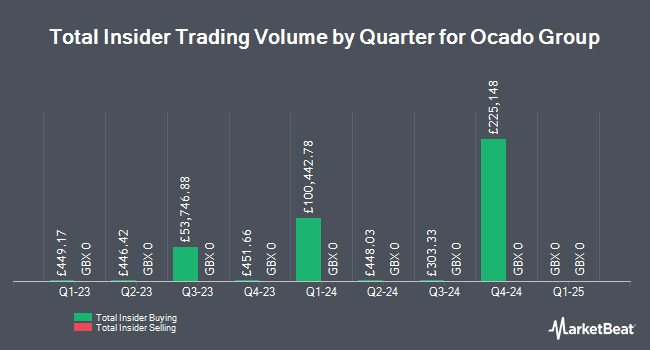

Ocado Group plc (LON:OCDO - Get Free Report) insider Stephen Daintith acquired 65 shares of the company's stock in a transaction dated Wednesday, October 15th. The shares were bought at an average cost of GBX 233 per share, with a total value of £151.45.

Stephen Daintith also recently made the following trade(s):

- On Monday, September 15th, Stephen Daintith purchased 62 shares of Ocado Group stock. The stock was acquired at an average cost of GBX 243 per share, with a total value of £150.66.

- On Friday, August 15th, Stephen Daintith purchased 40 shares of Ocado Group stock. The stock was acquired at an average cost of GBX 374 per share, with a total value of £149.60.

Ocado Group Trading Up 0.4%

OCDO stock traded up GBX 0.90 on Thursday, reaching GBX 239.30. The company's stock had a trading volume of 2,860,680 shares, compared to its average volume of 7,495,227. The business has a fifty day simple moving average of GBX 288.91 and a two-hundred day simple moving average of GBX 278.87. Ocado Group plc has a 12-month low of GBX 216.80 and a 12-month high of GBX 397.90. The firm has a market cap of £1.98 billion, a PE ratio of 509.15 and a beta of 1.85. The company has a debt-to-equity ratio of 144.16, a quick ratio of 2.82 and a current ratio of 2.35.

Analyst Ratings Changes

Separately, JPMorgan Chase & Co. increased their price objective on Ocado Group from GBX 400 to GBX 437 and gave the stock an "overweight" rating in a report on Friday, August 1st. One analyst has rated the stock with a Buy rating, According to data from MarketBeat, the company has an average rating of "Buy" and an average target price of GBX 437.

Check Out Our Latest Report on OCDO

About Ocado Group

(

Get Free Report)

Ocado Group is a UK based technology company that provides end-to-end online grocery fulfilment solutions, known as the Ocado Smart Platform, to some of the world's largest grocery retailers and holds a 50% share of Ocado Retail Ltd in the UK in a Joint Venture with Marks & Spencer. OSP comprises access to Ocado's physical infrastructure solutions, running highly efficient warehouse operations for the single pick of products, together with the entire end-to-end proprietary software applications required to operate a world class online grocery business.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Ocado Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ocado Group wasn't on the list.

While Ocado Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.