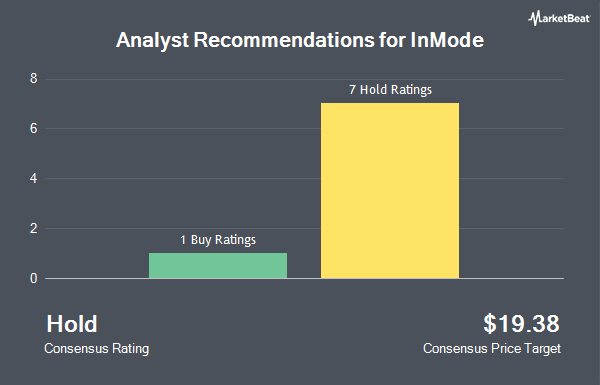

Shares of InMode Ltd. (NASDAQ:INMD - Get Free Report) have been assigned an average recommendation of "Hold" from the eight ratings firms that are covering the firm, MarketBeat.com reports. Seven investment analysts have rated the stock with a hold recommendation and one has assigned a buy recommendation to the company. The average 12 month price target among analysts that have issued ratings on the stock in the last year is $18.54.

A number of equities analysts have recently commented on the company. Baird R W cut InMode from a "strong-buy" rating to a "hold" rating in a report on Monday, April 28th. Needham & Company LLC reiterated a "hold" rating on shares of InMode in a research report on Monday, April 28th. Robert W. Baird cut shares of InMode from an "outperform" rating to a "neutral" rating and decreased their target price for the stock from $22.00 to $16.00 in a research note on Monday, April 28th. Barclays cut their price objective on InMode from $29.00 to $24.00 and set an "overweight" rating on the stock in a report on Wednesday. Finally, Jefferies Financial Group cut their price target on InMode from $16.00 to $15.00 and set a "hold" rating on the stock in a research note on Monday, April 14th.

Read Our Latest Analysis on INMD

Institutional Investors Weigh In On InMode

Hedge funds and other institutional investors have recently bought and sold shares of the stock. CWM LLC boosted its holdings in InMode by 106.4% in the first quarter. CWM LLC now owns 2,369 shares of the healthcare company's stock worth $42,000 after acquiring an additional 1,221 shares in the last quarter. Orion Capital Management LLC bought a new position in InMode in the 4th quarter valued at about $65,000. SBI Securities Co. Ltd. acquired a new position in InMode during the 4th quarter valued at about $87,000. Farther Finance Advisors LLC increased its holdings in InMode by 26.2% during the 4th quarter. Farther Finance Advisors LLC now owns 5,555 shares of the healthcare company's stock worth $93,000 after purchasing an additional 1,154 shares in the last quarter. Finally, Covestor Ltd raised its stake in shares of InMode by 13.9% in the fourth quarter. Covestor Ltd now owns 5,936 shares of the healthcare company's stock worth $99,000 after purchasing an additional 723 shares during the last quarter. 68.04% of the stock is owned by institutional investors.

InMode Price Performance

InMode stock traded down $0.13 during midday trading on Monday, hitting $14.57. The company's stock had a trading volume of 1,081,285 shares, compared to its average volume of 1,191,949. InMode has a 1-year low of $13.68 and a 1-year high of $19.85. The company has a 50-day moving average price of $16.89 and a two-hundred day moving average price of $17.56. The company has a market cap of $1.01 billion, a price-to-earnings ratio of 6.20 and a beta of 1.96.

InMode (NASDAQ:INMD - Get Free Report) last announced its quarterly earnings data on Monday, April 28th. The healthcare company reported $0.31 earnings per share for the quarter, missing the consensus estimate of $0.45 by ($0.14). InMode had a net margin of 45.91% and a return on equity of 18.25%. The company had revenue of $77.87 million during the quarter, compared to analyst estimates of $82.21 million. During the same period in the prior year, the firm earned $0.32 earnings per share. InMode's revenue was down 3.0% on a year-over-year basis. Sell-side analysts forecast that InMode will post 1.75 EPS for the current year.

About InMode

(

Get Free ReportInMode Ltd. designs, develops, manufactures, and markets minimally invasive aesthetic medical products based on its proprietary radiofrequency assisted lipolysis and deep subdermal fractional radiofrequency technologies in the United States and internationally. The company offers minimally invasive aesthetic medical products for various procedures, such as liposuction with simultaneous skin tightening, body and face contouring, and ablative skin rejuvenation treatments, as well as for use in women's health conditions and procedures.

See Also

Before you consider InMode, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and InMode wasn't on the list.

While InMode currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.