

Inhibrx Biosciences Company Profile

(

Get Free Report)

Inhibrx, Inc, a clinical-stage biopharmaceutical company, develops a pipeline of novel biologic therapeutic candidates. The company's therapeutic candidate includes INBRX-101, an alpha-1 antitrypsin (AAT)-Fc fusion protein therapeutic candidate, which is in Phase 1 clinical trials for use in the treatment of patients with AAT deficiency.

See Also

Before you consider Inhibrx Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Inhibrx Biosciences wasn't on the list.

While Inhibrx Biosciences currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.