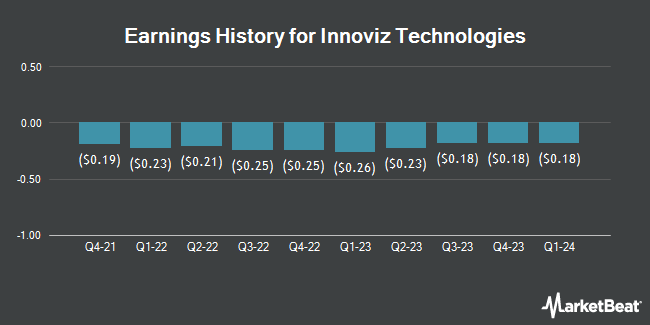

Innoviz Technologies (NASDAQ:INVZ - Get Free Report) released its quarterly earnings data on Wednesday. The company reported ($0.09) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.08) by ($0.01), Zacks reports. Innoviz Technologies had a negative return on equity of 78.82% and a negative net margin of 223.29%. Innoviz Technologies updated its FY 2025 guidance to EPS.

Innoviz Technologies Stock Down 13.2%

INVZ traded down $0.24 during midday trading on Wednesday, hitting $1.58. 19,155,124 shares of the company traded hands, compared to its average volume of 7,984,080. The company's 50-day moving average is $1.46 and its 200 day moving average is $1.06. Innoviz Technologies has a 52 week low of $0.45 and a 52 week high of $3.14. The firm has a market capitalization of $314.36 million, a PE ratio of -3.43 and a beta of 1.25.

Wall Street Analyst Weigh In

A number of equities research analysts have weighed in on INVZ shares. Rosenblatt Securities reissued a "buy" rating and set a $4.00 target price on shares of Innoviz Technologies in a report on Thursday, May 15th. Westpark Capital increased their target price on shares of Innoviz Technologies from $2.22 to $2.53 and gave the stock a "buy" rating in a research note on Wednesday, June 18th. The Goldman Sachs Group upped their price objective on shares of Innoviz Technologies from $0.75 to $1.00 and gave the stock a "neutral" rating in a report on Friday, May 16th. Finally, Wall Street Zen upgraded shares of Innoviz Technologies from a "sell" rating to a "hold" rating in a report on Thursday, May 22nd. Three analysts have rated the stock with a hold rating and two have given a buy rating to the company's stock. Based on data from MarketBeat.com, the stock has a consensus rating of "Hold" and a consensus target price of $2.38.

Read Our Latest Stock Report on Innoviz Technologies

Institutional Investors Weigh In On Innoviz Technologies

Several hedge funds and other institutional investors have recently added to or reduced their stakes in the company. Invesco Ltd. purchased a new position in shares of Innoviz Technologies in the second quarter valued at $67,000. NewEdge Advisors LLC increased its stake in shares of Innoviz Technologies by 499.6% during the first quarter. NewEdge Advisors LLC now owns 70,021 shares of the company's stock valued at $46,000 after buying an additional 58,343 shares during the period. Geode Capital Management LLC grew its stake in Innoviz Technologies by 97.5% in the second quarter. Geode Capital Management LLC now owns 144,534 shares of the company's stock valued at $237,000 after purchasing an additional 71,334 shares during the last quarter. Goldman Sachs Group Inc. grew its stake in shares of Innoviz Technologies by 38.2% during the first quarter. Goldman Sachs Group Inc. now owns 523,945 shares of the company's stock worth $342,000 after acquiring an additional 144,822 shares during the last quarter. Finally, JPMorgan Chase & Co. grew its stake in shares of Innoviz Technologies by 3,440,684.4% during the second quarter. JPMorgan Chase & Co. now owns 1,101,051 shares of the company's stock worth $1,806,000 after acquiring an additional 1,101,019 shares during the last quarter. 63.26% of the stock is owned by hedge funds and other institutional investors.

Innoviz Technologies Company Profile

(

Get Free Report)

Innoviz Technologies Ltd. manufactures and sells automotive grade LiDAR sensors and perception software to enable safe autonomous driving at a mass scale. The company offers InnovizOne, a solid-state LiDAR sensor designed for automakers and robotaxis, shuttles, trucks, and delivery companies requiring an automotive-grade and mass-producible solution to achieve autonomy.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Innoviz Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Innoviz Technologies wasn't on the list.

While Innoviz Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.