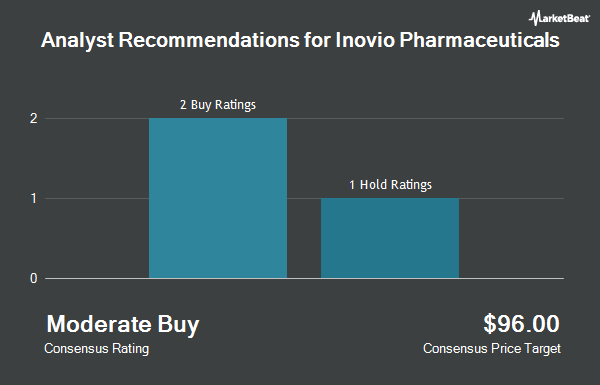

Shares of Inovio Pharmaceuticals, Inc. (NASDAQ:INO - Get Free Report) have been given a consensus recommendation of "Moderate Buy" by the five research firms that are presently covering the firm, MarketBeat.com reports. Two analysts have rated the stock with a hold rating and three have given a buy rating to the company. The average 12-month price target among brokers that have updated their coverage on the stock in the last year is $12.20.

INO has been the subject of a number of analyst reports. StockNews.com raised shares of Inovio Pharmaceuticals from a "sell" rating to a "hold" rating in a research report on Thursday, April 17th. JMP Securities reiterated a "market outperform" rating and set a $18.00 price objective on shares of Inovio Pharmaceuticals in a research note on Friday, January 10th. Royal Bank of Canada decreased their target price on shares of Inovio Pharmaceuticals from $6.00 to $5.00 and set a "sector perform" rating for the company in a research note on Wednesday, March 19th. Finally, HC Wainwright reaffirmed a "neutral" rating and set a $3.00 price target on shares of Inovio Pharmaceuticals in a research report on Wednesday, March 19th.

View Our Latest Stock Analysis on Inovio Pharmaceuticals

Inovio Pharmaceuticals Trading Up 1.3 %

Shares of INO stock traded up $0.03 on Friday, hitting $1.90. 76,273 shares of the stock were exchanged, compared to its average volume of 577,456. The firm has a market capitalization of $69.48 million, a P/E ratio of -0.48 and a beta of 1.84. Inovio Pharmaceuticals has a fifty-two week low of $1.42 and a fifty-two week high of $13.44. The business has a 50-day moving average of $1.85 and a 200 day moving average of $2.94.

Inovio Pharmaceuticals (NASDAQ:INO - Get Free Report) last released its quarterly earnings results on Tuesday, March 18th. The biopharmaceutical company reported ($0.69) earnings per share for the quarter, topping analysts' consensus estimates of ($0.87) by $0.18. The firm had revenue of $0.12 million for the quarter, compared to analyst estimates of $0.03 million. As a group, research analysts forecast that Inovio Pharmaceuticals will post -4.23 EPS for the current fiscal year.

Hedge Funds Weigh In On Inovio Pharmaceuticals

Several large investors have recently modified their holdings of the stock. Deep Track Capital LP boosted its holdings in shares of Inovio Pharmaceuticals by 72.9% during the 4th quarter. Deep Track Capital LP now owns 3,119,162 shares of the biopharmaceutical company's stock worth $5,708,000 after buying an additional 1,314,796 shares during the period. Stonepine Capital Management LLC bought a new stake in shares of Inovio Pharmaceuticals during the fourth quarter worth approximately $1,922,000. AIGH Capital Management LLC acquired a new position in shares of Inovio Pharmaceuticals in the fourth quarter valued at approximately $1,197,000. Bank of America Corp DE grew its position in shares of Inovio Pharmaceuticals by 1,035.2% in the fourth quarter. Bank of America Corp DE now owns 640,987 shares of the biopharmaceutical company's stock valued at $1,173,000 after purchasing an additional 584,521 shares during the last quarter. Finally, Geode Capital Management LLC increased its stake in shares of Inovio Pharmaceuticals by 1.1% during the fourth quarter. Geode Capital Management LLC now owns 628,505 shares of the biopharmaceutical company's stock worth $1,150,000 after purchasing an additional 6,874 shares during the period. 26.79% of the stock is owned by institutional investors.

About Inovio Pharmaceuticals

(

Get Free ReportInovio Pharmaceuticals, Inc, a biotechnology company, focuses on the discovery, development, and commercialization of DNA medicines to treat and protect people from diseases associated with human papillomavirus (HPV), cancer, and infectious diseases. Its DNA medicines platform uses precisely designed SynCon that identify and optimize the DNA sequence of the target antigen, as well as CELLECTRA smart devices technology that facilitates delivery of the DNA plasmids.

Featured Articles

Before you consider Inovio Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Inovio Pharmaceuticals wasn't on the list.

While Inovio Pharmaceuticals currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.